Time Warner Cable 2009 Annual Report Download - page 74

Download and view the complete annual report

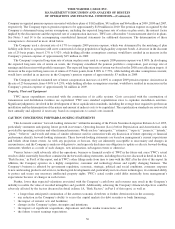

Please find page 74 of the 2009 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2. RECENT ACCOUNTING STANDARDS

Accounting Standards Adopted in 2009

Fair Value Measurements

In September 2006, the FASB issued authoritative guidance that establishes the authoritative definition of fair value, sets out a

framework for measuring fair value and expands the required disclosures about fair value measurements. The provisions of this guidance

related to nonfinancial assets and liabilities became effective for TWC on January 1, 2009, have been applied prospectively and did not

have a material impact on the Company’s consolidated financial statements.

Noncontrolling Interests

In December 2007, the FASB issued authoritative guidance that establishes accounting and reporting standards for a noncontrolling

interest in a subsidiary, including the accounting treatment upon the deconsolidation of a subsidiary. This guidance became effective for

TWC on January 1, 2009 and has been applied prospectively, except for the provisions related to the presentation of noncontrolling

interests, which have been applied retrospectively for all periods presented. Noncontrolling interests of $1.110 billion as of December 31,

2008 were reclassified to a component of total equity as reflected in the consolidated balance sheet. For the year ended December 31,

2008, minority interest income of $1.022 billion ($619 million, net of tax) and, for the year ended December 31, 2007, minority interest

expense of $165 million ($99 million, net of tax) are excluded from net income (loss) in the consolidated statement of operations. Net

income (loss) attributable to TWC per common share for prior periods is not impacted.

Determining Whether Instruments Granted in Share-Based Payment Transactions are Participating Securities

In June 2008, the FASB issued authoritative guidance that requires share-based compensation awards that qualify as participating

securities to be included in basic earnings per share using the two-class method. Under this guidance, all outstanding unvested share-

based payment awards that contain rights to nonforfeitable dividends or dividend equivalents are considered participating securities. This

guidance became effective for TWC on January 1, 2009 and is being applied retrospectively to all prior-period earnings per share

computations. The adoption of this guidance did not impact net income attributable to TWC per common share for prior periods. As

further discussed in Note 16, on January 27, 2010, the Company’s Board of Directors declared a regular quarterly cash dividend on TWC

Common Stock of $0.40 per share payable in March 2010. As a result of such declaration, the Company’s outstanding restricted stock

units will be treated as participating securities to the extent of declared dividends in the Company’s earnings per share calculation

beginning in the first quarter of 2010.

Business Combinations

In December 2007, the FASB issued authoritative guidance that establishes principles and requirements for how an acquirer in a

business combination (i) recognizes and measures in its financial statements the identifiable assets acquired, the liabilities assumed, and

any noncontrolling interest in the acquiree, (ii) recognizes and measures goodwill acquired in a business combination or a gain from a

bargain purchase, and (iii) determines what information to disclose to enable users of financial statements to evaluate the nature and

financial effects of the business combination. In addition, this guidance requires that changes in the amount of acquired tax attributes be

included in the Company’s results of operations. This guidance became effective for TWC on January 1, 2009. This guidance will be

applied to business combinations that have an acquisition date on or after January 1, 2009 and is being applied to deferred tax asset

valuation allowances and liabilities for income tax uncertainties recognized in prior business combinations. The adoption of this

guidance has not impacted the Company’s consolidated financial statements for prior periods; however, the Company’s consolidated

financial statements may be impacted to the extent the Company acquires entities in a purchase business combination in the future.

Interim Disclosures about Fair Value of Financial Instruments

In April 2009, the FASB issued authoritative guidance that requires disclosures about fair value of financial instruments to be

included in interim financial statements as well as in annual financial statements. This guidance became effective for TWC on April 1,

2009, is being applied prospectively beginning in the second quarter of 2009 and did not have a material impact on the Company’s

consolidated financial statements.

Subsequent Events

In May 2009, the FASB issued authoritative guidance related to the accounting for and disclosure of events that occur after the

balance sheet date but before the financial statements are issued or are available to be issued. This guidance requires the Company to

disclose the date through which subsequent events have been evaluated, as well as whether that date is the date the consolidated financial

62

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)