Time Warner Cable 2011 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2011 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

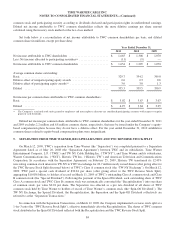

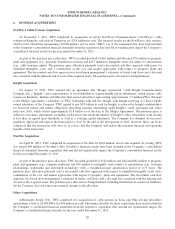

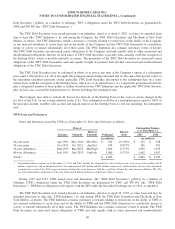

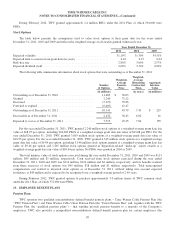

9. DEBT

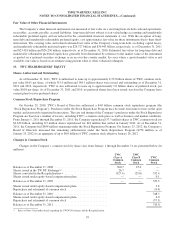

TWC’s debt as of December 31, 2011 and 2010 was as follows (in millions):

Outstanding Balance

as of December 31,

Maturity 2011 2010

Senior notes and debentures(a) ......................................... 2012-2041 $ 26,427 $ 23,118

Revolving credit facility ............................................. 2013 — —

Commercial paper program .......................................... 2013 — —

Capital leases ..................................................... 2013-2017 15 3

Total debt ........................................................ 26,442 23,121

Less: Current maturities ............................................. (2,122) —

Total long-term debt ................................................ $ 24,320 $ 23,121

(a) The weighted-average effective interest rate for senior notes and debentures as of December 31, 2011 is 6.040% and includes the effects of interest rate

swaps and cross-currency swaps.

