Time Warner Cable 2011 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2011 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)

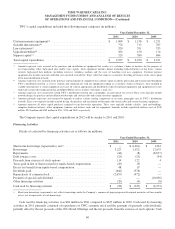

The Company expects pension expense to be approximately $180 million in 2012 based on a discount rate of 5.21%, an

expected long-term rate of return on plan assets of 7.75% and an estimated rate of future compensation increases of 4.25%.

Programming Agreements

The Company exercises significant judgment in estimating programming expense associated with certain video

programming contracts. The Company’s policy is to record video programming costs based on the Company’s contractual

agreements with its programming vendors, which are generally multi-year agreements that provide for the Company to make

payments to the programming vendors at agreed upon rates based on the number of subscribers to which the Company

provides the programming service. If a programming contract expires prior to the parties’ entry into a new agreement and the

Company continues to distribute the service, management estimates the programming costs during the period there is no

contract in place. In doing so, management considers the previous contractual rates, inflation and the status of the

negotiations in determining its estimates. When the programming contract terms are finalized, an adjustment to programming

expense is recorded, if necessary, to reflect the terms of the new contract. Management also makes estimates in the

recognition of programming expense related to other items, such as the accounting for free periods and credits from service

interruptions, as well as the allocation of consideration exchanged between the parties in multiple-element transactions.

Additionally, judgments are also required by management when the Company purchases multiple services from the same

programming vendor. In these scenarios, the total consideration provided to the programming vendor is allocated to the

various services received based upon their respective fair values. Because multiple services from the same programming

vendor may be received over different contractual periods and may have different contractual rates, the allocation of

consideration to the individual services may have an impact on the timing of the Company’s expense recognition.

Significant judgment is also involved when the Company enters into agreements that result in the Company receiving

cash consideration from the programming vendor, usually in the form of advertising sales, channel positioning fees, launch

support or marketing support. In these situations, management must determine based upon facts and circumstances if such

cash consideration should be recorded as revenue, a reduction in programming expense or a reduction in another expense

category (e.g., marketing).

Property, Plant and Equipment

TWC incurs expenditures associated with the construction of its cable systems. Costs associated with the construction of

transmission and distribution facilities are capitalized. With respect to customer premise equipment, which includes set-top

boxes and high-speed data and telephone modems, TWC capitalizes installation costs only upon the initial deployment of

these assets. All costs incurred in subsequent disconnects and reconnects of previously installed customer premise equipment

are expensed as incurred. TWC uses standard capitalization rates to capitalize installation activities. Significant judgment is

involved in the development of these capitalization standards, including the average time required to perform an installation

and the determination of the nature and amount of indirect costs to be capitalized. The capitalization standards are reviewed

at least annually and adjusted, if necessary, based on comparisons to actual costs incurred.

TWC generally capitalizes expenditures for tangible fixed assets having a useful life of greater than one year.

Capitalized costs include direct material, labor and overhead, as well as interest. Sales and marketing costs, as well as the

costs of repairing or maintaining existing fixed assets, are expensed as incurred. Depreciation on these assets is provided

using the straight-line method over their estimated useful lives, which are discussed further in Note 3 to the accompanying

consolidated financial statements. Significant judgment is involved in the determination of the useful lives of these assets and

is based upon an analysis of several factors, such as the physical attributes of the asset, as well as an assessment of the asset’s

exposure to future technological obsolescence.

CAUTION CONCERNING FORWARD-LOOKING STATEMENTS

This document contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform

Act of 1995, particularly statements anticipating future growth in revenues, OIBDA, cash provided by operating activities

and other financial measures. Words such as “anticipates,” “estimates,” “expects,” “projects,” “intends,” “plans,” “believes”

and words and terms of similar substance used in connection with any discussion of future operating or financial

67