Time Warner Cable 2011 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2011 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

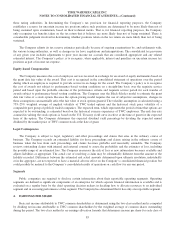

its fair value, an impairment charge is recognized in an amount equal to that excess. Refer to Note 8 for further details

regarding the Company’s indefinite-lived intangible assets and related impairment testing.

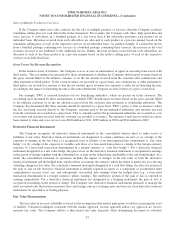

The impairment test for goodwill is conducted using a two-step process. The first step involves a comparison of the

estimated fair value of each of the Company’s reporting units to its carrying amount, including goodwill. If the estimated fair

value of a reporting unit exceeds its carrying amount, goodwill of the reporting unit is not impaired and the second step of the

impairment test is not necessary. If the carrying amount of a reporting unit exceeds its estimated fair value, then the second

step of the goodwill impairment test must be performed. The second step of the goodwill impairment test compares the

implied fair value of the reporting unit’s goodwill with its goodwill carrying amount to measure the amount of impairment, if

any. The implied fair value of goodwill is determined in the same manner as the amount of goodwill recognized in a business

combination. In other words, the estimated fair value of the reporting unit is allocated to all of the assets and liabilities of that

unit (including any unrecognized intangible assets) as if the reporting unit had been acquired in a business combination and

the fair value of the reporting unit was the purchase price paid. If the carrying amount of the reporting unit’s goodwill

exceeds the implied fair value of that goodwill, an impairment charge is recognized in an amount equal to that excess. Refer

to Note 8 for further details regarding the Company’s goodwill and related impairment testing.

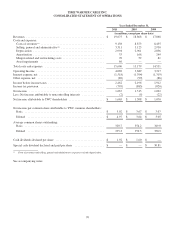

Revenues and Costs

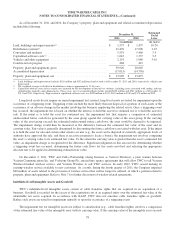

Revenues are principally derived from residential services, business services, advertising and other services. Residential

services revenues consist of video, high-speed data, voice and other revenues. Business services revenues consist of video,

high-speed data, voice, wholesale transport and other revenues. Residential and business services subscriber fees are

recorded as revenues in the period during which the service is provided. Residential and business services revenues received

from subscribers who purchase bundled services at a discounted rate are allocated to each product in a pro-rata manner based

on the individual product’s selling price (generally, the price at which the product is regularly sold on a standalone basis).

Installation revenues obtained from subscriber service connections are recognized as a component of residential and business

services revenues when the connections are completed, as installation revenues recognized are less than the related direct

selling costs. Advertising revenues are recognized in the period during which the advertisements are exhibited. Other

revenues primarily include (a) fees paid to TWC by (i) the Advance/Newhouse Partnership and Insight for the ability to

distribute TWC’s high-speed data service and (ii) the Advance/Newhouse Partnership for TWC’s management of certain

functions, including, among others, programming and engineering and (b) commissions earned on the sale of merchandise by

home shopping networks. Fees paid to TWC for the ability to distribute TWC’s services are recognized as revenues in the

period in which TWC’s services are distributed to a consumer. Fees received for managing certain functions for the Advance/

Newhouse Partnership are recognized as revenues in the period during which the management functions are performed.

Commissions earned on the sale of merchandise by home shopping networks are recognized as revenues in the period during

which the merchandise is sold.

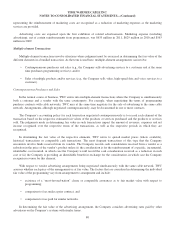

Video programming, high-speed data and voice costs are recorded as the services are provided. Video programming

costs are recorded based on the Company’s contractual agreements with its programming vendors. These contracts are

generally multi-year agreements that provide for the Company to make payments to the programming vendors at agreed upon

rates based on the number of subscribers to which the Company provides the programming service. If a programming

contract expires prior to the parties’ entry into a new agreement and the Company continues to distribute the service,

management estimates the programming costs during the period there is no contract in place. In doing so, management

considers the previous contractual rates, inflation and the status of the negotiations in determining its estimates. When the

programming contract terms are finalized, an adjustment to programming expense is recorded, if necessary, to reflect the

terms of the new contract. Management also makes estimates in the recognition of programming expense related to other

items, such as the accounting for free periods and credits from service interruptions, as well as the allocation of consideration

exchanged between the parties in multiple-element transactions. Additionally, judgments are also required by management

when the Company purchases multiple services from the same programming vendor. In these scenarios, the total

consideration provided to the programming vendor is allocated to the various services received based upon their respective

fair values. Because multiple services from the same programming vendor may be received over different contractual periods

and may have different contractual rates, the allocation of consideration to the individual services may have an impact on the

timing of the Company’s expense recognition.

Launch fees received by the Company from programming vendors are recognized as a reduction of expense on a

straight-line basis over the term of the related programming arrangement. Amounts received from programming vendors

79