Time Warner Cable 2009 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2009 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

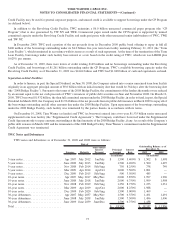

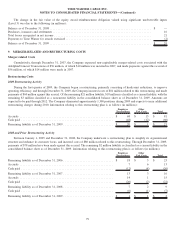

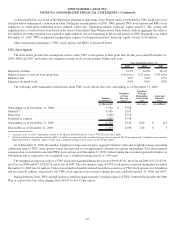

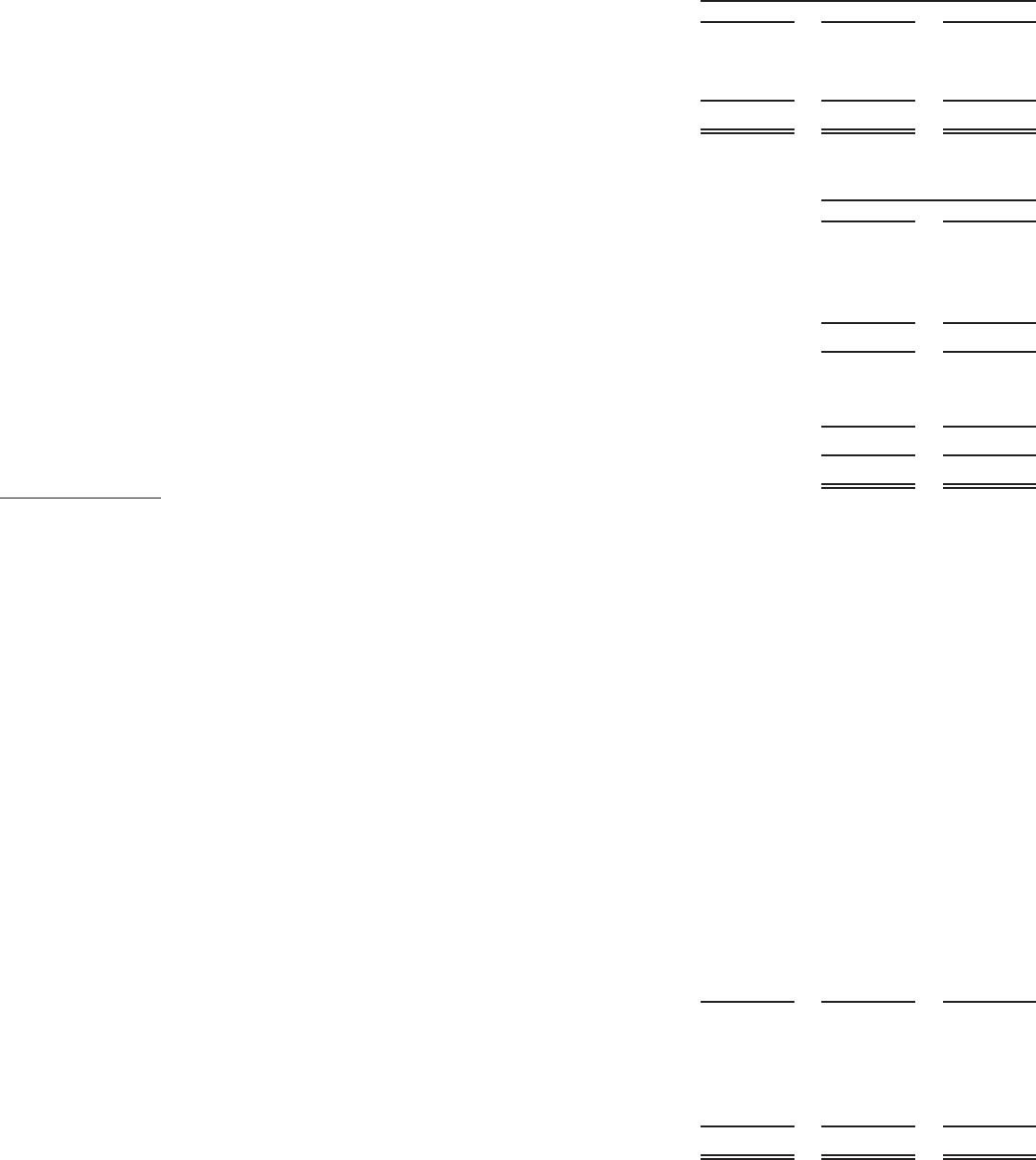

The differences between income tax (benefit) provision expected at the U.S. federal statutory income tax rate of 35% and income tax

