Time Warner Cable 2011 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2011 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

participates, (b) the level of an employer’s participation in the significant multiemployer plans, (c) the financial health of the

significant multiemployer plans and (d) the nature of the employer commitments to the plans. This guidance became

effective for the 2011 Form 10-K and did not have a material impact on the Company’s consolidated financial statements.

Accounting Standards Not Yet Adopted

Fair Value Measurements and Related Disclosures

In May 2011, the FASB issued authoritative guidance that provides a uniform framework for fair value measurements

and related disclosures between GAAP and International Financial Reporting Standards. Additional disclosure requirements

under this guidance include: (1) for Level 3 fair value measurements, quantitative information about unobservable inputs

used, a description of the valuation processes used by the entity, and a qualitative discussion about the sensitivity of the

measurements to changes in the unobservable inputs; (2) for an entity’s use of a nonfinancial asset that is different from the

asset’s highest and best use, the reason for the difference; (3) for financial instruments not measured at fair value but for

which disclosure of fair value is required, the fair value hierarchy level in which the fair value measurements were

determined; and (4) the disclosure of all transfers between Level 1 and Level 2 of the fair value hierarchy. This guidance will

be effective for TWC on January 1, 2012 and is not expected to have a material impact on the Company’s consolidated

financial statements.

Testing Goodwill for Impairment

In September 2011, the FASB issued authoritative guidance that allows an entity to use a qualitative approach to test

goodwill for impairment. Under this guidance, an entity has the option to first assess qualitative factors to determine whether

the existence of events or circumstances leads to a determination that it is more likely than not that the fair value of a

reporting unit is less than its carrying amount. If, after assessing the totality of events or circumstances, an entity determines

it is not more likely than not that the fair value of a reporting unit is less than its carrying amount, then performing the

two-step impairment test is unnecessary. In addition, an entity has the option to bypass the qualitative assessment for any

reporting unit in any period and proceed directly to performing the first step of the two-step goodwill impairment test. This

guidance will be effective for TWC’s goodwill impairment tests performed after December 31, 2011 and is not expected to

have a material impact on the Company’s consolidated financial statements.

3. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Cash and Equivalents

Cash and equivalents include money market funds, overnight deposits and other investments that are readily convertible

into cash and have original maturities of three months or less. Cash equivalents are carried at cost, which approximates fair

value.

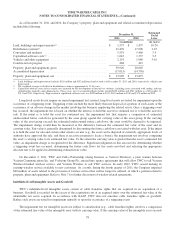

Accounts Receivable

Accounts receivable are recorded at net realizable value. The Company maintains an allowance for doubtful accounts,

which is determined after considering past collection experience, aging of accounts receivable, general economic factors and

other considerations.

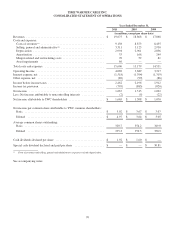

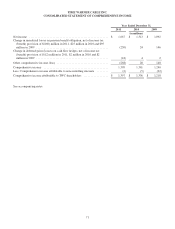

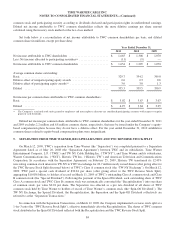

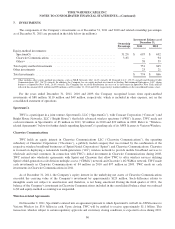

Changes in the Company’s allowance for doubtful accounts from January 1 through December 31 are presented below

(in millions):

2011 2010 2009

Balance at beginning of year ..................................... $ 74 $ 74 $ 90

Provision for bad debts(a) ........................................ 221 237 244

Write-offs, net of recoveries ..................................... (233) (237) (260)

Balance at end of year .......................................... $ 62 $ 74 $ 74

(a) Provision for bad debts primarily includes amounts charged to expense associated with the Company’s allowance for doubtful accounts and excludes

collection expenses and the benefit from late fees billed to subscribers.

76