Time Warner Cable 2011 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2011 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

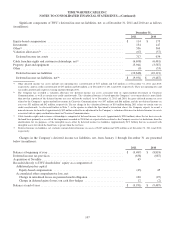

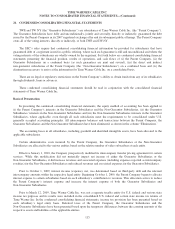

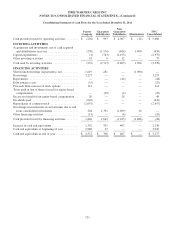

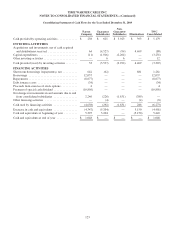

The Company’s condensed consolidating financial information is as follows (in millions):

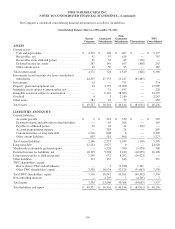

Consolidating Balance Sheet as of December 31, 2011

Parent

Company

Guarantor

Subsidiaries

Non-

Guarantor

Subsidiaries Eliminations

TWC

Consolidated

ASSETS

Current assets:

Cash and equivalents .......................... $ 4,372 $ 398 $ 407 $ — $ 5,177

Receivables, net .............................. 51 97 619 — 767

Receivables from affiliated parties ............... 39 34 45 (118) —

Deferred income tax assets ..................... 267 145 163 (308) 267

Other current assets ........................... 42 50 95 — 187

Total current assets ............................. 4,771 724 1,329 (426) 6,398

Investments in and amounts due from consolidated

subsidiaries ................................. 44,315 25,753 13,417 (83,485) —

Investments ................................... 19 — 755 — 774

Property, plant and equipment, net ................. 34 3,773 10,098 — 13,905

Intangible assets subject to amortization, net ......... — 31 197 — 228

Intangible assets not subject to amortization .......... — 6,216 18,056 — 24,272

Goodwill ..................................... 4 3 2,240 — 2,247

Other assets ................................... 384 16 52 — 452

Total assets .................................... $ 49,527 $ 36,516 $ 46,144 $ (83,911) $ 48,276

LIABILITIES AND EQUITY

Current liabilities:

Accounts payable ............................. $ 1 $ 214 $ 330 $ — $ 545

Deferred revenue and subscriber-related liabilities . . . — 65 104 — 169

Payables to affiliated parties .................... 32 45 41 (118) —

Accrued programming expense .................. — 783 24 — 807

Current maturities of long-term debt .............. 1,510 608 4 — 2,122

Other current liabilities ........................ 603 518 606 — 1,727

Total current liabilities ........................... 2,146 2,233 1,109 (118) 5,370

Long-term debt ................................ 22,234 2,077 9 — 24,320

Mandatorily redeemable preferred equity ............ — 1,928 300 (1,928) 300

Deferred income tax liabilities, net ................. 10,195 5,528 5,410 (10,935) 10,198

Long-term payables to affiliated parties ............. 7,249 972 8,702 (16,923) —

Other liabilities ................................ 173 132 246 — 551

TWC shareholders’ equity:

Due to (from) TWC and subsidiaries .............. — 7 (1,768) 1,761 —

Other TWC shareholders’ equity ................. 7,530 18,934 32,129 (51,063) 7,530

Total TWC shareholders’ equity ................... 7,530 18,941 30,361 (49,302) 7,530

Noncontrolling interests .......................... — 4,705 7 (4,705) 7

Total equity ................................... 7,530 23,646 30,368 (54,007) 7,537

Total liabilities and equity ........................ $ 49,527 $ 36,516 $ 46,144 $ (83,911) $ 48,276

116