Time Warner Cable 2011 Annual Report Download - page 123

Download and view the complete annual report

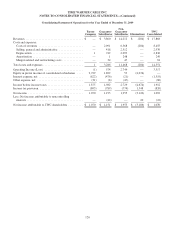

Please find page 123 of the 2011 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

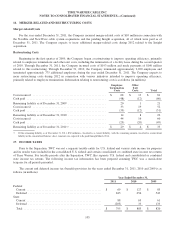

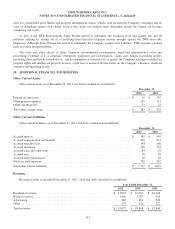

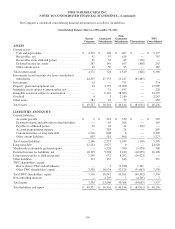

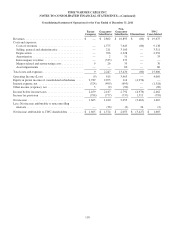

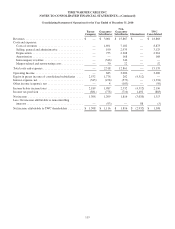

21. CONDENSED CONSOLIDATING FINANCIAL STATEMENTS

TWE and TW NY (the “Guarantor Subsidiaries”) are subsidiaries of Time Warner Cable Inc. (the “Parent Company”).

The Guarantor Subsidiaries have fully and unconditionally, jointly and severally, directly or indirectly, guaranteed the debt

issued by the Parent Company in its 2007 registered exchange offer and its subsequent public offerings. The Parent Company

owns all of the voting interests, directly or indirectly, of both TWE and TW NY.

The SEC’s rules require that condensed consolidating financial information be provided for subsidiaries that have

guaranteed debt of a registrant issued in a public offering, where each such guarantee is full and unconditional and where the

voting interests of the subsidiaries are wholly owned by the registrant. Set forth below are condensed consolidating financial

statements presenting the financial position, results of operations, and cash flows of (i) the Parent Company, (ii) the

Guarantor Subsidiaries on a combined basis (as such guarantees are joint and several), (iii) the direct and indirect

non-guarantor subsidiaries of the Parent Company (the “Non-Guarantor Subsidiaries”) on a combined basis and (iv) the

eliminations necessary to arrive at the information for Time Warner Cable Inc. on a consolidated basis.

There are no legal or regulatory restrictions on the Parent Company’s ability to obtain funds from any of its subsidiaries

through dividends, loans or advances.

These condensed consolidating financial statements should be read in conjunction with the consolidated financial

statements of Time Warner Cable Inc.

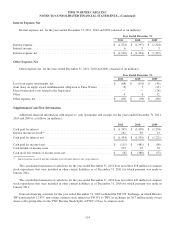

Basis of Presentation

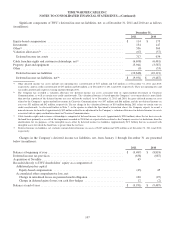

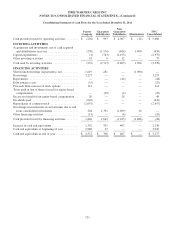

In presenting the condensed consolidating financial statements, the equity method of accounting has been applied to

(i) the Parent Company’s interests in the Guarantor Subsidiaries and the Non-Guarantor Subsidiaries, (ii) the Guarantor

Subsidiaries’ interests in the Non-Guarantor Subsidiaries and (iii) the Non-Guarantor Subsidiaries interests in the Guarantor

Subsidiaries, where applicable, even though all such subsidiaries meet the requirements to be consolidated under U.S.

generally accepted accounting principles. All intercompany balances and transactions between the Parent Company, the

Guarantor Subsidiaries and the Non-Guarantor Subsidiaries have been eliminated, as shown in the column “Eliminations.”

The accounting bases in all subsidiaries, including goodwill and identified intangible assets, have been allocated to the

applicable subsidiaries.

Certain administrative costs incurred by the Parent Company, the Guarantor Subsidiaries or the Non-Guarantor

Subsidiaries are allocated to the various entities based on the relative number of video subscribers at each entity.

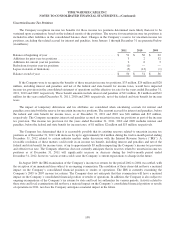

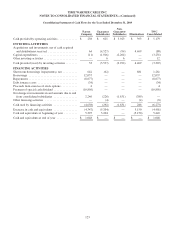

Effective January 1, 2010, the Company prospectively modified its intercompany transfer pricing agreement for certain

services. While this modification did not materially impact net income of either the Guarantor Subsidiaries or the

Non-Guarantor Subsidiaries, it did increase revenues and associated expenses (including expenses reported as intercompany

royalties) for the Non-Guarantor Subsidiaries and reduced revenues and associated expenses for the Guarantor Subsidiaries.

Prior to October 1, 2009, interest income (expense), net, was determined based on third-party debt and the relevant

intercompany amounts within the respective legal entity. Beginning October 1, 2009, the Parent Company began to allocate

interest expense to certain subsidiaries based on each subsidiary’s contribution to revenues. This allocation serves to reduce

the Parent Company’s interest expense and increase the interest expense of both the Guarantor Subsidiaries and

Non-Guarantor Subsidiaries.

Prior to March 12, 2009, Time Warner Cable Inc. was not a separate taxable entity for U.S. federal and various state

income tax purposes and its results were included in the consolidated U.S. federal and certain state income tax returns of

Time Warner Inc. In the condensed consolidating financial statements, income tax provision has been presented based on

each subsidiary’s legal entity basis. Deferred taxes of the Parent Company, the Guarantor Subsidiaries and the

Non-Guarantor Subsidiaries have been presented based upon the temporary differences between the carrying amounts of the

respective assets and liabilities of the applicable entities.

115