Time Warner Cable 2011 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2011 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)

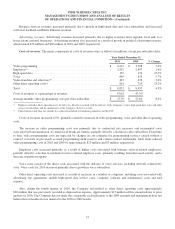

video programming costs are impacted by changes in cost estimates for programming services carried without a contract,

reversals of previously accrued programming audit reserves and certain contract settlements. Such items reduced video

programming costs in both 2011 and 2010 by approximately $25 million. The Company expects the rate of growth in video

programming costs per video subscriber in 2012 to increase compared to that in 2011.

Employee costs increased primarily as a result of higher headcount (which increased by approximately 650 employees,

including NaviSite employees) and higher compensation costs per employee.

Voice costs consist of the direct costs associated with the delivery of voice services, including network connectivity

costs. Voice costs declined primarily due to a decrease in delivery costs per subscriber as a result of the ongoing replacement

of Sprint as the provider of voice transport, switching and interconnection services, partially offset by growth in voice

subscribers. This replacement process began in the fourth quarter of 2010 and, as of December 31, 2011, TWC had replaced

Sprint with respect to nearly half of TWC’s voice lines. The Company expects to replace the majority of the remaining voice

lines in 2013, with the process completed during the first quarter of 2014. The Company expects average voice costs per

voice subscriber to decrease in 2012 compared to 2011.

Other direct operating costs increased as a result of increases in a number of categories, including costs associated with

advertising rep agreements, fuel expense and NaviSite-related costs. Additionally, in the fourth quarter of 2010, the

Company began classifying certain costs as other direct operating costs that were previously recorded as depreciation

expense. As a result, $15 million of costs related to the nine months ended September 30, 2010 were reclassified in the fourth

quarter of 2010. Management does not believe this reclassification is material to the current year or prior year fourth quarter

results.

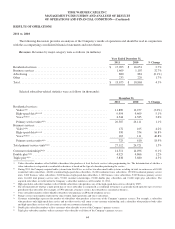

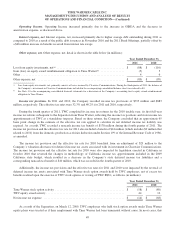

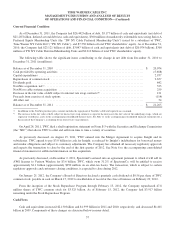

Selling, general and administrative expenses. The components of selling, general and administrative expenses were as

follows (in millions):

Year Ended December 31,

2011 2010 % Change

Employee ...................................................... $ 1,472 $ 1,330 10.7%

Marketing ...................................................... 635 629 1.0%

Bad debt(a) ...................................................... 118 114 3.5%

Separation-related “make-up” equity award costs(b) ...................... — 5 (100.0%)

Other .......................................................... 1,086 1,047 3.7%

Total .......................................................... $ 3,311 $ 3,125 6.0%

(a) Bad debt expense includes amounts charged to expense associated with the Company’s allowance for doubtful accounts and collection expenses, net of

late fees billed to subscribers. Late fees billed to subscribers were $140 million in both 2011 and 2010.

(b) As a result of the Company’s separation (the “Separation”) from Time Warner Inc. (“Time Warner”) on March 12, 2009, pursuant to their terms, Time

Warner equity awards held by TWC employees were forfeited and/or experienced a reduction in value as of the date of the Separation. Amounts

represent the costs associated with TWC stock options and restricted stock units (“RSUs”) granted to TWC employees during the second quarter of

2009 to offset these forfeitures and/or reduced values (“Separation-related ‘make-up’ equity award costs”).

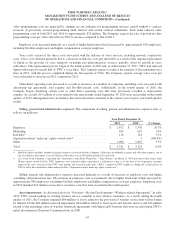

Selling, general and administrative expenses increased primarily as a result of increases in employee costs and higher

consulting and professional fees. The increase in employee costs was primarily due to higher headcount (which increased by

approximately 830 employees, including NaviSite employees) and higher compensation costs per employee. Employee costs

in 2010 included $12 million of executive severance costs that were recorded in the fourth quarter.

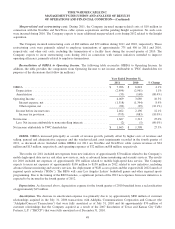

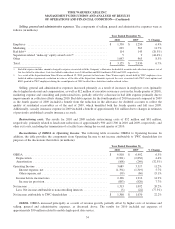

Asset impairments. As discussed above in “Overview—Recent Developments—Wireless-related Agreements,” in early

2012, TWC ceased making its existing wireless service available to new wireless customers. As a result, during the fourth

quarter of 2011, the Company impaired $60 million of assets related to the provision of wireless service that will no longer

be utilized. Of the $60 million noncash impairment, $44 million related to fixed assets and wireless devices and $16 million

related to the remaining value of wireless wholesale agreements with Sprint and Clearwire that were recorded upon TWC’s

initial investment in Clearwire Communications in 2008.

47