Time Warner Cable 2011 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2011 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

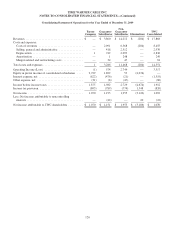

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

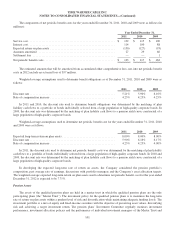

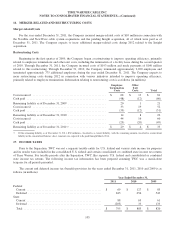

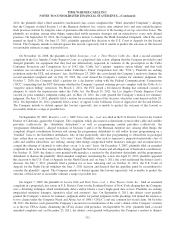

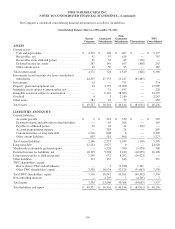

The following table summarizes the Company’s aggregate contractual obligations as of December 31, 2011 under

certain programming and content, voice and high-speed data connectivity and other agreements and the estimated timing and

effect that such obligations are expected to have on the Company’s liquidity and cash flows in future periods (in millions):

2012 .................................................................................... $ 4,625

2013 - 2014 .............................................................................. 7,722

2015 - 2016 .............................................................................. 5,425

Thereafter ............................................................................... 7,699

Total .................................................................................... $ 25,471

Programming purchases represent contracts that the Company has with cable television networks and broadcast stations

to provide programming services to its subscribers. The amounts included above represent estimates of the future

programming costs for these contract requirements and commitments based on subscriber numbers and tier placement as of

December 31, 2011 applied to the per-subscriber rates contained in these contracts. Actual amounts due under such contracts

may differ from the amounts above based on the actual subscriber numbers and tier placements. These amounts also include

programming rights negotiated directly with content owners for distribution on TWC-owned channels or networks.

Voice connectivity obligations relate to transport, switching and interconnection services, primarily provided by Sprint,

that allow for the origination and termination of local and long-distance telephony traffic. These expenses also include

related technical support services. In the fourth quarter of 2010, the Company began replacing Sprint as the provider of these

services. There is generally no obligation to purchase these services if the Company is not providing voice service. The

amounts included above are estimated based on the number of voice subscribers as of December 31, 2011 and the

per-subscriber contractual rates contained in the contracts that were in effect as of December 31, 2011 and also reflect the

replacement of Sprint between the fourth quarter 2010 and the first quarter of 2014.

High-speed data connectivity obligations are based on the contractual terms for bandwidth circuits that were in use as of

December 31, 2011.

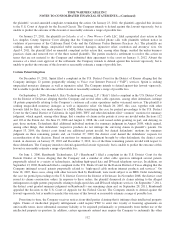

Minimum pension funding requirements have not been presented as such amounts have not been determined beyond

2011. The Company was not required to make any cash contributions to the qualified pension plans in 2011; however, the

Company made cash contributions of $405 million to the pension plans during 2011 and may make discretionary cash

contributions to the pension plans in 2012.

Legal Proceedings

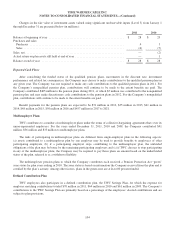

On April 7, 2011, the Company filed a complaint in the U.S. District Court for the Southern District of New York

against Viacom International Inc. and several of its subsidiaries (“Viacom”). The complaint asked the court to render a

declaratory judgment that certain programming agreements between the Company and Viacom allow the Company to

provide video programming services to its customers over its cable systems through devices of the customers’ choosing,

including through the Company’s iPad App and Smart TVs. The complaint further asks the court to declare that by providing

video programming services to its customers in this fashion, the Company is not infringing Viacom copyrights. The same

day, Viacom filed its own complaint against the Company in the same court, alleging copyright and trademark infringement

and breach of contract, and asking for a declaratory judgment that the programming agreements between the Company and

Viacom do not allow the Company to distribute Viacom programming “via broadband.” The parties entered into a

“standstill” agreement, effective June 17, 2011, pursuant to which no further activity would take place in the cases while the

parties explored possible settlement of this and other issues between the companies. On October 3, 2011, the Company

terminated the “standstill” agreement and filed an answer to Viacom’s complaint as well as a counterclaim alleging that

Viacom is in breach of its agreement with the Company concerning Viacom’s CMT (formerly Country Music Television)

service. On November 2, 2011, Viacom filed a motion to dismiss the Company’s counterclaim. The Company intends to

prosecute its lawsuit, and defend against Viacom’s complaint, vigorously, but is unable to predict the outcome of Viacom’s

lawsuit or reasonably estimate a range of possible loss.

The Company is the defendant in In re: Set-Top Cable Television Box Antitrust Litigation, ten purported class actions

filed in federal district courts throughout the U.S. These actions are subject to a Multidistrict Litigation (“MDL”) Order

transferring the cases for pre-trial purposes to the U.S. District Court for the Southern District of New York. On July 26,

110