Time Warner Cable 2011 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2011 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)

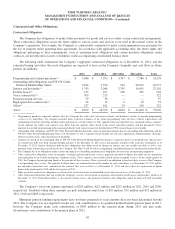

Foreign Currency Exchange Risk

TWC is exposed to the market risks associated with fluctuations in the British pound sterling exchange rate as it relates

to the £625 million in aggregate principal amount of 5.75% senior unsecured notes due 2031 issued in the May 2011 Bond

Offering. As described further in Note 11 to the accompanying consolidated financial statements, the Company has entered

into cross-currency swaps to effectively convert the entire balance of its fixed-rate British pound sterling denominated debt

to fixed-rate U.S. dollar denominated debt, hedging the risk that the cash flows related to annual interest payments and the

payment of principal at maturity may be adversely affected by fluctuations in currency exchange rates. The gains and losses

on the cross-currency swaps offset changes in the fair value of the Company’s fixed-rate British pound sterling denominated

debt resulting from changes in exchange rates.

Equity Risk

TWC is also exposed to market risk as it relates to changes in the market value of its investments. TWC invests in

equity instruments of companies for operational and strategic business purposes. These investments are subject to significant

fluctuations in fair market value. As of December 31, 2011, TWC had $774 million of investments, which included $693

million related to SpectrumCo. Refer to “Overview—Recent Developments—Wireless-related Agreements” for further

details regarding SpectrumCo’s pending sale of its AWS licenses to Verizon Wireless.

Prior to 2007, some of TWC’s employees were granted options to purchase shares of Time Warner common stock in

connection with their past employment with subsidiaries and affiliates of Time Warner, including TWC. Upon the exercise of

Time Warner stock options held by TWC employees, TWC is obligated to reimburse Time Warner for the excess of the

market price of Time Warner common stock on the day of exercise over the option exercise price (the “intrinsic” value of the

award). The Company records the equity award reimbursement obligation at fair value in other current liabilities in the

consolidated balance sheet, which is estimated using the Black-Scholes model. The change in the equity award

reimbursement obligation fluctuates primarily with the fair value and expected volatility of Time Warner common stock and

changes in fair value are recorded in other expense, net, in the period of change. For the year ended December 31, 2011,

TWC recognized a loss of $5 million in other expense, net, in the accompanying consolidated statement of operations for the

change in the fair value of the equity award reimbursement obligation after the Separation.

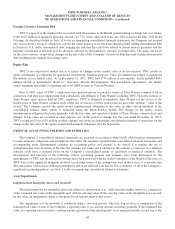

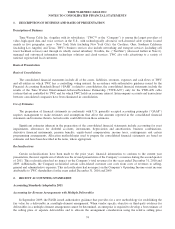

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

The Company’s consolidated financial statements are prepared in accordance with GAAP, which requires management

to make estimates, judgments and assumptions that affect the amounts reported in the consolidated financial statements and

accompanying notes. Management considers an accounting policy and estimate to be critical if it requires the use of

assumptions that were uncertain at the time the estimate was made and if changes in the estimate or selection of a different

estimate could have a material effect on the Company’s consolidated results of operations or financial condition. The

development and selection of the following critical accounting policies and estimates have been determined by the

management of TWC and the related disclosures have been reviewed with the Audit Committee of the Board of Directors of

TWC. Due to the significant judgment involved in selecting certain of the assumptions used in these areas, it is possible that

different parties could choose different assumptions and reach different conclusions. For a summary of all of the Company’s

significant accounting policies, see Note 3 to the accompanying consolidated financial statements.

Asset Impairments

Indefinite-lived Intangible Assets and Goodwill

The impairment test for intangible assets not subject to amortization (e.g., cable franchise rights) involves a comparison

of the estimated fair value of the intangible asset with its carrying value. If the carrying value of the intangible asset exceeds

its fair value, an impairment charge is recognized in an amount equal to that excess.

The impairment test for goodwill is conducted using a two-step process. The first step involves a comparison of the

estimated fair value of each of the Company’s reporting units to its carrying amount, including goodwill. If the estimated fair

value of a reporting unit exceeds its carrying amount, goodwill of the reporting unit is not impaired and the second step of the

64