Time Warner Cable 2011 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2011 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

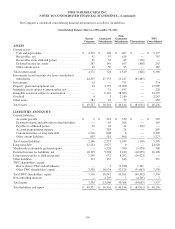

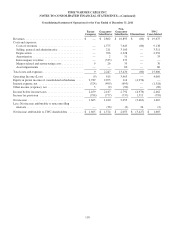

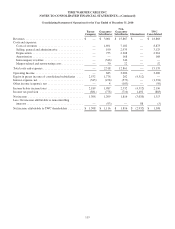

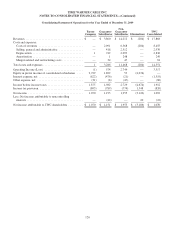

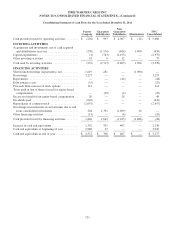

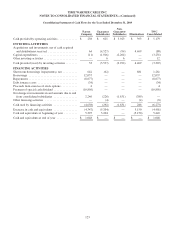

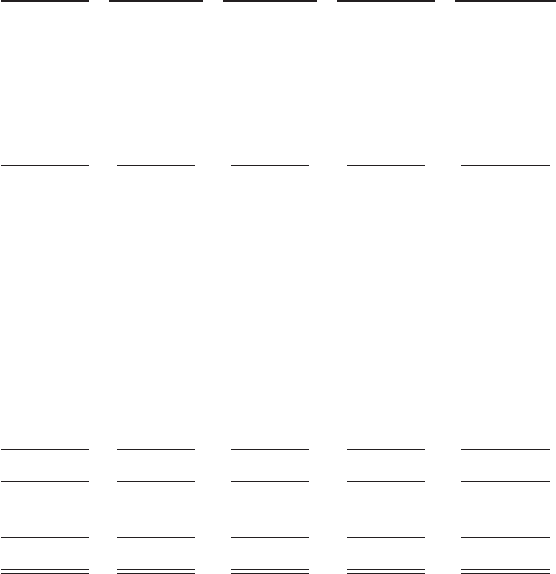

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Consolidating Statement of Cash Flows for the Year Ended December 31, 2009

Parent

Company

Guarantor

Subsidiaries

Non-

Guarantor

Subsidiaries Eliminations

TWC

Consolidated

Cash provided by operating activities ............. $ 238 $ 625 $ 3,923 $ 393 $ 5,179

INVESTING ACTIVITIES

Acquisitions and investments, net of cash acquired

and distributions received .................... 64 (4,527) (94) 4,469 (88)

Capital expenditures .......................... (11) (1,016) (2,204) — (3,231)

Other investing activities ....................... — 6 6 — 12

Cash provided (used) by investing activities ........ 53 (5,537) (2,292) 4,469 (3,307)

FINANCING ACTIVITIES

Short-term borrowings (repayments), net .......... 642 (62) — 681 1,261

Borrowings ................................. 12,037 — — — 12,037

Repayments ................................. (8,677) — — — (8,677)

Debt issuance costs ........................... (34) — — — (34)

Proceeds from exercise of stock options ........... 4 — — — 4

Payment of special cash dividend ................ (10,856) — — — (10,856)

Net change in investments in and amounts due to and

from consolidated subsidiaries ................ 2,246 (226) (1,631) (389) —

Other financing activities ...................... — (4) — (4) (8)

Cash used by financing activities ................ (4,638) (292) (1,631) 288 (6,273)

Decrease in cash and equivalents ................ (4,347) (5,204) — 5,150 (4,401)

Cash and equivalents at beginning of year ......... 5,395 5,204 — (5,150) 5,449

Cash and equivalents at end of year .............. $ 1,048 $ — $ — $ — $ 1,048

123