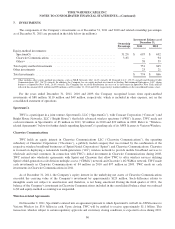

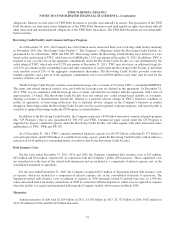

Senior Notes and Debentures

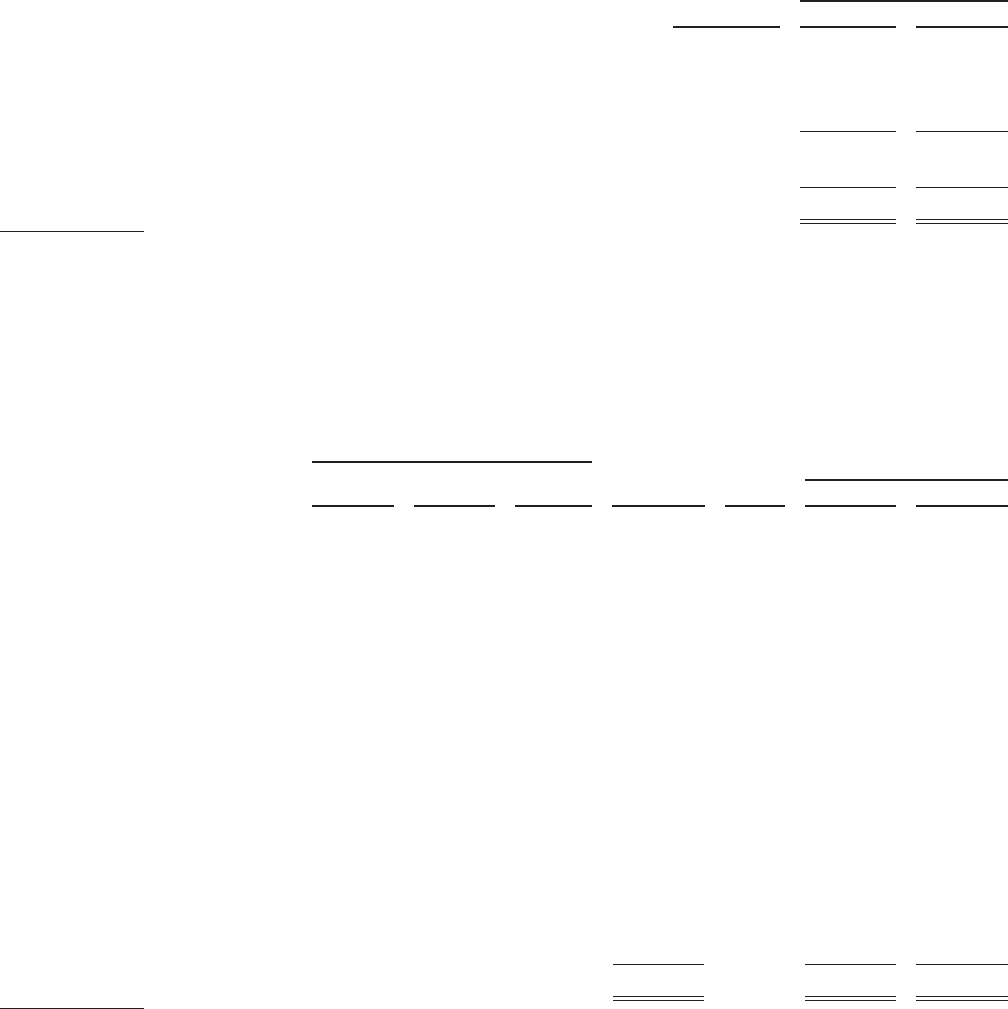

TWC Notes and Debentures

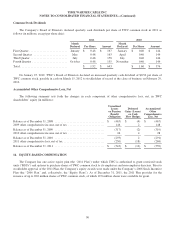

Notes and debentures issued by TWC as of December 31, 2011 and 2010 were as follows:

Date of Outstanding Balance

as of December 31,

Interest

Payment

Interest

RateIssuance Maturity Principal 2011 2010

(in millions) (in millions)

5-year notes .................. Apr2007 July 2012 Jan/July $ 1,500 5.400% $ 1,510 $ 1,529

5-year notes .................. June 2008 July 2013 Jan/July 1,500 6.200% 1,540 1,550

5-year notes .................. Nov2008 Feb 2014 Feb/Aug 750 8.250% 776 771

5-year notes .................. Mar2009 Apr 2014 Apr/Oct 1,000 7.500% 1,046 1,042

5-year notes .................. Dec2009 Feb 2015 Feb/Aug 500 3.500% 525 512

10-year notes ................. Apr2007 May 2017 May/Nov 2,000 5.850% 2,138 2,000

10-year notes ................. June 2008 July 2018 Jan/July 2,000 6.750% 1,999 1,999

10-year notes ................. Nov2008 Feb 2019 Feb/Aug 1,250 8.750% 1,237 1,235

10-year notes ................. Mar2009 Apr 2019 Apr/Oct 2,000 8.250% 1,990 1,989

10-year notes ................. Dec2009 Feb 2020 Feb/Aug 1,500 5.000% 1,475 1,472

10-year notes ................. Nov2010 Feb 2021 Feb/Aug 700 4.125% 696 696

10-year notes ................. Sep2011 Sep 2021 Mar/Sep 1,000 4.000% 991 —

20-year notes(a) ................ May2011 June 2031 June 971 5.750% 968 —

30-year debentures ............. Apr2007 May 2037 May/Nov 1,500 6.550% 1,492 1,492

30-year debentures ............. June 2008 July 2038 Jan/July 1,500 7.300% 1,496 1,496

30-year debentures ............. June 2009 June 2039 June/Dec 1,500 6.750% 1,460 1,459

30-year debentures ............. Nov2010 Nov 2040 May/Nov 1,200 5.875% 1,177 1,176

30-year debentures ............. Sep2011 Sep 2041 Mar/Sep 1,250 5.500% 1,228 —

Total(b) ....................... $ 23,621 $ 23,744 $ 20,418

(a) Outstanding balance amount of the 20-year notes maturing June 2031 (the “Sterling Notes”) as of December 31, 2011 includes £623 million valued at

$968 million using the exchange rate at that date.

(b) Outstanding balance amounts as of December 31, 2011 and 2010 include the estimated fair value of interest rate swap assets of $293 million and $167

million, respectively, and exclude an unamortized discount of $170 million and $149 million, respectively.

TWC has a shelf registration statement on Form S-3 on file with the Securities and Exchange Commission (“SEC”) that

allows TWC to offer and sell from time to time a variety of securities. TWC has issued notes and debentures (the “TWC

89