Time Warner Cable 2009 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2009 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

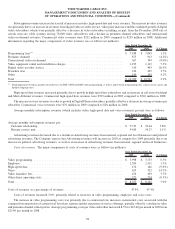

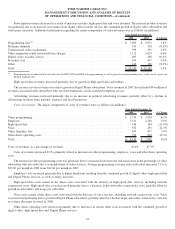

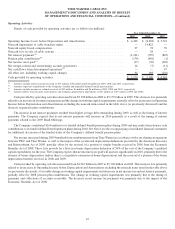

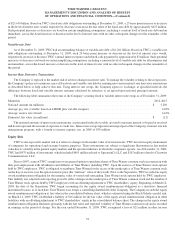

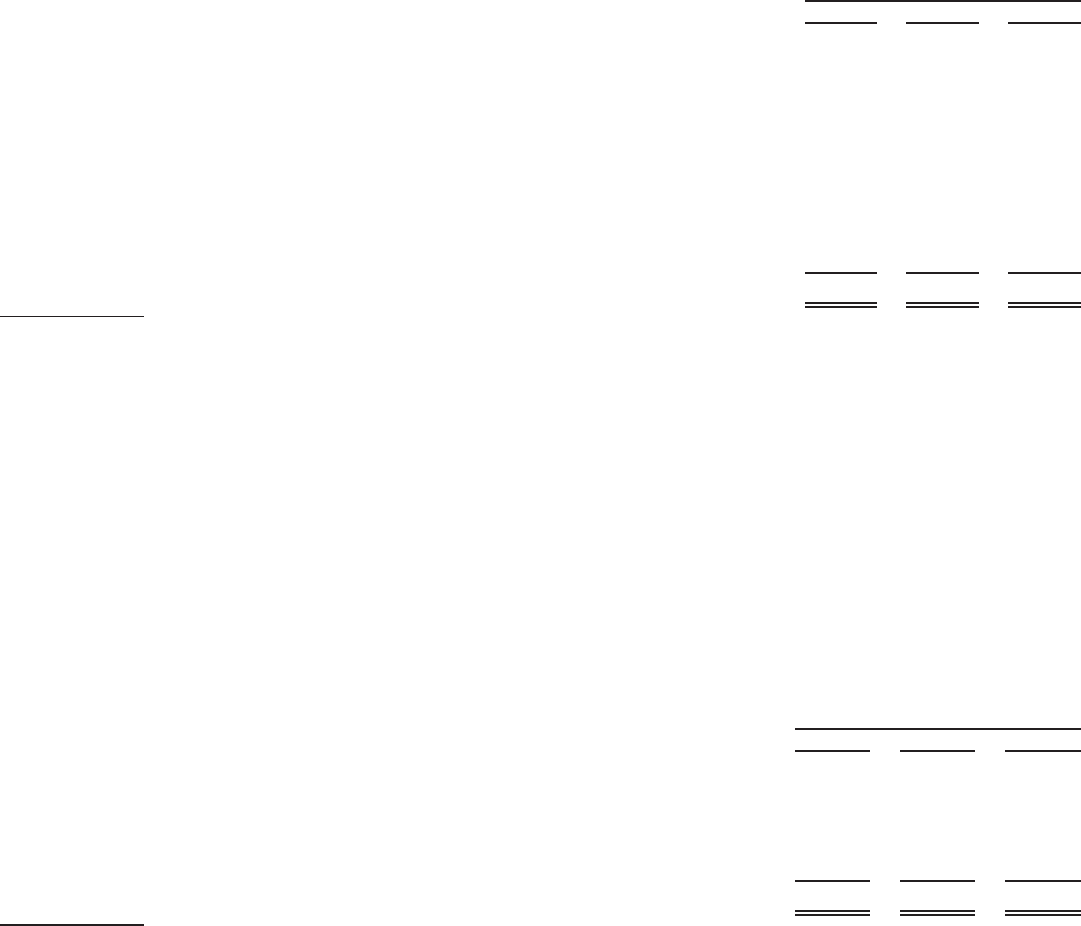

Investing Activities

Details of cash used by investing activities are as follows (in millions):

2009 2008 2007

Year Ended December 31,

Investments and acquisitions, net of cash acquired and distributions received:

Clearwire Communications LLC

(a)

............................................ $ (97) $ (536) $ —

The Reserve Fund

(b)

...................................................... 64 (103) —

SpectrumCo LLC

(a)

....................................................... (29) (3) (33)

Distributions received from an investee

(c)

....................................... — — 51

Acquisition of Adelphia assets and exchange of systems with Comcast

(d)

............... — 2 (25)

All other ............................................................... (26) (45) (53)

Capital expenditures ........................................................ (3,231) (3,522) (3,433)

Proceeds from the sale of cable systems ......................................... — 51 52

Other investing activities . . . .................................................. 12 16 9

Cash used by investing activities ............................................... $ (3,307) $ (4,140) $ (3,432)

(a)

Refer to Note 11 to the accompanying consolidated financial statements for details on the Company’s investments in Clearwire Communications LLC and

SpectrumCo LLC.

