Time Warner Cable 2011 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2011 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

method. This guidance became effective for TWC on January 1, 2011 and did not have a material impact on the Company’s

consolidated financial statements.

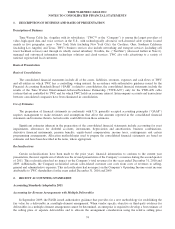

Accounting for Revenue Arrangements with Software Elements

In September 2009, the FASB issued authoritative guidance that provides for a new methodology for recognizing

revenue for tangible products that are bundled with software products. Under the new guidance, tangible products that are

bundled with software components that are essential to the functionality of the tangible product will no longer be accounted

for under the software revenue recognition accounting guidance. Rather, such products will be accounted for under the new

authoritative guidance covering multiple-element arrangements described above. This guidance became effective for TWC

on January 1, 2011 and did not have a material impact on the Company’s consolidated financial statements.

Business Combinations and Disclosures

In December 2010, the FASB issued authoritative guidance that updates existing disclosure requirements related to

supplementary pro forma information for business combinations. Under the updated guidance, a public entity that presents

comparative financial statements should disclose revenue and earnings of the combined entity as though the business

combination that occurred during the current year had occurred as of the beginning of the comparable prior annual reporting

period only. The guidance also expands the supplemental pro forma disclosures to include a description of the nature and

amount of material, nonrecurring pro forma adjustments directly attributable to the business combination included in the

reported pro forma revenue and earnings. This guidance became effective for TWC on January 1, 2011 and will be applied

prospectively to material business combinations that have an acquisition date on or after January 1, 2011.

Impairment Testing for Goodwill

In December 2010, the FASB issued authoritative guidance that provides additional guidance on when to perform the

second step of the goodwill impairment test for reporting units with zero or negative carrying amounts. Under this guidance,

an entity is required to perform the second step of the goodwill impairment test for reporting units with zero or negative

carrying amounts if qualitative factors indicate that it is more likely than not that a goodwill impairment exists. The

qualitative factors are consistent with the existing guidance, which requires that goodwill of a reporting unit be tested for

impairment between annual tests if an event occurs or circumstances change that would more likely than not reduce the fair

value of a reporting unit below its carrying amount. This guidance became effective for TWC on January 1, 2011 and did not

have an impact on the Company’s consolidated financial statements.

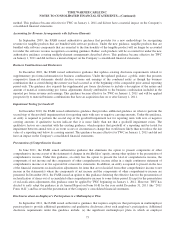

Presentation of Comprehensive Income

In June 2011, the FASB issued authoritative guidance that eliminates the option to present components of other

comprehensive income as part of the statement of changes in stockholders’ equity, among other updates to the presentation of

comprehensive income. Under this guidance, an entity has the option to present the total of comprehensive income, the

components of net income and the components of other comprehensive income either in a single continuous statement of

comprehensive income or in two separate but consecutive statements. In addition, an entity is required to present on the face

of the financial statements reclassification adjustments for items that are reclassified from other comprehensive income to net

income in the statement(s) where the components of net income and the components of other comprehensive income are

presented. In December 2011, the FASB issued an update to this guidance deferring the effective date for the presentation of

reclassification of items out of accumulated other comprehensive income to some future period. Except for the presentation

of reclassification adjustments, this guidance must be applied by TWC beginning on January 1, 2012. However, TWC has

elected to early adopt the guidance in its Annual Report on Form 10-K for the year ended December 31, 2011 (the “2011

Form 10-K”) and has revised the presentation of the Company’s consolidated financial statements.

Disclosures about an Employer’s Participation in a Multiemployer Plan

In September 2011, the FASB issued authoritative guidance that requires employers that participate in multiemployer

pension plans to provide additional quantitative and qualitative disclosures about such employer’s participation. Additional

disclosure requirements under this guidance include: (a) the significant multiemployer plans in which an employer

75