Time Warner Cable 2011 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2011 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

common stock and participating security according to dividends declared and participation rights in undistributed earnings.

Diluted net income attributable to TWC common shareholders reflects the more dilutive earnings per share amount

calculated using the treasury stock method or the two-class method.

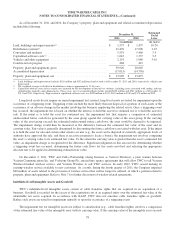

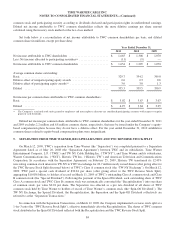

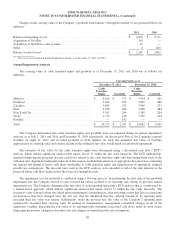

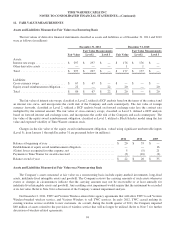

Set forth below is a reconciliation of net income attributable to TWC common shareholders per basic and diluted

common share (in millions, except per share data):

Year Ended December 31,

2011 2010 2009

Net income attributable to TWC shareholders ........................... $ 1,665 $ 1,308 $ 1,070

Less: Net income allocated to participating securities(a) .................... (11) (9) —

Net income attributable to TWC common shareholders ................... $ 1,654 $ 1,299 $ 1,070

Average common shares outstanding:

Basic ........................................................... 329.7 354.2 349.0

Dilutive effect of nonparticipating equity awards ........................ 2.6 2.3 0.6

Dilutive effect of participating equity awards(a) .......................... 3.0 3.0 1.3

Diluted ......................................................... 335.3 359.5 350.9

Net income per common share attributable to TWC common shareholders:

Basic ........................................................... $ 5.02 $ 3.67 $ 3.07

Diluted ......................................................... $ 4.97 $ 3.64 $ 3.05

(a) The Company’s restricted stock units granted to employees and non-employee directors are considered participating securities with respect to regular

quarterly cash dividends.

Diluted net income per common share attributable to TWC common shareholders for the year ended December 31, 2011

and 2009 excludes 2.2 million and 6.8 million common shares, respectively, that may be issued under the Company’s equity-

based compensation plans because they do not have a dilutive effect. For the year ended December 31, 2010 antidilutive

common shares related to equity-based compensation plans were insignificant.

5. SEPARATION FROM TIME WARNER, RECAPITALIZATION AND TWC REVERSE STOCK SPLIT

On March 12, 2009, TWC’s separation from Time Warner (the “Separation”) was completed pursuant to a Separation

Agreement dated as of May 20, 2008 (the “Separation Agreement”) between TWC and its subsidiaries, Time Warner

Entertainment Company, L.P. (“TWE”) and TW NY Cable Holding Inc. (“TW NY”), and Time Warner and its subsidiaries,

Warner Communications Inc. (“WCI”), Historic TW Inc. (“Historic TW”) and American Television and Communications

Corporation. In accordance with the Separation Agreement, on February 25, 2009, Historic TW transferred its 12.43%

non-voting common stock interest in TW NY to TWC in exchange for 26.7 million newly issued shares (after giving effect to

the TWC Reverse Stock Split discussed below) of TWC’s Class A common stock (the “TW NY Exchange”). On March 12,

2009, TWC paid a special cash dividend of $30.81 per share (after giving effect to the TWC Reverse Stock Split),

aggregating $10.856 billion, to holders of record on March 11, 2009 of TWC’s outstanding Class A common stock and Class

B common stock (the “Special Dividend”). Following the payment of the Special Dividend, each outstanding share of TWC

Class A common stock and TWC Class B common stock was automatically converted (the “Recapitalization”) into one share

of common stock, par value $0.01 per share. The Separation was effected as a pro rata dividend of all shares of TWC

common stock held by Time Warner to holders of record of Time Warner’s common stock (the “Spin-Off Dividend”). The

TW NY Exchange, the Special Dividend, the Recapitalization, the Separation and the Spin-Off Dividend collectively are

referred to as the “Separation Transactions.”

In connection with the Separation Transactions, on March 12, 2009, the Company implemented a reverse stock split at a

1-for-3 ratio (the “TWC Reverse Stock Split”), effective immediately after the Recapitalization. The shares of TWC common

stock distributed in the Spin-Off Dividend reflected both the Recapitalization and the TWC Reverse Stock Split.

84