Time Warner Cable 2011 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2011 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

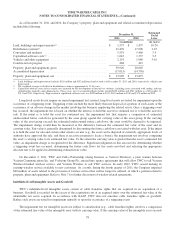

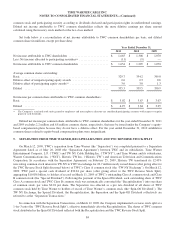

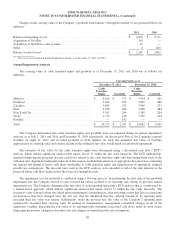

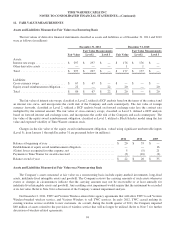

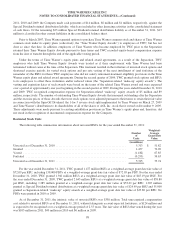

Changes in the carrying value of the Company’s goodwill from January 1 through December 31 are presented below (in

millions):

2011 2010

Balance at beginning of year .................................................... $ 2,091 $ 2,111

Acquisition of NaviSite ........................................................ 142 —

Acquisition of NewWave cable systems ........................................... 10 —

Other ....................................................................... 4 (20)

Balance at end of year(a) ......................................................... $ 2,247 $ 2,091

(a) There were no accumulated goodwill impairment charges as of December 31, 2011 and 2010.

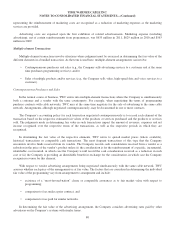

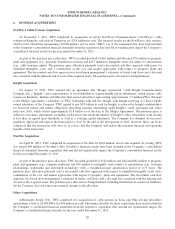

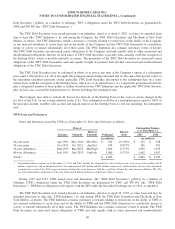

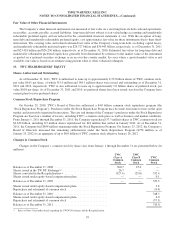

Annual Impairment Analysis

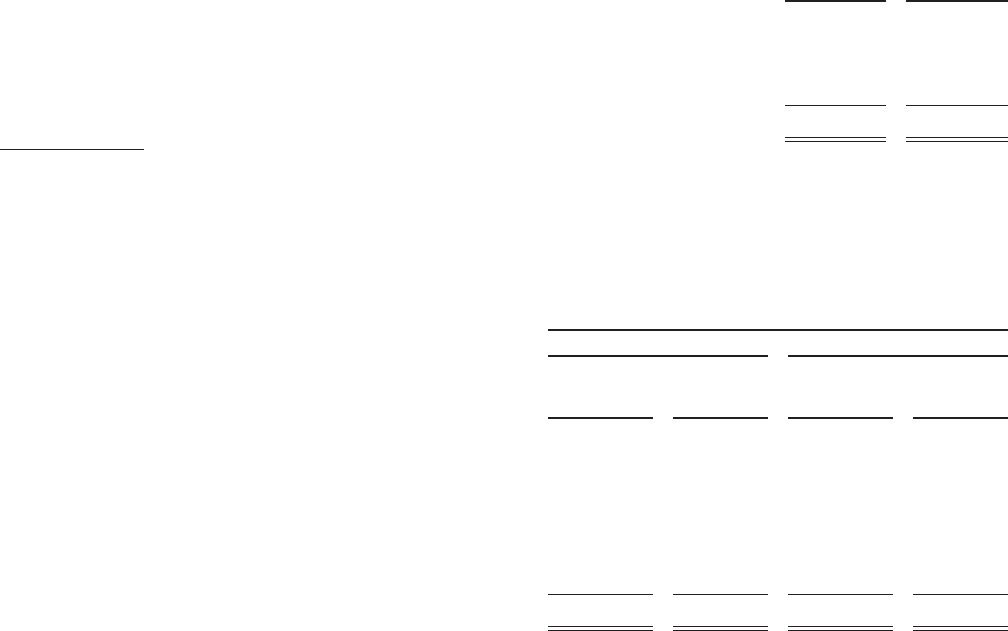

The carrying value of cable franchise rights and goodwill as of December 31, 2011 and 2010 was as follows (in

millions):

Carrying Value as of

December 31, 2011 December 31, 2010

Cable

Franchise

Rights Goodwill

Cable

Franchise

Rights Goodwill

Midwest ............................................. $ 6,100 $ 572 $ 5,934 $ 562

Northeast ............................................. 5,645 466 5,645 466

Carolinas ............................................. 3,969 231 3,969 231

West ................................................ 3,498 484 3,498 484

New York City ........................................ 3,345 204 3,345 204

Texas ................................................ 1,715 148 1,700 144

NaviSite ............................................. — 142 — —

Total ................................................ $ 24,272 $ 2,247 $ 24,091 $ 2,091

The Company determined that cable franchise rights and goodwill were not impaired during its annual impairment

analyses as of July 1, 2011 and 2010 and December 31, 2009 respectively. As discussed in Note 6, the Company acquired

NaviSite on April 21, 2011 and recorded goodwill of $142 million. As such, the estimated fair value of NaviSite

approximates its carrying value and a future decline in the estimated fair value would result in a goodwill impairment.

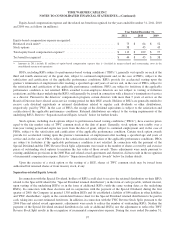

The estimates of fair value for the cable franchise rights were determined using a discounted cash flow (“DCF”)

analysis, which utilizes significant unobservable inputs (Level 3) within the fair value hierarchy. The DCF methodology

entailed identifying the projected discrete cash flows related to the cable franchise rights and discounting them back to the

valuation date. Significant judgments inherent in this analysis included the selection of appropriate discount rates, estimating

the amount and timing of future cash flows attributable to cable franchise rights and identification of appropriate terminal

growth rate assumptions. The discount rates used in the DCF analyses were intended to reflect the risk inherent in the

projected future cash flows generated by the respective intangible assets.

The impairment test for goodwill is conducted using a two-step process. In performing the first step of the goodwill

impairment test, the Company elected to carry forward the values ascribed to its reporting units during its previous annual

impairment test. The Company determined the fair value of each reporting unit using a DCF analysis that is corroborated by

a market-based approach, which utilizes significant unobservable inputs (Level 3) within the fair value hierarchy. The

election to carry forward values was based upon management’s determination, after reviewing events that have occurred and

circumstances that have changed since the last test, that the likelihood that the carrying amount of its reporting units

exceeded their fair value was remote. Additionally, under the previous test, the value of the Company’s reporting units

significantly exceeded their carrying value. In making its determination, management considered changes in all of the

significant variables impacting the fair value of its reporting units including, forecasted cash flows under its most recent

long-range projections, changes in discount rates and changes in terminal growth rate assumptions.

88