Time Warner Cable 2011 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2011 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

On February 9, 2012, Comcast and Verizon Wireless received a Request for Additional Information and Documentary Materials

from the U.S. Department of Justice in connection with their required notification filed under the Hart-Scott-Rodino Antitrust

Improvements Act of 1976, as amended.

Separately, on December 2, 2011, TWC, Comcast, Bright House and Verizon Wireless also entered into agency

agreements that will allow the cable companies to sell Verizon Wireless-branded wireless service, and Verizon Wireless to

sell each cable company’s services. After a four-year period, subject to certain conditions, the cable companies will have the

option to offer wireless service under their own brands utilizing Verizon Wireless’ network. In addition, the parties entered

into an agreement that provides for the creation of an innovation technology joint venture to better integrate wireless and

cable services. On January 13, 2012, TWC received a civil investigative demand from the U.S. Department of Justice

requesting additional information about these agreements.

In early 2012, TWC ceased making its existing wireless service available to new wireless customers. As a result, during

the fourth quarter of 2011, the Company impaired $60 million ($36 million on an after-tax basis) of assets related to the

provision of wireless service that will no longer be utilized. Of the $60 million noncash impairment, $44 million related to

fixed assets and wireless devices and $16 million related to the remaining value of the wireless wholesale agreements with

Sprint and Clearwire discussed above.

Upon the closing of the SpectrumCo transaction, the Company expects to record a pretax gain of approximately $430

million (approximately $260 million on an after-tax basis), which will be included in other income (expense), net, in the

Company’s consolidated statement of operations. Additionally, in the quarter in which the SpectrumCo transaction closes,

the Company expects to record a noncash income tax benefit of approximately $45 million related to an adjustment to the

Company’s valuation allowance for deferred income tax assets associated with its investment in Clearwire Communications.

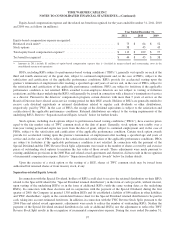

8. INTANGIBLE ASSETS AND GOODWILL

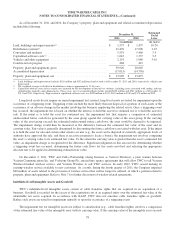

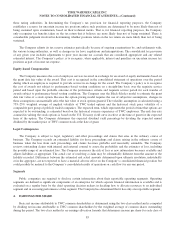

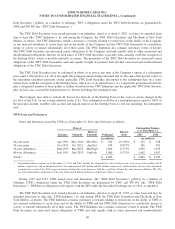

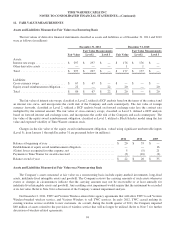

As of December 31, 2011 and 2010, the Company’s intangible assets and related accumulated amortization consisted of

the following (in millions):

December 31, 2011 December 31, 2010

Gross

Accumulated

Amortization Net Gross

Accumulated

Amortization Net

Intangible assets subject to

amortization:

Customer relationships ............. $ 50 $ (7) $ 43 $ 6 $ (5) $ 1

Cable franchise renewals and access

rights 252 (94) 158 220 (94) 126

Other ........................... 37 (10) 27 42 (37) 5

Total ........................... $ 339 $ (111) $ 228 $ 268 $ (136) $ 132

Intangible assets not subject to

amortization:

Cable franchise rights .............. $ 25,194 $ (922) $ 24,272 $ 25,013 $ (922) $ 24,091

The Company recorded amortization expense of $33 million in 2011, $168 million in 2010 and $249 million in 2009.

Based on the remaining carrying value of intangible assets subject to amortization as of December 31, 2011, amortization

expense is expected to be $40 million in 2012, $37 million in 2013, $34 million in 2014, $30 million in 2015 and $23 million

in 2016. These amounts may vary as acquisitions and dispositions occur in the future, including the pending Insight

acquisition.

87