Time Warner Cable 2011 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2011 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

10. MANDATORILY REDEEMABLE PREFERRED EQUITY MEMBERSHIP UNITS

In connection with the financing of the acquisition of substantially all of the cable assets of Adelphia Communications

Corporation in 2006, TW NY Cable LLC (“TW NY Cable”), a subsidiary of TWC, issued $300 million of its Series A

Preferred Membership Units (the “TW NY Cable Preferred Membership Units”) to a limited number of third parties. The

TW NY Cable Preferred Membership Units pay cash dividends at an annual rate equal to 8.210% of the sum of the

liquidation preference thereof and any accrued but unpaid dividends thereon, on a quarterly basis. The TW NY Cable

Preferred Membership Units are subject to mandatory redemption by TW NY Cable on August 1, 2013 and are not

redeemable by TW NY Cable at any time prior to that date. The redemption price of the TW NY Cable Preferred

Membership Units is equal to the respective holders’ liquidation preference plus any accrued and unpaid dividends through

the redemption date. Except under limited circumstances, holders of TW NY Cable Preferred Membership Units have no

voting rights.

The terms of the TW NY Cable Preferred Membership Units require that holders owning a majority of the TW NY

Cable Preferred Membership Units must approve any agreement for a material sale or transfer by TW NY Cable and its

subsidiaries of assets at any time during which TW NY Cable and its subsidiaries maintain, collectively, cable systems

serving fewer than 500,000 cable subscribers, or that would (after giving effect to such asset sale) cause TW NY Cable to

maintain, directly or indirectly, fewer than 500,000 cable subscribers, unless the net proceeds of the asset sale are applied to

fund the redemption of the TW NY Cable Preferred Membership Units and the sale occurs on or immediately prior to the

redemption date. Additionally, for so long as the TW NY Cable Preferred Membership Units remain outstanding, TW NY

Cable may not merge or consolidate with another company, or convert from a limited liability company to a corporation,

partnership or other entity, unless (i) such merger or consolidation is permitted by the asset sale covenant described above,

(ii) if TW NY Cable is not the surviving entity or is no longer a limited liability company, the then holders of the TW NY

Cable Preferred Membership Units have the right to receive from the surviving entity securities with terms at least as

favorable as the TW NY Cable Preferred Membership Units and (iii) if TW NY Cable is the surviving entity, the tax

characterization of the TW NY Cable Preferred Membership Units would not be affected by the merger or consolidation.

Any securities received from a surviving entity as a result of a merger or consolidation or the conversion into a corporation,

partnership or other entity must rank senior to any other securities of the surviving entity with respect to dividends and

distributions or rights upon a liquidation.

11. DERIVATIVE FINANCIAL INSTRUMENTS

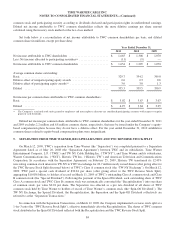

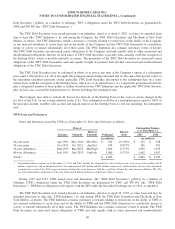

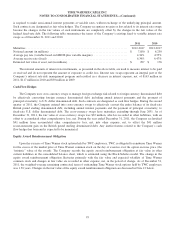

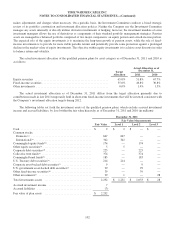

The fair values of the assets and liabilities associated with the Company’s derivative financial instruments recorded in

the consolidated balance sheet as of December 31, 2011 and 2010 were as follows (in millions):

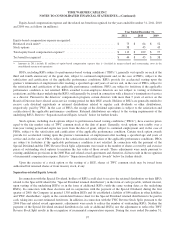

Assets Liabilities

December 31, December 31,

2011 2010 2011 2010

Interest rate swaps(a) ........................................ $ 297 $ 176 $—$—

Cross-currency swaps(b) ..................................... — — 67 —

Equity award reimbursement obligation(b) ....................... — — 22 20

Other ................................................... — 1 — —

Total .................................................... $ 297 $ 177 $ 89 $ 20

(a) The fair value of the asset associated with interest rate swaps is recorded in other current assets and other assets in the consolidated balance sheet based

on the maturity date of the hedged debt. Of the total asset recorded as of December 31, 2011, $14 million is recorded in other current assets in the

consolidated balance sheet.

(b) The fair value of the liabilities associated with cross-currency swaps and equity award reimbursement obligation is recorded in other liabilities and other

current liabilities, respectively, in the consolidated balance sheet.

Fair Value Hedges

The Company uses interest rate swaps to manage interest rate risk by effectively converting fixed-rate debt into

variable-rate debt. Under such contracts, the Company is entitled to receive semi-annual interest payments at fixed rates and

92