Time Warner Cable 2011 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2011 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)

RESULTS OF OPERATIONS

2011 vs. 2010

The following discussion provides an analysis of the Company’s results of operations and should be read in conjunction

with the accompanying consolidated financial statements and notes thereto.

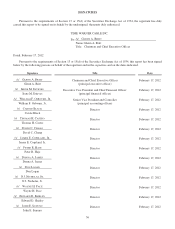

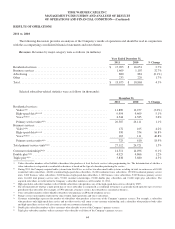

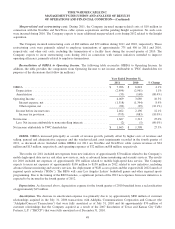

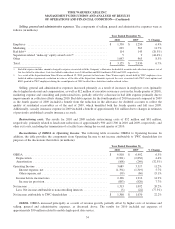

Revenues. Revenues by major category were as follows (in millions):

Year Ended December 31,

2011 2010 % Change

Residential services ............................................... $ 17,093 $ 16,651 2.7%

Business services ................................................. 1,469 1,107 32.7%

Advertising ..................................................... 880 881 (0.1%)

Other .......................................................... 233 229 1.7%

Total ........................................................... $ 19,675 $ 18,868 4.3%

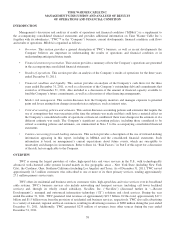

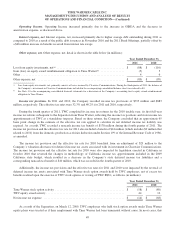

Selected subscriber-related statistics were as follows (in thousands):

December 31,

2011 2010 % Change

Residential services:

Video(a)(b) ..................................................... 11,889 12,257 (3.0%)

High-speed data(b)(c)(d) ........................................... 9,954 9,469 5.1%

Voice(b)(d)(e) .................................................... 4,544 4,385 3.6%

Primary service units(b)(f) ......................................... 26,387 26,111 1.1%

Business services: ................................................

Video(a)(b) ..................................................... 172 165 4.2%

High-speed data(b)(c)(d) ........................................... 390 334 16.8%

Voice(b)(d)(e) .................................................... 163 111 46.8%

Primary service units(b)(f) ......................................... 725 610 18.9%

Total primary service units(b)(f) ...................................... 27,112 26,721 1.5%

Customer relationships(b)(g) ......................................... 14,511 14,496 0.1%

Double play(b)(h) .................................................. 4,925 4,866 1.2%

Triple play(b)(i) ................................................... 3,838 3,680 4.3%

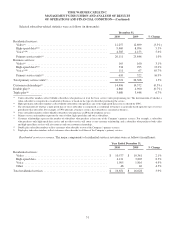

(a) Video subscriber numbers reflect billable subscribers who purchase at least the basic service video programming tier. The determination of whether a

video subscriber is categorized as residential or business is based on the type of subscriber purchasing the service.

(b) During 2011, the Company acquired cable systems from NewWave, as well as two other small cable systems, resulting, in total, in an increase of 85,000

residential video subscribers, 48,000 residential high-speed data subscribers, 26,000 residential voice subscribers, 159,000 residential primary service

units, 2,000 business video subscribers, 2,000 business high-speed data subscribers, 1,000 business voice subscribers, 5,000 business primary service

units, 164,000 total primary service units, 97,000 customer relationships, 25,000 double play subscribers and 21,000 triple play subscribers. The

acquired subscribers are reflected in the Company’s subscriber numbers as of December 31, 2011.

(c) High-speed data subscriber numbers reflect billable subscribers who purchase any of the high-speed data services offered by TWC.

(d) The determination of whether a high-speed data or voice subscriber is categorized as residential or business is generally based upon the type of service

provided to that subscriber. For example, if TWC provides a business service, the subscriber is classified as business.

(e) Voice subscriber numbers reflect billable subscribers who purchase an IP-based telephony service.

(f) Primary service unit numbers represent the sum of video, high-speed data and voice subscribers.

(g) Customer relationships represent the number of subscribers who purchase at least one of the Company’s primary services. For example, a subscriber

who purchases only high-speed data service and no video service will count as one customer relationship, and a subscriber who purchases both video

and high-speed data services will also count as only one customer relationship.

(h) Double play subscriber numbers reflect customers who subscribe to two of the Company’s primary services.

(i) Triple play subscriber numbers reflect customers who subscribe to all three of the Company’s primary services.

44