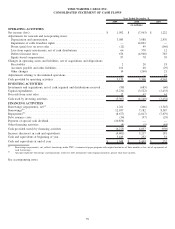

Time Warner Cable 2009 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2009 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

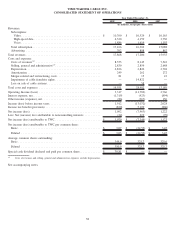

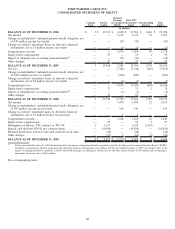

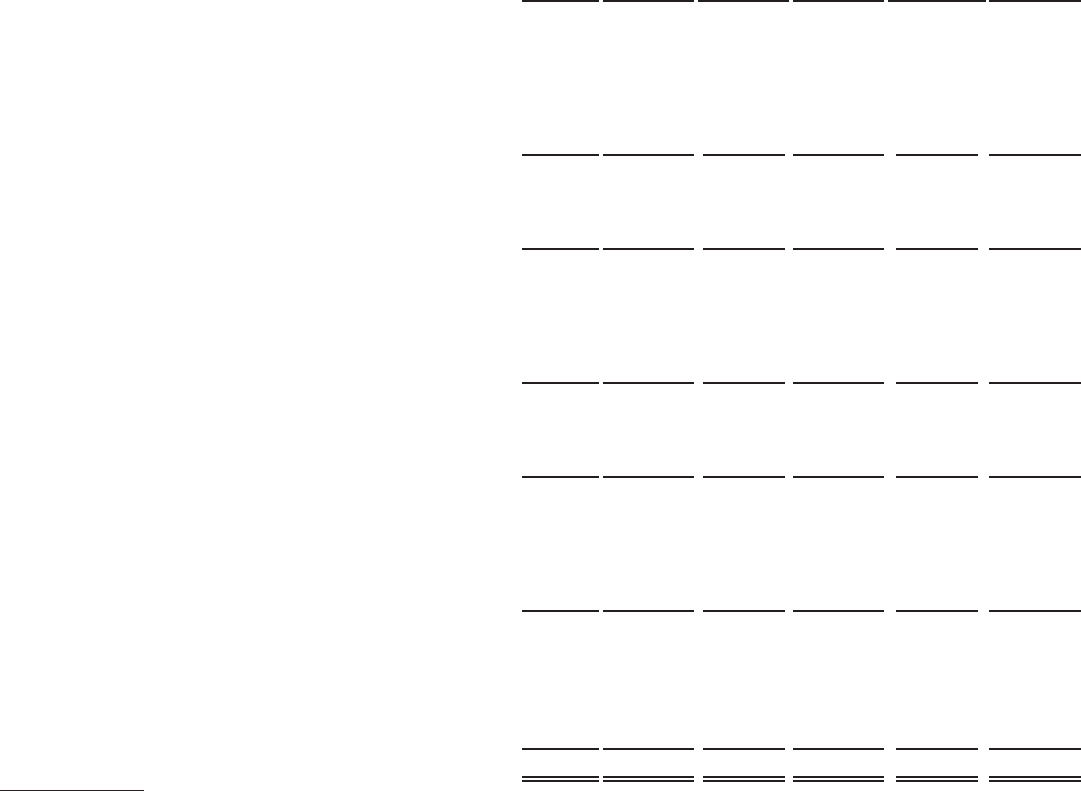

TIME WARNER CABLE INC.

CONSOLIDATED STATEMENT OF EQUITY

Common

Stock

Paid-in

Capital

Retained

Earnings

(Accumulated

Deficit)

Total TWC

Shareholders’

Equity

Noncontrolling

Interests

Total

Equity

(in millions)

BALANCE AS OF DECEMBER 31, 2006 ................ $ 3$ 19,321 $ 4,240 $ 23,564 $ 1,624 $ 25,188

Net income . ...................................... — — 1,123 1,123 99 1,222

Change in underfunded / unfunded pension benefit obligation, net

of $29 million income tax benefit...................... — — (43) (43) — (43)

Change in realized / unrealized losses on derivative financial

instruments, net of $1 million income tax benefit .......... — — (1) (1) — (1)

Comprehensive income . . . ............................ — — 1,079 1,079 99 1,178

Equity-based compensation ............................ — 55 — 55 4 59

Impact of adopting new accounting pronouncements

(a)

........ — — (34) (34) — (34)

Other changes ..................................... — 42 — 42 (3) 39

BALANCE AS OF DECEMBER 31, 2007 ................ 3 19,418 5,285 24,706 1,724 26,430

Net loss .......................................... — — (7,344) (7,344) (619) (7,963)

Change in underfunded / unfunded pension benefit obligation, net

of $192 million income tax benefit ..................... — — (290) (290) — (290)

Change in realized / unrealized losses on derivative financial

instruments, net of $2 million income tax benefit .......... — — (3) (3) — (3)

Comprehensive loss ................................. — — (7,637) (7,637) (619) (8,256)

Equity-based compensation ............................ — 73 — 73 5 78

Impact of adopting new accounting pronouncements

(a)

........ — — (1) (1) — (1)

Other changes ..................................... — 23 — 23 — 23

BALANCE AS OF DECEMBER 31, 2008 ................ 3 19,514 (2,353) 17,164 1,110 18,274

Net income . ...................................... — — 1,070 1,070 22 1,092

Change in underfunded / unfunded pension benefit obligation, net

of $95 million income tax provision . . . ................. — — 146 146 — 146

Change in realized / unrealized gains on derivative financial

instruments, net of $2 million income tax provision . . . ...... — — 2 2 — 2

Comprehensive income . . . ............................ — — 1,218 1,218 22 1,240

Equity-based compensation ............................ — 95 — 95 2 97

Redemption of Historic TW’s interest in TW NY . ........... 1 1,127 — 1,128 (1,128) —

Special cash dividend ($30.81 per common share). ........... — (10,856) — (10,856) — (10,856)

Retained distribution related to unvested restricted stock units . . . — (46) — (46) — (46)

Other changes ..................................... — (21) 3 (18) (2) (20)

BALANCE AS OF DECEMBER 31, 2009 ................ $ 4$ 9,813 $ (1,132) $ 8,685 $ 4 $ 8,689

(a)

For the year ended December 31, 2008, the amount reflects the impact of adopting authoritative guidance issued by the Financial Accounting Standards Board (“FASB”)

relating to accounting for collateral assignment split-dollar life insurance arrangements of $1 million. For the year ended December 31, 2007, the amount relates to the

impact of adopting authoritative guidance issued by the FASB relating to accounting for sabbatical leave and other similar benefits of $37 million andaccountingfor

uncertainty in income taxes of $(3) million.

See accompanying notes.

60