Time Warner Cable 2009 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2009 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

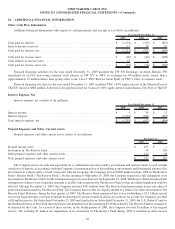

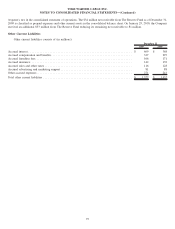

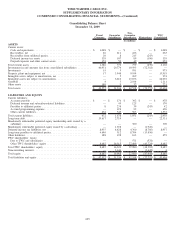

18. ADDITIONAL FINANCIAL INFORMATION

Other Cash Flow Information

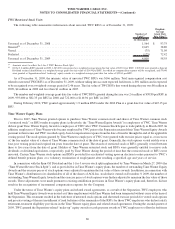

Additional financial information with respect to cash (payments) and receipts is as follows (in millions):

2009 2008 2007

Year Ended December 31,

Cash paid for interest ................................................. $ (1,234) $ (745) $ (855)

Interest income received............................................... 13 38 10

Cash paid for interest, net ............................................. $ (1,221) $ (707) $ (845)

Cash paid for income taxes ............................................ $ (90) $ (40) $ (298)

Cash refunds of income taxes ........................................... 53 4 6

Cash paid for income taxes, net ......................................... $ (37) $ (36) $ (292)

Noncash financing activities for the year ended December 31, 2009 included the TW NY Exchange, in which Historic TW

transferred its 12.43% non-voting common stock interest in TW NY to TWC in exchange for 80 million newly issued shares

(approximately 27 million shares after giving effect to the 1-for-3 TWC Reverse Stock Split) of TWC’s Class A common stock.

Noncash financing activities for the year ended December 31, 2007 included TWC’s 50% equity interest in the Houston Pool of

TKCCP, valued at $880 million, delivered as the purchase price for Comcast’s 50% equity interest in the Kansas City Pool of TKCCP.

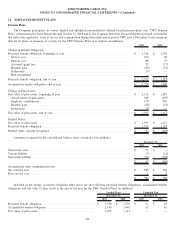

Interest Expense, Net

Interest expense, net consists of (in millions):

2009 2008 2007

Year Ended December 31,

Interest income ..................................................... $ 5 $ 38 $ 13

Interest expense ..................................................... (1,324) (961) (907)

Total interest expense, net ............................................. $ (1,319) $ (923) $ (894)

Prepaid Expenses and Other Current Assets

Prepaid expenses and other current assets consist of (in millions):

2009 2008

December 31,

Prepaid income taxes ............................................................ $ 103 $ —

Investment in The Reserve Fund .................................................... 34 103

Other prepaid expenses and other current assets ......................................... 115 98

Total prepaid expenses and other current assets ......................................... $ 252 $ 201

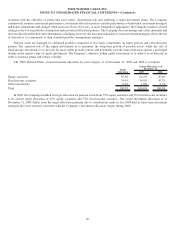

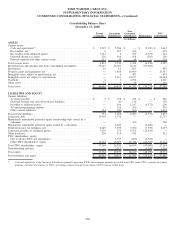

The Company invests its cash and equivalents in a combination of money market, government and treasury funds, as well as bank

certificates of deposit, in accordance with the Company’s investment policy of diversifying its investments and limiting the amount of its

investments in a single entity or fund. Consistent with the foregoing, the Company invested $490 million in June 2008 in The Reserve

Fund’s Primary Fund (“The Reserve Fund”). On the morning of September 15, 2008, the Company requested a full redemption of its

investment in The Reserve Fund, but the redemption request was not honored. On September 22, 2008, The Reserve Fund announced that

redemptions of shares were suspended pursuant to an SEC order requested by The Reserve Fund so that an orderly liquidation could be

effected. Through December 31, 2009, the Company received $451 million from The Reserve Fund representing its pro rata share of

partial distributions made by The Reserve Fund. The Company believes that it is legally entitled to a return of its entire investment in The

Reserve Fund. However, during the first quarter of 2009, The Reserve Fund announced that it was establishing a $3.5 billion special

reserve for legal and other costs that would not be distributed to investors until all claims are resolved. As a result, the Company recorded

a $10 million reserve. By Order dated November 25, 2009 and clarified in an Order dated December 11, 2009, the U.S. District Court for

the Southern District of New York directed the pro rata distribution of the remaining $3.4 billion held by The Reserve Fund in a manner to

be directed by the Court. As a result of these actions, in the fourth quarter of 2009, the Company reversed $5 million of the original

reserve. The resulting $5 million net impairment of its investment in The Reserve Fund during 2009 is included in other income

96

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)