Time Warner Cable 2011 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2011 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

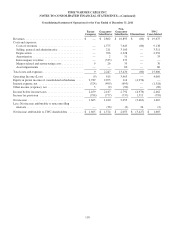

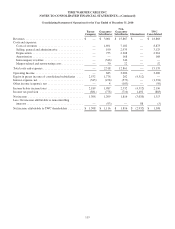

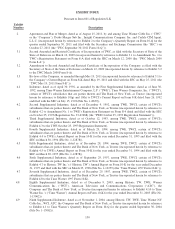

TIME WARNER CABLE INC.

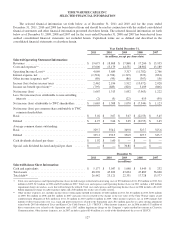

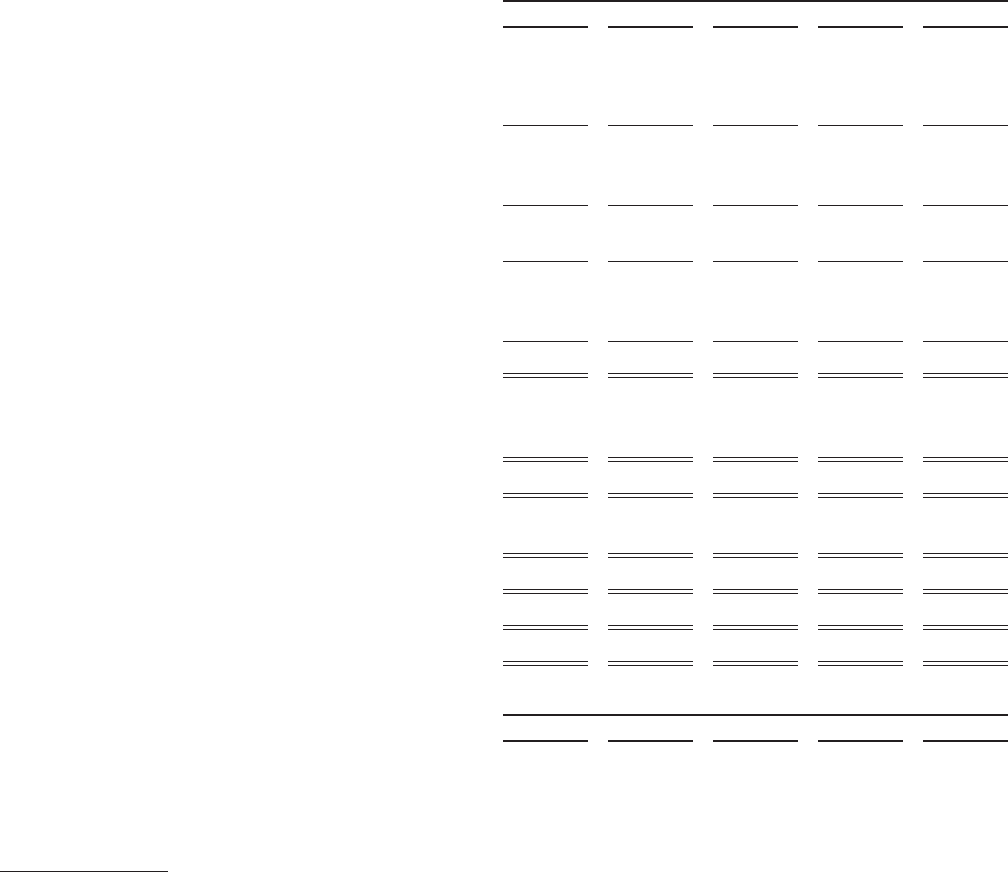

SELECTED FINANCIAL INFORMATION

The selected financial information set forth below as of December 31, 2011 and 2010 and for the years ended

December 31, 2011, 2010 and 2009 has been derived from and should be read in conjunction with the audited consolidated

financial statements and other financial information presented elsewhere herein. The selected financial information set forth

below as of December 31, 2009, 2008 and 2007 and for the years ended December 31, 2008 and 2007 has been derived from

audited consolidated financial statements not included herein. Capitalized terms are as defined and described in the

consolidated financial statements or elsewhere herein.

