Time Warner Cable 2011 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2011 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

7. INVESTMENTS

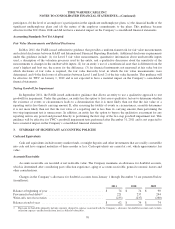

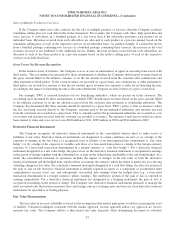

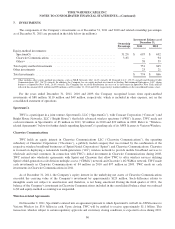

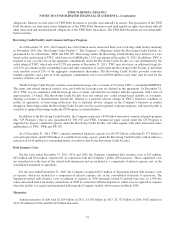

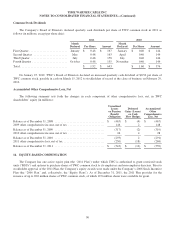

The components of the Company’s investments as of December 31, 2011 and 2010 and related ownership percentages

as of December 31, 2011 are presented in the table below (in millions):

Ownership

Percentage

Investment Balance as of

December 31,

2011 2010

Equity-method investments:

SpectrumCo ........................................................ 31.2% $ 693 $ 692

Clearwire Communications ............................................ 3.4% — 94

Other(a) ............................................................ 58 59

Total equity-method investments ......................................... 751 845

Other investments ..................................................... 23 21

Total investments ...................................................... $ 774 $ 866

(a) Other includes other equity-method investments, such as MLB Network, LLC (6.4% owned), iN Demand L.L.C. (29.3% owned) and National Cable

Communications LLC (16.7% owned). In addition, the Company has an equity-method investment in Sterling Entertainment Enterprises, LLC (doing

business as SportsNet New York, 26.8% owned). The Company has received distributions in excess of its investment in SportsNet New York and has

reflected this amount ($101 million and $99 million as of December 31, 2011 and 2010, respectively) in other liabilities in the consolidated balance sheet.

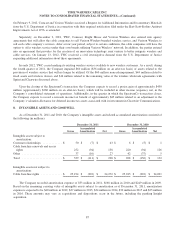

For the years ended December 31, 2011, 2010 and 2009, the Company recognized losses from equity-method

investments of $88 million, $110 million and $49 million, respectively, which is included in other expense, net, in the

consolidated statement of operations.

SpectrumCo

TWC is a participant in a joint venture, SpectrumCo, LLC (“SpectrumCo”), with Comcast Corporation (“Comcast”) and

Bright House Networks, LLC (“Bright House”) that holds advanced wireless spectrum (“AWS”) licenses. TWC made net

cash investments in SpectrumCo of $3 million in 2011, $2 million in 2010 and $29 million in 2009. Refer to “Wireless-

related Agreements” below for further details regarding SpectrumCo’s pending sale of its AWS licenses to Verizon Wireless.

Clearwire Communications

TWC holds an equity interest in Clearwire Communications LLC (“Clearwire Communications”), the operating

subsidiary of Clearwire Corporation (“Clearwire”), a publicly traded company that was formed by the combination of the

respective wireless broadband businesses of Sprint Nextel Corporation (“Sprint”) and Clearwire Communications. Clearwire

is focused on deploying a nationwide fourth-generation (“4G”) wireless network to provide mobile broadband services to

wholesale and retail customers. In connection with TWC’s initial investment in Clearwire Communications during 2008,

TWC entered into wholesale agreements with Sprint and Clearwire that allow TWC to offer wireless services utilizing

Sprint’s third-generation code division multiple access (“CDMA”) network and Clearwire’s 4G WiMax network. TWC made

cash investments in Clearwire Communications of $4 million in 2010 and $97 million in 2009. TWC made no cash

investments in Clearwire Communications in 2011.

As of December 31, 2011, the Company’s equity interest in the underlying net assets of Clearwire Communications

exceeded the carrying value of the Company’s investment by approximately $129 million. Such difference relates to

intangible assets not subject to amortization and, therefore, is not being amortized. During the third quarter of 2011, the

balance of the Company’s investment in Clearwire Communications included in the consolidated balance sheet was reduced

to $0 and equity-method accounting was suspended.

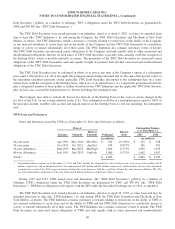

Wireless-related Agreements

On December 2, 2011, SpectrumCo entered into an agreement pursuant to which SpectrumCo will sell its AWS licenses to

Verizon Wireless for $3.6 billion in cash. Upon closing, TWC will be entitled to receive approximately $1.1 billion. This

transaction, which is subject to certain regulatory approvals and customary closing conditions, is expected to close during 2012.

86