Time Warner Cable 2011 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2011 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

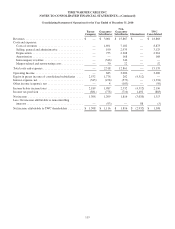

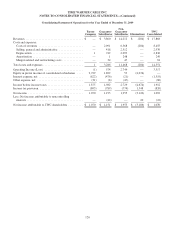

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

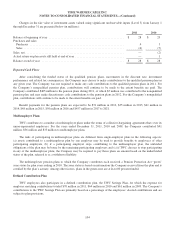

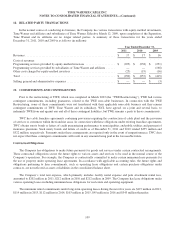

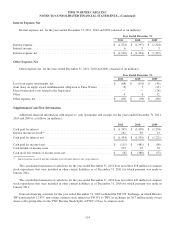

Interest Expense, Net

Interest expense, net, for the years ended December 31, 2011, 2010 and 2009 consisted of (in millions):

Year Ended December 31,

2011 2010 2009

Interest expense ..................................................... $ (1,524) $ (1,397) $ (1,324)

Interest income ..................................................... 6 3 5

Interest expense, net ................................................. $ (1,518) $ (1,394) $ (1,319)

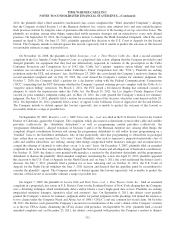

Other Expense, Net

Other expense, net, for the years ended December 31, 2011, 2010 and 2009 consisted of (in millions):

Year Ended December 31,

2011 2010 2009

Loss from equity investments, net ...................................... $ (88) $ (110) $ (49)

Gain (loss) on equity award reimbursement obligation to Time Warner ......... (5) 5 (21)

Direct transaction costs related to the Separation .......................... — — (28)

Other ............................................................ 4 6 12

Other expense, net .................................................. $ (89) $ (99) $ (86)

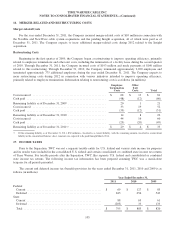

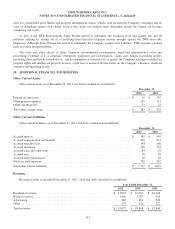

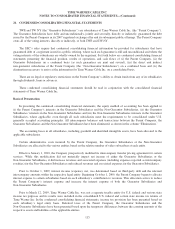

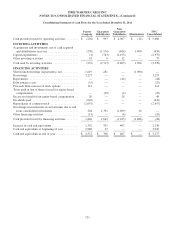

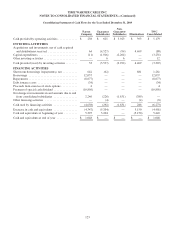

Supplemental Cash Flow Information

Additional financial information with respect to cash (payments) and receipts for the years ended December 31, 2011,

2010 and 2009 is as follows (in millions):

2011 2010 2009

Cash paid for interest ................................................ $ (1,595) $ (1,458) $ (1,234)

Interest income received(a) ............................................ 161 99 13

Cash paid for interest, net ............................................ $ (1,434) $ (1,359) $ (1,221)

Cash paid for income taxes ........................................... $ (111) $ (481) $ (90)

Cash refunds of income taxes ......................................... 273 93 53

Cash (paid for) refunds of income taxes, net .............................. $ 162 $ (388) $ (37)

(a) Interest income received includes amounts received under interest rate swap contracts.

The consolidated statement of cash flows for the year ended December 31, 2011 does not reflect $18 million of common

stock repurchases that were included in other current liabilities as of December 31, 2011 for which payment was made in

January 2012.

The consolidated statement of cash flows for the year ended December 31, 2010 does not reflect $43 million of common

stock repurchases that were included in other current liabilities as of December 31, 2010 for which payment was made in

January 2011.

Noncash financing activities for the year ended December 31, 2009 included the TW NY Exchange, in which Historic

TW transferred its 12.43% non-voting common stock interest in TW NY to TWC in exchange for 26.7 million newly issued

shares (after giving effect to the TWC Reverse Stock Split) of TWC’s Class A common stock.

114