Time Warner Cable 2009 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2009 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

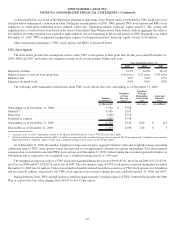

As discussed below, as a result of the Separation, pursuant to their terms, Time Warner equity awards held by TWC employees were

forfeited and/or experienced a reduction in value. During the second quarter of 2009, TWC granted TWC stock options and RSUs to its

employees to offset these forfeitures and/or reduced values (the “Separation-related ’make-up’ equity awards”). The vesting and

expiration dates of such awards were based on the terms of the related Time Warner award. Such awards, with an aggregate fair value of

$15 million, are being expensed over a period of approximately one year beginning in the second quarter of 2009. During the year ended

December 31, 2009, TWC recognized compensation expense for Separation-related “make-up” equity awards of $9 million.

Other information pertaining to TWC stock options and RSUs is discussed below.

TWC Stock Options

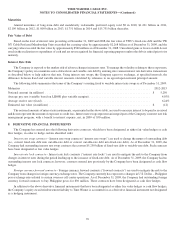

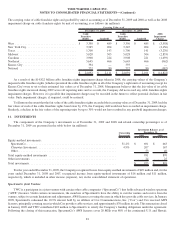

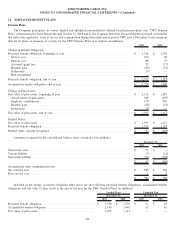

The table below presents the assumptions used to value TWC stock options at their grant date for the years ended December 31,

2009, 2008 and 2007 and reflects the weighted average of all awards granted within each year:

2009 2008 2007

Year Ended December 31,

Expected volatility ...................................................... 34.3% 30.0% 24.1%

Expected term to exercise from grant date ..................................... 6.04 years 6.51 years 6.58 years

Risk-free rate .......................................................... 2.6% 3.2% 4.7%

Expected dividend yield .................................................. 0.0% 0.0% 0.0%

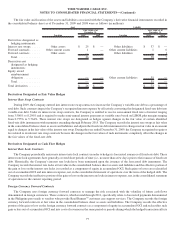

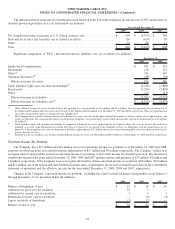

The following table summarizes information about TWC stock options that were outstanding as of December 31, 2009:

Number

of Options

(a)

Weighted-

Average

Exercise

Price

(a)

Weighted-

Average

Remaining

Contractual

Life

Aggregate

Intrinsic

Value

(in thousands) (in years) (in millions)

Outstanding as of December 31, 2008 .......................... 5,702 $ 39.88

Granted

(b)

............................................... 6,345 25.93

Exercised ............................................... (126) 35.29

Forfeited or expired ....................................... (401) 33.98

Outstanding as of December 31, 2009 .......................... 11,520 32.45 8.04 $ 115

Exercisable as of December 31, 2009 .......................... 1,849 42.08 7.26 $ 5

(a)

Amounts recast to reflect adjustments related to the Special Dividend and the 1-for-3 TWC Reverse Stock Split.

(b)

Of the 6.3 million stock options granted in 2009, 5.1 million were granted with a weighted average exercise price of $24.09 per option and 1.2 million were granted as

Separation-related “make-up” equity awards with a weighted-average exercise price of $33.80 per option.

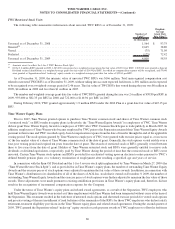

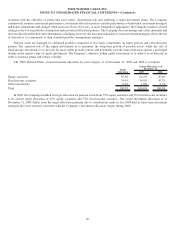

As of December 31, 2009, the number, weighted-average exercise price, aggregate intrinsic value and weighted-average remaining

contractual term of TWC stock options vested and expected to vest approximate amounts for options outstanding. Total unrecognized

compensation cost related to unvested TWC stock options as of December 31, 2009, without taking into account expected forfeitures, is

$54 million and is expected to be recognized over a weighted-average period of 2.40 years.

The weighted-average fair value of a TWC stock option granted during the year was $9.69 ($5.81, net of tax) in 2009, $13.22 ($7.93,

net of tax) in 2008 and $17.20 ($10.32, net of tax) in 2007. The total intrinsic value of TWC stock options exercised during the year ended

December 31, 2009 was $1 million. Cash received and tax benefits realized from these exercises of TWC stock options was $4 million

and less than $1 million, respectively. No TWC stock options were exercised during the years ended December 31, 2008 and 2007.

During February 2010, TWC granted options to purchase approximately 3.8 million shares of TWC Common Stock under the 2006

Plan at a grant date fair value ranging from $10.87 to $11.33 per option.

85

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)