Time Warner Cable 2011 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2011 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

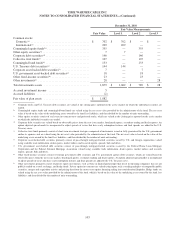

12. FAIR VALUE MEASUREMENTS

Assets and Liabilities Measured at Fair Value on a Recurring Basis

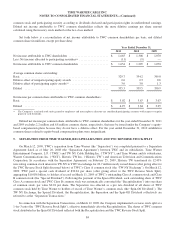

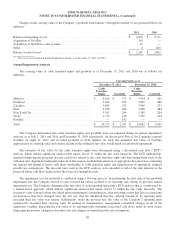

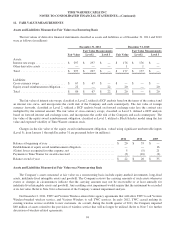

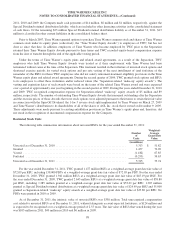

The fair values of derivative financial instruments classified as assets and liabilities as of December 31, 2011 and 2010

were as follows (in millions):

December 31, 2011 December 31, 2010

Fair Value Measurements Fair Value Measurements

Fair Value Level 2 Level 3 Fair Value Level 2 Level 3

Assets:

Interest rate swaps .................... $ 297 $ 297 $ — $ 176 $ 176 $ —

Other derivative assets ................ — — — 1 1 —

Total .............................. $ 297 $ 297 $ — $ 177 $ 177 $ —

Liabilities:

Cross-currency swaps ................. $ 67 $ 67 $ — $ — $ — $ —

Equity award reimbursement obligation . . . 22 — 22 20 — 20

Total .............................. $ 89 $ 67 $ 22 $ 20 $ — $ 20

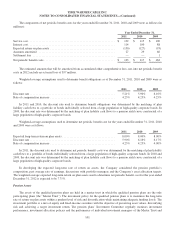

The fair value of interest rate swaps, classified as Level 2, utilized a DCF analysis based on the terms of the contract and

an interest rate curve, and incorporates the credit risk of the Company and each counterparty. The fair value of foreign

currency forwards, classified as Level 2, utilized a DCF analysis based on forward exchange rates less the contract rate

multiplied by the notional amount. The fair value of cross-currency swaps, classified as Level 2, utilized a DCF analysis

based on forward interest and exchange rates, and incorporates the credit risk of the Company and each counterparty. The

fair value of the equity award reimbursement obligation, classified as Level 3, utilized a Black-Scholes model using the fair

value and expected volatility of Time Warner common stock.

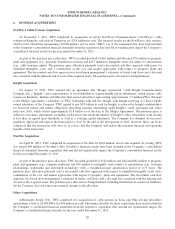

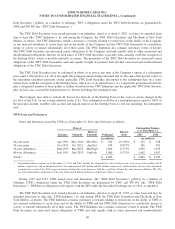

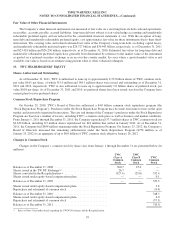

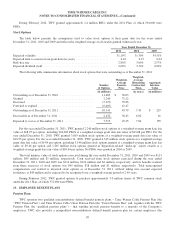

Changes in the fair value of the equity award reimbursement obligation, valued using significant unobservable inputs

(Level 3), from January 1 through December 31 are presented below (in millions):

2011 2010 2009

Balance at beginning of year ............................................. $ 20 $ 35 $ —

Establishment of equity award reimbursement obligation ....................... — — 16

(Gains) losses recognized in other expense, net .............................. 5 (5) 21

Payments to Time Warner for awards exercised .............................. (3) (10) (2)

Balance at end of year .................................................. $ 22 $ 20 $ 35

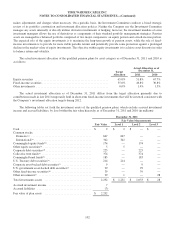

Assets and Liabilities Measured at Fair Value on a Nonrecurring Basis

The Company’s assets measured at fair value on a nonrecurring basis include equity-method investments, long-lived

assets, indefinite-lived intangible assets and goodwill. The Company reviews the carrying amounts of such assets whenever

events or changes in circumstances indicate that the carrying amounts may not be recoverable or at least annually for

indefinite-lived intangible assets and goodwill. Any resulting asset impairment would require that the instrument be recorded

at its fair value. Refer to Note 8 for a discussion of the Company’s annual impairment analysis.

On December 2, 2011, TWC and Verizon Wireless entered into agency agreements that will allow TWC to sell Verizon

Wireless-branded wireless service, and Verizon Wireless to sell TWC services. In early 2012, TWC ceased making its

existing wireless service available to new customers. As a result, during the fourth quarter of 2011, the Company impaired

$60 million of assets related to the provision of wireless service that will no longer be utilized. Refer to Note 7 for further

discussion of wireless-related agreements.

94