(b)

2008 amount reflects the classification of the Company’s investment in The Reserve Fund as prepaid expenses and other current assets on the Company’s

consolidated balance sheet as a result of the then current status of the Company’s investment. 2009 amount reflects the receipt of the Company’s pro rata share of

partial distributions made by The Reserve Fund during 2009.

(c)

Distributions received from an investee represent distributions received from Sterling Entertainment Enterprises, LLC (d/b/a SportsNet New York), an

equity-method investee.

(d)

2007 amount primarily represents additional transaction-related costs, including working capital adjustments.

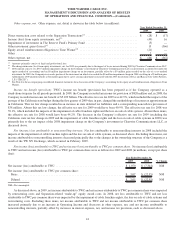

Cash used by investing activities decreased from $4.140 billion in 2008 to $3.307 billion in 2009. This decrease was principally due

to the change in investments and acquisitions, net, and a decrease in capital expenditures. The Company expects that capital expenditures

will decrease to less than $3.0 billion in 2010.

Cash used by investing activities increased from $3.432 billion in 2007 to $4.140 billion in 2008. This increase was principally due

to the Company’s investment in Clearwire Communications LLC and the classification of the Company’s investment in The Reserve

Fund as prepaid expenses and other current assets on the Company’s consolidated balance sheet (as discussed above), as well as an

increase in capital expenditures.

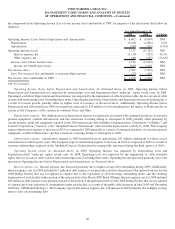

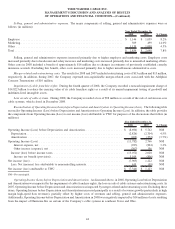

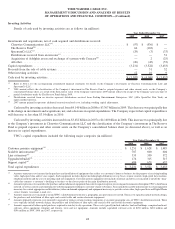

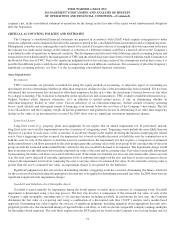

TWC’s capital expenditures included the following major categories (in millions):

2009 2008 2007

Year Ended December 31,

Customer premise equipment

(a)

............................................... $ 1,251 $ 1,628 $ 1,485

Scalable infrastructure

(b)

.................................................... 787 600 604

Line extensions

(c)

......................................................... 335 350 372

Upgrades/rebuilds

(d)

....................................................... 174 315 315

Support capital

(e)

.......................................................... 684 629 657

Total capital expenditures ................................................... $ 3,231 $ 3,522 $ 3,433

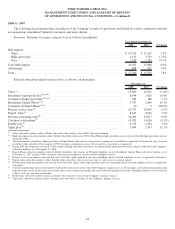

(a)

Amounts represent costs incurred in the purchase and installation of equipment that resides at a customer’s home or business for the purpose of receiving/sending

video, high-speed data and/or voice signals. Such equipment includes digital (including high-definition) set-top boxes, remote controls, high-speed data modems,

telephone modems and the costs of installing such new equipment. Customer premise equipment also includes materials and labor costs incurred to install the “drop”

cable that connects a customer’s dwelling or business to the closest point of the main distribution network.

(b)

Amounts represent costs incurred in the purchase and installation of equipment that controls signal reception, processing and transmission throughout TWC’s distribution

network, as well as controls and communicates with the equipment residing at a customer’s home or business. Also included in scalable infrastructure is certain equipment

necessary for content aggregation and distribution (video-on-demand equipment) and equipment necessary to provide certain video, high-speed data and Digital Phone

service features (voicemail, e-mail, etc.).

(c)

Amounts represent costs incurred to extend TWC’s distribution network into a geographic area previously not served. These costs typically include network design,

the purchase and installation of fiber optic and coaxial cable and certain electronic equipment.

(d)

Amounts primarily represent costs incurred to upgrade or replace certain existing components or an entire geographic area of TWC’s distribution network. These

costs typically include network design, the purchase and installation of fiber optic and coaxial cable and certain electronic equipment.

(e)

Amounts represent all other capital purchases required to run day-to-day operations. These costs typically include vehicles, land and buildings, computer hardware/

software, office equipment, furniture and fixtures, tools and test equipment. Amounts include capitalized software costs of $202 million, $201 million and

$196 million in 2009, 2008 and 2007, respectively.

48

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)