Time Warner Cable 2011 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2011 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)

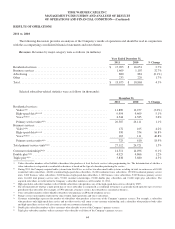

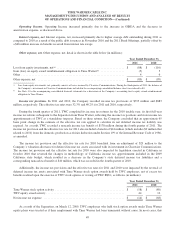

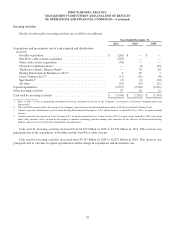

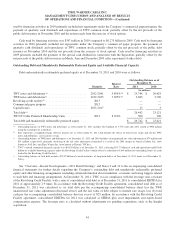

Average monthly revenues per unit were as follows:

Year Ended December 31,

2010 2009 % Change

Residential services:

Video(a) ...................................................... $ 70.46 NA NA

High-speed data(b) .............................................. 37.00 $ 36.24 2.1%

Voice(c) ....................................................... 37.08 37.98 (2.4%)

Primary service units(d) .......................................... 53.24 52.21 2.0%

NA—Not available.

(a) Average monthly residential video revenues per unit represents residential video revenues divided by the corresponding average residential video

subscribers for the period.

(b) Average monthly residential high-speed data revenues per unit represents residential high-speed data revenues divided by the corresponding average

residential high-speed data subscribers for the period.

(c) Average monthly residential voice revenues per unit represents residential voice revenues divided by the corresponding average residential voice

subscribers for the period.

(d) Average monthly residential revenues per residential primary service unit represents residential services revenues divided by the corresponding average

residential primary service units for the period.

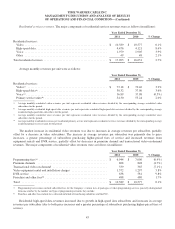

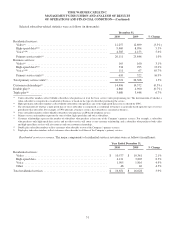

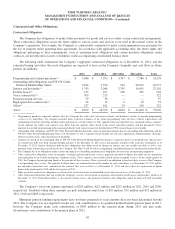

The increase in residential video revenues was primarily due to increases in average revenues per subscriber (due to

price increases, improved subscriber mix and increased DVR service revenues), partially offset by a decrease in video

subscribers. The major components of residential video revenues were as follows (in millions):

Year Ended December 31,

2010 2009 % Change

Programming tiers(a) .............................................. $ 7,006 $ 6,977 0.4%

Premium channels ............................................... 848 858 (1.2%)

Transactional video-on-demand ..................................... 365 364 0.3%

Video equipment rental and installation charges ........................ 1,297 1,185 9.5%

DVR service .................................................... 581 510 13.9%

Franchise and other fees(b) .......................................... 480 467 2.8%

Total .......................................................... $ 10,577 $ 10,361 2.1%

(a) Programming tier revenues include subscriber fees for the Company’s various tiers or packages of video programming services generally distinguished

from one another by the number and type of programming networks they include.

(b) Franchise and other fees include fees collected on behalf of franchising authorities and the FCC.

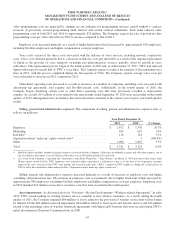

Residential high-speed data revenues increased primarily due to growth in high-speed data subscribers and, to a lesser

extent, increases in average revenues per subscriber (due to both price increases and improved subscriber mix).

The increase in residential voice revenues was due to growth in voice subscribers, partially offset by a decrease in

average revenues per subscriber.

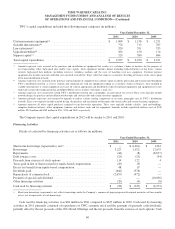

Business services revenues. The major components of business services revenues were as follows (in millions):

Year Ended December 31,

2010 2009 % Change

Business services:

Video ........................................................ $ 266 $ 251 6.0%

High-speed data ................................................ 614 550 11.6%

Voice ........................................................ 127 70 81.4%

Wholesale transport ............................................. 91 36 152.8%

Other ........................................................ 9 9 —

Total business services ............................................ $ 1,107 $ 916 20.9%

52