Time Warner Cable 2011 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2011 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)

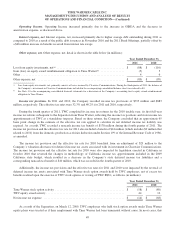

On August 15, 2011, TWC entered into an agreement (the “Merger Agreement”) with Insight Communications

Company, Inc. (“Insight”) and a representative of its stockholders to acquire Insight and its subsidiaries, which operate cable

systems in Kentucky, Indiana and Ohio that then served subscribers representing approximately 1.5 million primary service

units. Insight reported revenues of approximately $1.1 billion for the year ended December 31, 2010. Pursuant to the Merger

Agreement, a subsidiary of TWC will merge with and into Insight, with Insight surviving as a direct wholly owned

subsidiary of the Company. TWC agreed to pay $3.0 billion in cash for Insight, as reduced by Insight’s indebtedness for

borrowed money and similar obligations (including amounts outstanding under Insight’s credit agreement and senior notes

due 2018, which totaled approximately $1.8 billion as of the date of the Merger Agreement). The purchase price is subject to

customary adjustments, including a reduction to the extent the number of Insight’s video subscribers at the closing is less

than an agreed upon threshold, as well as a working capital adjustment. The Company has obtained all necessary regulatory

approvals and expects the transaction to close by the end of the first quarter of 2012; however, there can be no assurances

that the transaction will close or, if it does, that the Company will realize the potential financial and operating benefits of the

transaction. See Note 6 to the accompanying consolidated financial statements for additional information on the Insight

acquisition.

On November 1, 2011, TWC completed its acquisition of certain NewWave Communications (“NewWave”) cable

systems in Kentucky and western Tennessee for $259 million in cash. The financial results for the NewWave cable systems,

which served subscribers representing 138,000 primary service units as of the acquisition date, have been included in the

Company’s consolidated financial statements from the acquisition date. See Note 6 to the accompanying consolidated

financial statements for additional information on the NewWave cable systems acquisition.

Additionally, during 2011, TWC completed two acquisitions of cable systems in Texas and Ohio serving subscribers

representing a total of 26,000 primary service units for $38 million in cash.

2011 Bond Offerings

On May 26, 2011, TWC issued £625 million (approximately $1.0 billion) in aggregate principal amount of 5.75% senior

unsecured notes due 2031 in a public offering under a shelf registration statement on Form S-3 (the “May 2011 Bond

Offering”). As described further in Note 11 to the accompanying consolidated financial statements, the Company has entered

into cross-currency swap arrangements to effectively convert its fixed-rate British pound sterling denominated debt,

including annual interest payments and the payment of principal at maturity, to fixed-rate U.S. dollar denominated debt.

On September 12, 2011, TWC issued $2.250 billion in aggregate principal amount of senior unsecured notes and

debentures in a public offering under a shelf registration statement on Form S-3 (the “September 2011 Bond Offering” and,

collectively with the May 2011 Bond Offering, the “2011 Bond Offerings”). The September 2011 Bond Offering consisted of

$1.0 billion principal amount of 4.0% notes due 2021 and $1.250 billion principal amount of 5.5% debentures due 2041.

TWC’s obligations under the debt securities issued in the 2011 Bond Offerings are guaranteed by its subsidiaries, Time

Warner Entertainment Company, L.P. (“TWE”) and TW NY Cable Holding Inc. See Note 9 to the accompanying

consolidated financial statements for further details regarding the debt securities issued in the 2011 Bond Offerings.

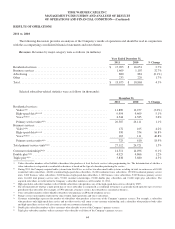

FINANCIAL STATEMENT PRESENTATION

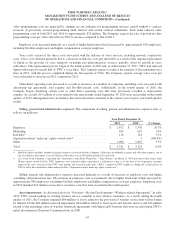

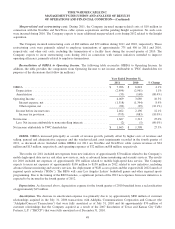

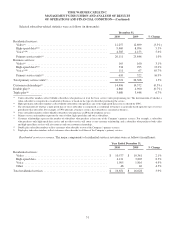

Revenues

During the second quarter of 2011, the Company revised its presentation of revenues to provide additional detail about

the Company’s sources of revenues, which had no impact on total revenues for any period presented. The Company’s

revenues consist of residential services, business services, advertising and other revenues.

Residential services. Residential services revenues consist of revenues from the following residential services:

Video. Video revenues include residential subscriber fees for the Company’s various tiers or packages of video

programming services generally distinguished from one another by the number and type of programming networks they

41