(benefit) provision provided are as set forth below (in millions):

2009 2008 2007

Year Ended December 31,

Tax (benefit) provision on income at U.S. federal statutory rate .................. $ 669 $ (4,575) $ 710

State and local taxes (tax benefits), net of federal tax effects .................... 126 (620) 85

Other............................................................. 25 86 11

Total ............................................................. $ 820 $ (5,109) $ 806

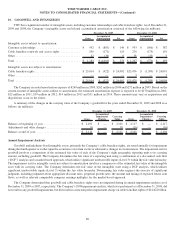

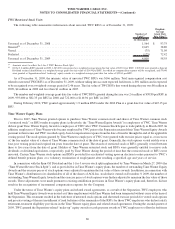

Significant components of TWC’s deferred income tax liabilities, net, are as follows (in millions):

2009 2008

December 31,

Equity-based compensation ........................................................ $ 181 $ 161

Investments ................................................................... 130 152

Other

(a)

...................................................................... 351 449

Valuation allowances

(b)

........................................................... (88) (76)

Deferred income tax assets ...................................................... 574 686

Cable franchise rights and customer relationships

(c)

...................................... (6,136) (5,886)

Fixed assets ................................................................... (3,239) (2,824)

Other ........................................................................ (17) (13)

Deferred income tax liabilities .................................................... (9,392) (8,723)

Deferred income tax liabilities, net

(d)

............................................... $ (8,818) $ (8,037)

(a)

Other deferred income tax assets includes federal net operating loss carryforwards of $14 million and $14 million, state net operating loss carryforwards of

$1 million and $2 million and state credit carryforwards of $29 million and $22 million as of December 31, 2009 and 2008, respectively. These net operating loss

and credit carryforwards expire in varying amounts through 2029.

(b)

The Company has recorded a valuation allowance for deferred tax assets associated with equity-method investments as well as certain state net operating loss and

credit carryforwards. The valuation allowance is based upon the Company’s assessment that it is more likely than not that a portion of the deferred tax asset will not

be realized.

(c)

Cable franchise rights and customer relationships is comprised of deferred tax assets (approximately $1.1 billion) where the tax basis exceeds the book basis

primarily as a result of the impairment recorded in 2008 that are expected to be realized as the Company receives tax deductions from the amortization, for tax

purposes, of the intangible assets offset by deferred tax liabilities (approximately $7.2 billion) that are associated with intangible assets for which the book basis is

greater than the tax basis.

(d)

Deferred income tax liabilities, net, includes current deferred income tax assets of $139 million and $156 million as of December 31, 2009 and 2008, respectively.

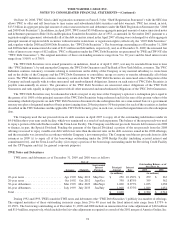

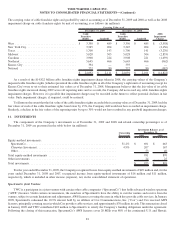

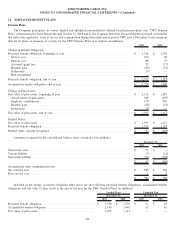

Uncertain Income Tax Positions

The Company has a $73 million and $27 million reserve for uncertain income tax positions as of December 31, 2009 and 2008,

respectively, which includes an accrual for interest and penalties of $17 million and $5 million, respectively. The Company’s policy is to

recognize interest and penalties accrued on uncertain income tax positions as part of the income tax (benefit) provision. The income tax

(benefit) provision for the years ended December 31, 2009, 2008 and 2007 includes interest and penalties of $13 million, $2 million and

$1 million, respectively. If the Company were to recognize the benefits of these uncertain income tax positions, $28 million, $19 million

and $13 million, net of the federal and state benefit for income taxes, would impact the income tax (benefit) provision in the consolidated

statement of operations and the effective tax rate for the year ended December 31, 2009, 2008 and 2007, respectively.

Changes in the Company’s uncertain income tax positions, excluding the related accrual for interest and penalties, from January 1

through December 31 are presented below (in millions):

2009 2008 2007

Balance at beginning of year ........................................... $ 22 $ 18 $ 16

Additions for prior year tax positions ..................................... 32 3 —

Additions for current year tax positions ................................... 3 5 3

Reductions for prior year tax positions .................................... — (2) (1)

Lapses in statute of limitations .......................................... (1) (2) —

Balance at end of year ................................................ $ 56 $ 22 $ 18

83

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)