Time Warner Cable 2011 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2011 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

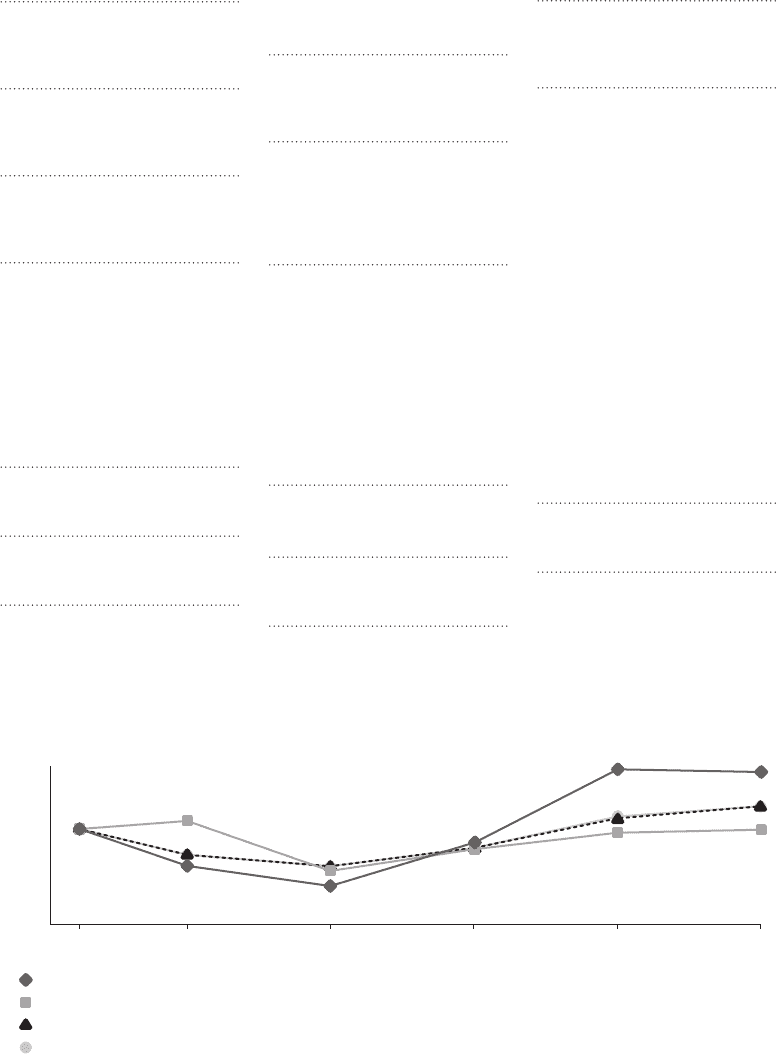

3/1/2007 12/31/2007 12/31/2008 12/31/2009 12/31/2010 12/31/2011

Time Warner Cable Inc. $100 $71 $55 $89 $146 $145

S&P 500 Index $100 $106 $67 $85 $97 $99

Peer Group (ex-Charter) $100 $80 $71 $86 $110 $118

Peer Group (Charter commencing 12/2/2009) $100 $80 $71 $85 $109 $118

Carole Black

Former President &

Chief Executive O icer

Lifetime Entertainment Services

Glenn A. Britt

Chairman &

Chief Executive O icer

Time Warner Cable Inc.

Thomas H. Castro

President &

Chief Executive O icer

El Dorado Capital, LLC

David C. Chang

Chancellor

Polytechnic Institute of

New York University

James E. Copeland, Jr.

Former Chief Executive O icer

Deloitte & Touche USA LLP

Deloitte Touche Tohmatsu Limited

Peter R. Haje

Lead Director

(through May 17, 2012)

Legal & Business Consultant

Former Executive Vice President,

General Counsel & Secretary

Time Warner Inc.

Donna A. James

Consultant, Business Advisor &

Managing Director

Lardon & Associates LLC

Don Logan

Investor

Media, Entertainment and Sports

Former Chairman, Media &

Communications Group

Time Warner Inc.

N.J. Nicholas, Jr.

Lead Director

(commencing May 17, 2012)

Investor

Wayne H. Pace

Former Executive Vice President &

Chief Financial O icer

Time Warner Inc.

Edward D. Shirley

President &

Chief Executive O icer

Bacardi Limited

John E. Sununu

Former U.S. Senator

Glenn A. Britt

Chairman & Chief Executive O icer

Ellen M. East

Executive Vice President &

Chief Communications O icer

Irene M. Esteves

Executive Vice President &

Chief Financial O icer

Michael L. LaJoie

Executive Vice President &

Chief Technology O icer

Marc Lawrence-Apfelbaum

Executive Vice President,

General Counsel & Secretary

Gail G. MacKinnon

Executive Vice President &

Chief Government Relations O icer

Robert D. Marcus

President &

Chief Operating O icer

Tomas G. Mathews

Executive Vice President,

Human Resources

Carl U.J. Rossetti

Executive Vice President &

President,

Time Warner Cable Ventures

Peter C. Stern

Executive Vice President &

Chief Strategy O icer

Melinda C. Witmer

Executive Vice President &

Chief Video & Content O icer

BOARD

OF DIRECTORS

EXECUTIVE

OFFICERS

COMPARISON

OF CUMULATIVE

TOTAL RETURNS

This chart compares the performance of the Company’s common stock with the performance of the S&P 500 Index and a peer group index (the “Peer Group Index”) by measuring changes in the

common stock prices from March 1, 2007, the irst day the Company’s Class A common stock traded on the New York Stock Exchange, through December 31, 2011. On March 12, 2009, the Company

e ected a recapitalization whereby each share of the Company’s Class A common stock and Class B common stock was automatically converted into a single share of common stock, and following the

recapitalization, a reverse stock split whereby every three shares of the Company’s common stock was combined into one share of common stock.

Pursuant to the SEC’s rules, the Company created a peer group index with which to compare its own stock performance, since a relevant published industry or line-of-business index does not exist. The

common stocks of the following companies have been included in the Peer Group Index: Cablevision Systems Corporation (Class A), Charter Communications, Inc. (Class A), Comcast Corporation (Class

A), DIRECTV (Class A) and DISH Network Corporation. Charter Communications, Inc. was added to this index as of the date its stock began trading after it emerged from protection under Chapter 11 of the

U.S. Bankruptcy Code, December 2, 2009.

The chart assumes $100 was invested on March 1, 2007 in each of the Company’s common stock, the S&P 500 Index and the Peer Group Index and relects reinvestment of dividends and distributions on

a monthly basis and quarterly market capitalization weighting.

$150

$125

$100

$75

$50

$25