Time Warner Cable 2011 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2011 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

“nonqualified pension plan” and, together with the qualified pension plans, the “pension plans”). Pension benefits are based

on formulas that reflect the employees’ years of service and compensation during their employment period. Effective

January 1, 2011, with respect to employees hired on or after January 1, 2011, the TWC Pension Plan was amended to provide

that an employee’s service period prior to the date the employee satisfies the plan’s one-year service requirement and

commences participation in the plan is excluded from the employee’s benefit service period for the purpose of calculating

pension benefits in the applicable period. TWC uses a December 31 measurement date for its pension plans.

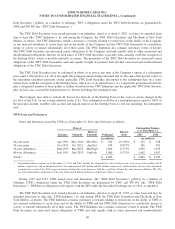

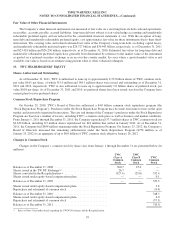

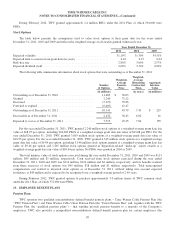

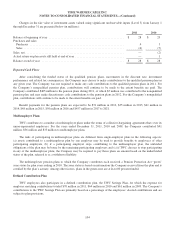

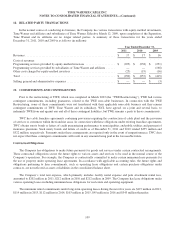

Changes in the Company’s projected benefit obligation, fair value of plan assets and funded status from January 1

through December 31 are presented below (in millions):

2011 2010

Projected benefit obligation at beginning of year ........................................ $ 1,803 $ 1,552

Service cost ................................................................... 132 115

Interest cost ................................................................... 114 100

Actuarial loss .................................................................. 322 62

Benefits paid .................................................................. (29) (26)

Projected benefit obligation at end of year ............................................. $ 2,342 $ 1,803

Accumulated benefit obligation at end of year .......................................... $ 1,900 $ 1,477

Fair value of plan assets at beginning of year ........................................... $ 1,882 $ 1,595

Actual return on plan assets ....................................................... 34 209

Employer contributions .......................................................... 405 104

Benefits paid .................................................................. (29) (26)

Fair value of plan assets at end of year ................................................ $ 2,292 $ 1,882

Funded status .................................................................... $ (50) $ 79

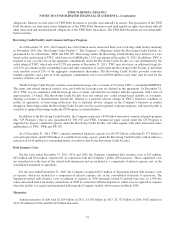

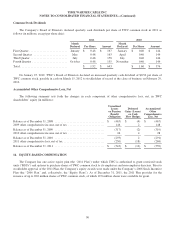

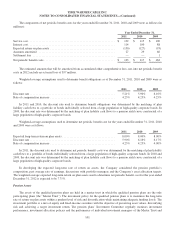

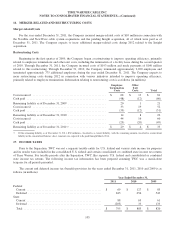

The projected benefit obligation, accumulated benefit obligation and fair value of plan assets for the qualified pension

plans and nonqualified pension plan as of December 31, 2011 and 2010 were as follows (in millions):

Qualified Pension Plans Nonqualified Pension Plan

December 31, December 31,

2011 2010 2011 2010

Projected benefit obligation .............................. $ 2,305 $ 1,769 $ 37 $ 34

Accumulated benefit obligation ........................... 1,865 1,444 35 33

Fair value of plan assets ................................. 2,292 1,882 — —

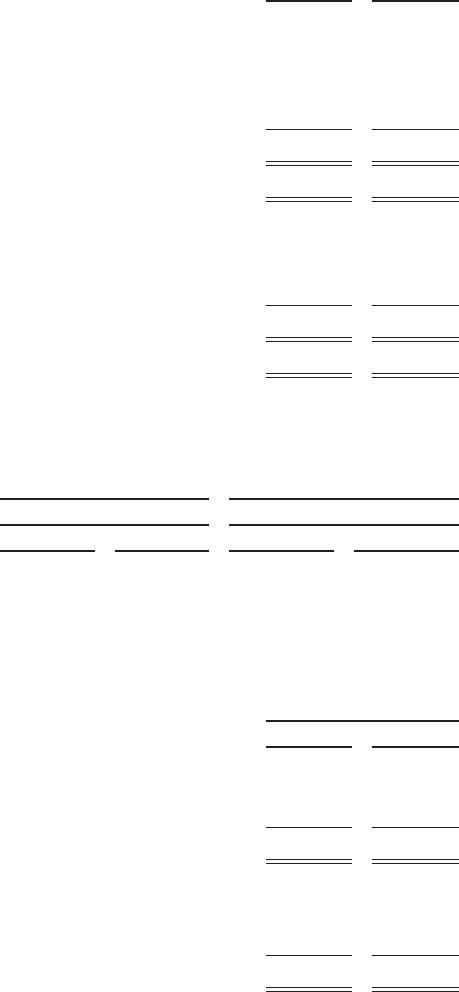

Amounts recognized in the consolidated balance sheet as of December 31, 2011 and 2010 consisted of (in millions):

December 31,

2011 2010

Noncurrent asset ................................................................. $ — $ 113

Current liability .................................................................. (4) (4)

Noncurrent liability ............................................................... (46) (30)

Total amounts recognized in assets and liabilities ........................................ $ (50) $ 79

Accumulated other comprehensive loss:

Net actuarial loss ................................................................. $ 890 $ 479

Prior service cost ................................................................. 1 1

Total amounts recognized in TWC shareholders’ equity .................................. $ 891 $ 480

100