Time Warner Cable 2009 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2009 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

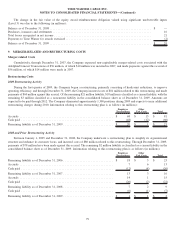

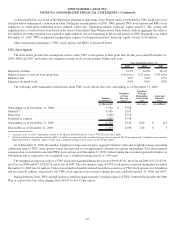

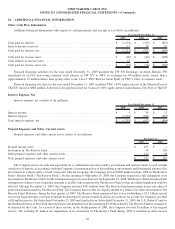

The components of net periodic benefit costs are as follows (in millions):

2009 2008 2007

Year Ended December 31,

Service cost . ....................................................... $ 100 $ 96 $ 75

Interest cost . ....................................................... 88 79 68

Expected return on plan assets .......................................... (93) (102) (90)

Amounts amortized .................................................. 66 18 11

Settlement loss ..................................................... 1 — —

Net periodic benefit costs .............................................. $ 162 $ 91 $ 64

The estimated amounts that will be amortized from accumulated other comprehensive loss, net, into net periodic benefit costs in

2010 include an actuarial loss of $31 million.

In addition, certain employees of TWC participate in multi-employer pension plans, not included in the net periodic costs above, for

which the expense was $33 million in 2009, $31 million in 2008 and $28 million in 2007.

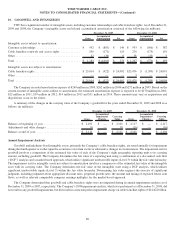

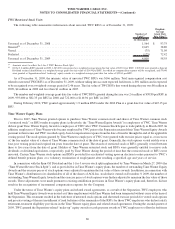

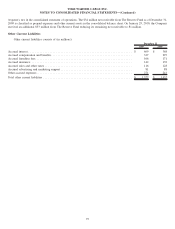

Weighted-average assumptions used to determine benefit obligations at December 31, 2009, 2008 and 2007 are as follows:

2009 2008 2007

Year Ended December 31,

Discount rate ....................................................... 6.16% 6.17% 6.00%

Rate of compensation increase .......................................... 4.25% 4.00% 4.50%

Weighted-average assumptions used to determine net periodic benefit cost for the years ended December 31, 2009, 2008 and 2007

are as follows:

2009 2008 2007

Year Ended December 31,

Discount rate ....................................................... 6.17% 6.00% 6.00%

(a)

Expected long-term return on plan assets .................................. 8.00% 8.00% 8.00%

Rate of compensation increase .......................................... 4.00% 4.50% 4.50%

(a)

In connection with the Adelphia/Comcast Transactions, the TWC Pension Plans were remeasured on August 1, 2007 using a discount rate of 6.25%.

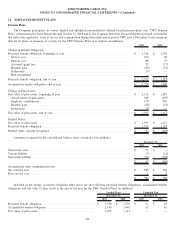

In 2009 and 2008, the discount rate was determined by the matching of plan liability cash flows to a pension yield curve constructed of

a large population of high-quality corporate bonds. In 2007, the discount rate was determined by comparison against the Moody’s Aa

Corporate Index rate, adjusted for coupon frequency and duration of the obligation, which was consistent with prior periods. The resulting

discount rate was supported by periodic matching of plan liability cash flows to a pension yield curve constructed of a large population of

high-quality corporate bonds. A decrease in the discount rate of 25 basis points, from 6.17% to 5.92%, while holding all other assumptions

constant, would have resulted in an increase in the Company’s pension expense of approximately $15 million in 2009.

In developing the expected long-term rate of return on assets, the Company considered the pension portfolio’s composition, past

average rate of earnings and discussions with portfolio managers. The expected long-term rate of return was based on the 2008 asset

allocation targets. A decrease in the expected long-term rate of return of 25 basis points, from 8.00% to 7.75%, while holding all other

assumptions constant, would have resulted in an increase in the Company’s pension expense of approximately $3 million in 2009.

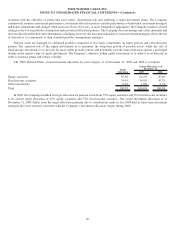

Pension Assets

Effective October 31, 2008, the assets of the TWC Pension Plans held in a master trust with the plan assets of other Time Warner

defined benefit pension plans (the “Time Warner Master Trust”) were transferred to a new master trust established to hold the assets of the

TWC Pension Plans (the “TWC Master Trust”). As of December 31, 2008, the TWC Master Trust’s assets included 565,000 shares of

Time Warner common stock, after giving effect to the Time Warner Reverse Stock Split, with a total value of $17 million (approximately

2% of total plan assets held in the TWC Master Trust). In March 2009, the TWC Master Trust received 142,000 shares of TWC Common

Stock in connection with the Distribution. During December 2009, the TWC Common Stock and Time Warner common stock held in the

TWC Master Trust were sold. As of December 31, 2009, there were no shares of TWC Common Stock or Time Warner common stock

held in the TWC Master Trust.

The Company’s investment policy for the TWC Pension Plans is to maximize the long-term rate of return on plan assets within a

prudent level of risk and diversification while maintaining adequate funding levels. The Company uses a mix of equity and fixed-income

89

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)