Time Warner Cable 2011 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2011 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)

As a result of the Separation, on March 12, 2009, TWC employees who held stock option awards under Time Warner

equity plans were treated as if their employment with Time Warner had been terminated without cause. In most cases, this

treatment resulted in shortened exercise periods for vested awards, generally one year from the date of the Separation;

however, certain awards expire over a five-year period from the date of the Separation. Deferred income tax assets were

established based on the Time Warner awards’ fair values, and a corresponding benefit to the Company’s income tax

provision was recognized over the awards’ service periods. For unexercised awards that expired “out of the money,” the fair

value was $0 and the Company received no tax deduction in connection with these awards. As a result, the previously-

recognized deferred income tax assets were written off through noncash charges to income tax expense during the periods in

which the awards expired. As noted above, the charges were reduced by excess tax benefits realized upon the exercise of

TWC stock options or vesting of TWC RSUs in the same year in which the charge was taken.

Absent the impacts of the above items, the effective tax rates would have been 40.3% and 40.9% for 2010 and 2009,

respectively.

Net income attributable to noncontrolling interests. Net income attributable to noncontrolling interests decreased

principally due to changes in the ownership structure of the Company that occurred during the first quarter of 2009 in

connection with the Separation.

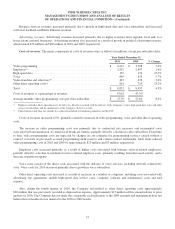

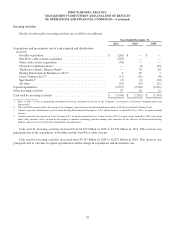

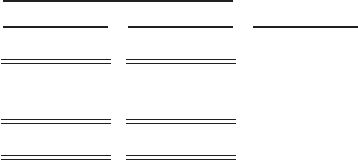

Net income attributable to TWC shareholders and net income per common share attributable to TWC common

shareholders. Net income attributable to TWC shareholders and net income per common share attributable to TWC common

shareholders were as follows for 2010 and 2009 (in millions, except per share data):

Year Ended December 31,

2010 2009 % Change

Net income attributable to TWC shareholders .......................... $ 1,308 $ 1,070 22.2%

Net income per common share attributable to TWC common shareholders:

Basic ........................................................ $ 3.67 $ 3.07 19.5%

Diluted ....................................................... $ 3.64 $ 3.05 19.3%

Net income attributable to TWC shareholders and net income per common share attributable to TWC common

shareholders increased primarily due to an increase in Operating Income, which was partially offset by increases in income

tax provision and interest expense, net, each as discussed above.

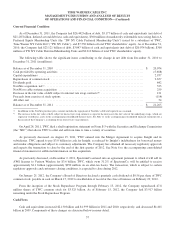

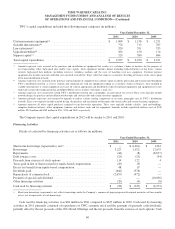

FINANCIAL CONDITION AND LIQUIDITY

Management believes that cash generated by or available to TWC should be sufficient to fund its capital and liquidity

needs for the next twelve months and for the foreseeable future thereafter, including the pending Insight acquisition,

quarterly dividend payments, common stock repurchases and maturities of long-term debt. TWC’s sources of cash include

cash and equivalents on hand, cash provided by operating activities, borrowing capacity under its committed credit facility

and commercial paper program and, subject to closing, the expected proceeds from the pending sale of SpectrumCo’s AWS

licenses, as well as access to capital markets.

The Company generally invests its cash and equivalents in a combination of money market, government and treasury

funds, as well as other similar instruments, in accordance with the Company’s investment policy of diversifying its

investments and limiting the amount of its investments in a single entity or fund. As of December 31, 2011, nearly all of the

Company’s cash and equivalents was invested in money market funds and income earning bank deposits, including

certificates of deposit, with no more than 10% invested in any one fund or deposit.

TWC’s unused committed financial capacity was $9.033 billion as of December 31, 2011, reflecting $5.177 billion of

cash and equivalents and $3.856 billion of available borrowing capacity under the Company’s $4.0 billion senior unsecured

three-year revolving credit facility (the “Revolving Credit Facility”).

56