Time Warner Cable 2011 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2011 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)

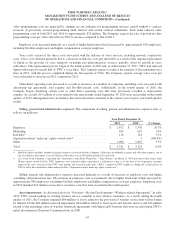

Consistent with the Company’s overall balance sheet management strategy, during 2011, TWC paid quarterly cash

dividends to TWC stockholders totaling $642 million, or $1.92 per share of TWC common stock. On January 25, 2012, the

Company’s Board of Directors declared an increased quarterly cash dividend of $0.56 per share of TWC common stock,

payable in cash on March 15, 2012 to stockholders of record at the close of business on February 29, 2012. In addition to

paying quarterly cash dividends, during 2011, TWC repurchased common stock under its $4.0 billion common stock

repurchase program (the “Stock Repurchase Program”). On January 25, 2012, the Company’s Board of Directors increased

the remaining authorization under the Stock Repurchase Program ($758 million as of January 25, 2012) to an aggregate of up

to $4.0 billion of TWC common stock effective January 26, 2012. Purchases under the Stock Repurchase Program may be

made from time to time on the open market and in privately negotiated transactions. The size and timing of the Company’s

purchases under the Stock Repurchase Program are based on a number of factors, including TWC’s common stock price, as

well as business and market conditions. From the inception of the Stock Repurchase Program through February 15, 2012, the

Company repurchased 47.8 million shares of TWC common stock for $3.325 billion and, as of February 15, 2012, the

Company had $3.917 billion remaining under the Stock Repurchase Program.

Recent Developments

Wireless-related Agreements

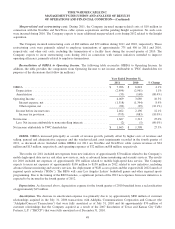

On December 2, 2011, SpectrumCo, LLC (“SpectrumCo”), a joint venture between TWC, Comcast Corporation

(“Comcast”) and Bright House Networks, LLC (“Bright House”) that holds advanced wireless spectrum (“AWS”) licenses

that cover 20MHz over 80% of the continental U.S. and Hawaii, entered into an agreement pursuant to which SpectrumCo

will sell its AWS licenses to Cellco Partnership (doing business as Verizon Wireless), a joint venture between Verizon

Communications Inc. and Vodafone Group Plc, for $3.6 billion in cash. Upon closing, TWC, which owns 31.2% of

SpectrumCo, will be entitled to receive approximately $1.1 billion. This transaction, which is subject to certain regulatory

approvals and customary closing conditions, is expected to close during 2012. On February 9, 2012, Comcast and Verizon

Wireless received a Request for Additional Information and Documentary Materials from the U.S. Department of Justice in

connection with their required notification filed under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as

amended.

Separately, on December 2, 2011, TWC, Comcast, Bright House and Verizon Wireless also entered into agency

agreements that will allow the cable companies to sell Verizon Wireless-branded wireless service, and Verizon Wireless to

sell each cable company’s services. After a four-year period, subject to certain conditions, the cable companies will have the

option to offer wireless service under their own brands utilizing Verizon Wireless’ network. In addition, the parties entered

into an agreement that provides for the creation of an innovation technology joint venture to better integrate wireless and

cable services. On January 13, 2012, TWC received a civil investigative demand from the U.S. Department of Justice

requesting additional information about these agreements.

In early 2012, TWC ceased making its existing wireless service available to new wireless customers. As a result, during

the fourth quarter of 2011, the Company impaired $60 million ($36 million on an after-tax basis) of assets related to the

provision of wireless service that will no longer be utilized. Of the $60 million noncash impairment, $44 million related to

fixed assets and wireless devices and $16 million related to the remaining value of wireless wholesale agreements with Sprint

Nextel Corporation (“Sprint”) and Clearwire Corporation (“Clearwire”) that were recorded upon TWC’s initial investment in

Clearwire Communications LLC (“Clearwire Communications”) in 2008.

Upon the closing of the SpectrumCo transaction, the Company expects to record a pretax gain of approximately $430

million (approximately $260 million on an after-tax basis), which will be included in other income (expense), net, in the

Company’s consolidated statement of operations. Additionally, in the quarter in which the SpectrumCo transaction closes,

the Company expects to record a noncash income tax benefit of approximately $45 million related to an adjustment to the

Company’s valuation allowance for deferred income tax assets associated with its investment in Clearwire Communications.

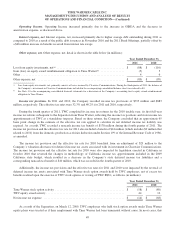

Acquisitions

On April 21, 2011, TWC completed its acquisition of NaviSite for $263 million, net of cash acquired. At closing, TWC

also repaid $44 million of NaviSite’s debt. NaviSite’s financial results have been included in the Company’s consolidated

financial statements from the acquisition date. See Note 6 to the accompanying consolidated financial statements for

additional information on the NaviSite acquisition.

40