Year Ended December 31,

2011 2010 2009 2008 2007

(in millions, except per share data)

Selected Operating Statement Information:

Revenues ........................................ $ 19,675 $ 18,868 $ 17,868 $ 17,200 $ 15,955

Costs and expenses(a) ............................... 15,606 15,179 14,551 28,982 13,189

Operating Income (Loss)(a) .......................... 4,069 3,689 3,317 (11,782) 2,766

Interest expense, net ............................... (1,518) (1,394) (1,319) (923) (894)

Other income (expense), net(b) ........................ (89) (99) (86) (367) 156

Income (loss) before income taxes .................... 2,462 2,196 1,912 (13,072) 2,028

Income tax benefit (provision)(c) ...................... (795) (883) (820) 5,109 (806)

Net income (loss) ................................. 1,667 1,313 1,092 (7,963) 1,222

Less: Net (income) loss attributable to noncontrolling

interests ....................................... (2) (5) (22) 619 (99)

Net income (loss) attributable to TWC shareholders ...... $ 1,665 $ 1,308 $ 1,070 $ (7,344) $ 1,123

Net income (loss) per common share attributable to TWC

common shareholders:

Basic ........................................... $ 5.02 $ 3.67 $ 3.07 $ (22.55) $ 3.45

Diluted ......................................... $ 4.97 $ 3.64 $ 3.05 $ (22.55) $ 3.45

Average common shares outstanding:

Basic ........................................... 329.7 354.2 349.0 325.7 325.6

Diluted ......................................... 335.3 359.5 350.9 325.7 325.7

Cash dividends declared per share .................... $ 1.92 $ 1.60 $ — $ — $ —

Special cash dividend declared and paid per share ....... $ — $ — $ 30.81 $ — $ —

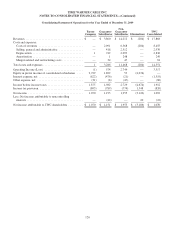

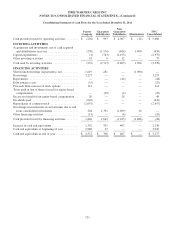

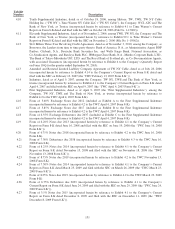

December 31,

2011 2010 2009 2008 2007

(in millions)

Selected Balance Sheet Information:

Cash and equivalents .............................. $ 5,177 $ 3,047 $ 1,048 $ 5,449 $ 232

Total assets ...................................... 48,276 45,822 43,694 47,889 56,600

Total debt(d) ...................................... 26,442 23,121 22,331 17,728 13,577

(a) Total costs and expenses and Operating Income (Loss) include merger-related and restructuring costs of $70 million in 2011, $52 million in 2010, $81

million in 2009, $15 million in 2008 and $23 million in 2007. Total costs and expenses and Operating Income (Loss) in 2011 includes a $60 million

impairment charge on wireless assets that will no longer be utilized. Total costs and expenses and Operating Income (Loss) in 2008 includes a $14.822

billion impairment charge on cable franchise rights and a $58 million loss on the sale of cable systems.

(b) Other income (expense), net, includes income (losses) from equity-method investments of $(88) million in 2011, $(110) million in 2010, $(49) million

in 2009, $16 million in 2008 and $11 million in 2007 and gains (losses) related to the change in the fair value of the Time Warner equity award

reimbursement obligation of $(5) million in 2011, $5 million in 2010 and $(21) million in 2009. Other income (expense), net, in 2009 includes $28

million of direct transaction costs (e.g., legal and professional fees) related to the Separation and a $12 million gain due to a post-closing adjustment

related to the 2007 dissolution of Texas and Kansas City Cable Partners, L.P. (“TKCCP”). Other income (expense), net, in 2008 includes $17 million of

direct transaction costs related to the Separation and a $367 million impairment charge on the Company’s equity-method investment in Clearwire

Communications. Other income (expense), net, in 2007 includes a gain of $146 million as a result of the distribution of the assets of TKCCP.

127