Time Warner Cable 2011 Annual Report Download - page 93

Download and view the complete annual report

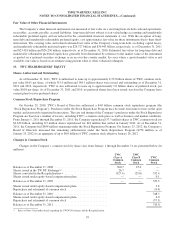

Please find page 93 of the 2011 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

6. BUSINESS ACQUISITIONS

NewWave Cable Systems Acquisition

On November 1, 2011, TWC completed its acquisition of certain NewWave Communications (“NewWave”) cable

systems in Kentucky and western Tennessee for $259 million in cash. The financial results for the NewWave cable systems,

which served subscribers representing 138,000 primary service units (“PSUs”) as of the acquisition date, have been included

in the Company’s consolidated financial statements from the acquisition date and did not significantly impact the Company’s

consolidated financial results for the year ended December 31, 2011.

As part of the purchase price allocation, TWC recorded goodwill of $10 million and allocated $79 million to property,

plant and equipment (e.g., primarily distribution systems) and $157 million to intangible assets not subject to amortization

(e.g., cable franchise rights). The purchase price allocation primarily used a discounted cash flow approach with respect to

identified intangible assets and a combination of the cost and market approaches with respect to property, plant and

equipment. The discounted cash flow approach was based upon management’s estimates of future cash flows and a discount

rate consistent with the inherent risk of each of the acquired assets. The purchase price allocation is being finalized.

Insight Acquisition

On August 15, 2011, TWC entered into an agreement (the “Merger Agreement”) with Insight Communications

Company, Inc. (“Insight”) and a representative of its stockholders to acquire Insight and its subsidiaries, which operate cable

systems in Kentucky, Indiana and Ohio that then served subscribers representing approximately 1.5 million PSUs. Pursuant

to the Merger Agreement, a subsidiary of TWC will merge with and into Insight, with Insight surviving as a direct wholly

owned subsidiary of the Company. TWC agreed to pay $3.0 billion in cash for Insight, as reduced by Insight’s indebtedness

for borrowed money and similar obligations (including amounts outstanding under Insight’s credit agreement and senior

notes due 2018, which totaled approximately $1.8 billion as of the date of the Merger Agreement). The purchase price is

subject to customary adjustments, including a reduction to the extent the number of Insight’s video subscribers at the closing

is less than an agreed upon threshold, as well as a working capital adjustment. The Company has obtained all necessary

regulatory approvals and expects the transaction to close by the end of the first quarter of 2012; however, there can be no

assurances that the transaction will close or, if it does, that the Company will realize the potential financial and operating

benefits of the transaction.

NaviSite Acquisition

On April 21, 2011, TWC completed its acquisition of NaviSite for $263 million, net of cash acquired. At closing, TWC

also repaid $44 million of NaviSite’s debt. NaviSite’s financial results have been included in the Company’s consolidated

financial statements from the acquisition date and did not significantly impact the Company’s consolidated financial results

for the year ended December 31, 2011.

As part of the purchase price allocation, TWC recorded goodwill of $142 million and allocated $61 million to property,

plant and equipment (e.g., computer hardware) and $56 million to intangible assets subject to amortization (e.g., customer

relationships, trademarks and developed technology) with a weighted-average amortization period of 6.71 years. The

purchase price allocation primarily used a discounted cash flow approach with respect to identified intangible assets and a

combination of the cost and market approaches with respect to property, plant and equipment. The discounted cash flow

approach was based upon management’s estimates of future cash flows and a discount rate consistent with the inherent risk

of each of the acquired assets. The purchase price allocation is being finalized, including finalization of certain tax liabilities,

but the Company does not expect any material changes to the allocation.

Other Acquisitions

Additionally, during 2011, TWC completed two acquisitions of cable systems in Texas and Ohio serving subscribers

representing a total of 26,000 PSUs for $38 million in cash. The financial results for these acquisitions have been included in

the Company’s consolidated financial statements from the respective acquisition date and did not significantly impact the

Company’s consolidated financial results for the year ended December 31, 2011.

85