Time Warner Cable 2011 Annual Report Download - page 89

Download and view the complete annual report

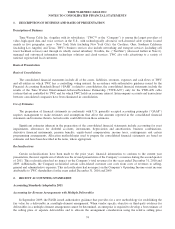

Please find page 89 of the 2011 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Sales of Multiple Products or Services

If the Company enters into sales contracts for the sale of multiple products or services, then the Company evaluates

standalone selling price for each deliverable in the transaction. For example, the Company sells video, high-speed data and

voice services to subscribers in a bundled package at a rate lower than if the subscriber purchases each product on an

individual basis. Revenues received from such subscribers are allocated to each product in a pro-rata manner based on the

standalone selling price of each of the respective services on an individual basis. As another example, if a subscriber moves

from a bundled package containing two services to a bundled package containing three services, the increase in the total

revenues received is not attributed to the additional service. Rather, the total revenues received from such subscribers are

allocated to each of the three products in a pro-rata manner based on the relative selling price of each of the respective

services on an individual basis.

Gross Versus Net Revenue Recognition

In the normal course of business, the Company acts as or uses an intermediary or agent in executing transactions with

third parties. The accounting issue presented by these arrangements is whether the Company should report revenue based on

the gross amount billed to the ultimate customer or on the net amount received from the customer after commissions and

other payments to third parties. To the extent revenues are recorded on a gross basis, any commissions or other payments to

third parties are recorded as expense so that the net amount (gross revenues less expense) is reflected in Operating Income.

Accordingly, the impact on Operating Income is the same whether the Company records revenue on a gross or net basis.

For example, TWC is assessed franchise fees by franchising authorities, which are passed on to the customer. The

accounting issue presented by these arrangements is whether TWC should report revenues based on the gross amount billed

to the ultimate customer or on the net amount received from the customer after payments to franchising authorities. The

Company has determined that these amounts should be reported on a gross basis. TWC’s policy is that, in instances where

the fees are being assessed directly to the Company, amounts paid to the governmental authorities and amounts received

from the customers are recorded on a gross basis. That is, amounts paid to the governmental authorities are recorded as costs

of revenues and amounts received from the customer are recorded as revenues. The amount of such fees recorded on a gross

basis related to video and voice services was $610 million in 2011, $585 million in 2010 and $544 million in 2009.

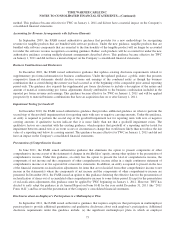

Derivative Financial Instruments

The Company recognizes all derivative financial instruments in the consolidated balance sheet as either assets or

liabilities at fair value. Derivative financial instruments are designated, if certain conditions are met, as (a) a hedge of the

exposure to changes in the fair value of a recognized asset or liability or an unrecognized firm commitment (a “fair value

hedge”) or (b) a hedge of the exposure to variable cash flows of a forecasted transaction or a hedge of the foreign currency

exposure of a forecasted transaction denominated in a foreign currency (a “cash flow hedge”). For a derivative financial

instrument designated as a fair value hedge, the gain or loss on the derivative financial instrument is recognized in earnings

in the period of change together with the offsetting loss or gain on the hedged item attributable to the risk being hedged. As a

result, the consolidated statement of operations includes the impact of changes in the fair value of both the derivative

financial instrument and the hedged item, which reflects in earnings the extent to which the hedge is ineffective in achieving

offsetting changes in fair value. For a derivative financial instrument designated as a cash flow hedge, the effective portion of

the gain or loss on the derivative financial instrument is initially reported in equity as a component of accumulated other

comprehensive income (loss), net, and subsequently reclassified into earnings when the hedged item (e.g., a forecasted

transaction denominated in a foreign currency) affects earnings. The ineffective portion of the gain or loss is reported in

earnings immediately. For a derivative financial instrument not designated as a hedging instrument, the gain or loss is

recognized in earnings in the period of change. The Company uses derivative financial instruments primarily to manage the

risks associated with fluctuations in interest rates and foreign currency exchange rates and does not issue derivative financial

instruments for speculative or trading purposes.

Fair Value Measurements

The fair value of an asset or liability is based on the assumptions that market participants would use in pricing the asset

or liability. Valuation techniques consistent with the market approach, income approach and/or cost approach are used to

measure fair value. The Company follows a three-tiered fair value hierarchy when determining the inputs to valuation

81