Time Warner Cable 2009 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2009 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

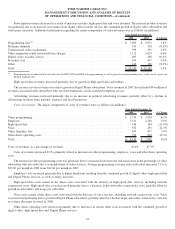

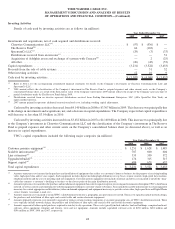

Employee costs increased primarily due to an increase in pension expense and employee medical and compensation expenses.

Voice costs consist of the direct costs associated with the delivery of voice services, including network connectivity costs. Voice

costs increased primarily due to growth in Digital Phone subscribers.

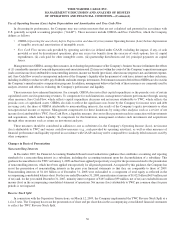

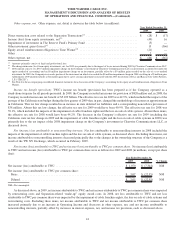

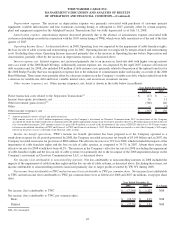

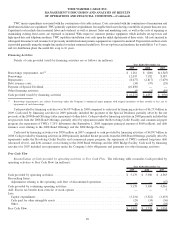

Selling, general and administrative expenses. The components of selling, general and administrative expenses were as follows (in

millions):

2009 2008 % Change

Year Ended December 31,

Employee ............................................................... $ 1,153 $ 1,146 0.6%

Marketing ............................................................... 563 569 (1.1%)

Separation-related “make-up” equity award costs .................................. 9 — NM

Other .................................................................. 1,105 1,139 (3.0%)

Total ................................................................... $ 2,830 $ 2,854 (0.8%)

NM—Not meaningful.

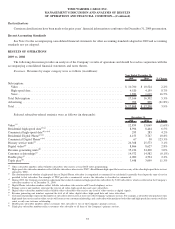

Selling, general and administrative expenses decreased slightly primarily as a result of lower bad debt expense, which declined by

$38 million in 2009 primarily due to improvement in collection efforts and a reduction in the allowance for doubtful accounts to reflect

the quality of residential receivables as of the end of 2009. The decrease in bad debt expense benefited both the fourth quarter and full

year 2009. Casualty insurance expense in 2009 and 2008 included benefits of approximately $11 million and $16 million, respectively,

due to changes in estimates of previously established casualty insurance accruals. Employee costs in 2009 remained essentially flat as an

increase in pension expense was primarily offset by a decrease in employee headcount.

As a result of the Separation, pursuant to their terms, Time Warner equity awards held by TWC employees were forfeited and/or

experienced a reduction in value. During 2009, the Company recorded $9 million of costs associated with TWC stock options and

restricted stock units granted to its employees to offset these forfeitures and/or reduced values.

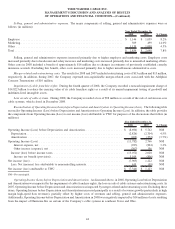

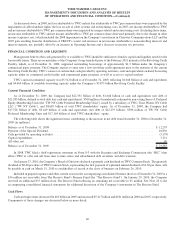

Restructuring costs. The results for 2009 and 2008 included restructuring costs of $81 million and $15 million, respectively. The

Company eliminated approximately 1,300 positions during 2009. The Company expects to incur additional restructuring charges during

2010.

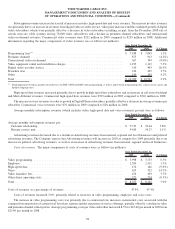

Impairment of cable franchise rights. During the fourth quarter of 2008, the Company recorded a noncash impairment charge of

$14.822 billion to reduce the carrying value of its cable franchise rights as a result of its annual impairment testing of goodwill and

indefinite-lived intangible assets. There was no such impairment charge in 2009. See “Critical Accounting Policies—Asset

Impairments—Goodwill and Indefinite-lived Intangible Assets” and Notes 3 and 10 to the accompanying consolidated financial

statements for further details on the Company’s 2009 and 2008 impairment testing of cable franchise rights.

Loss on sale of cable systems. During 2008, the Company recorded a loss of $58 million as a result of the sale of certain non-core

cable systems, which closed in December 2008.

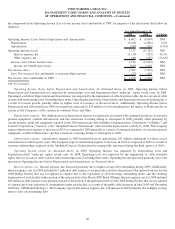

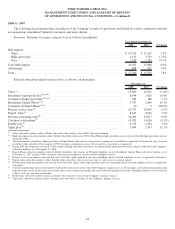

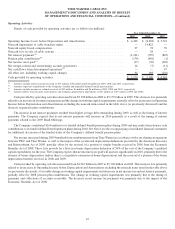

Reconciliation of Operating Income (Loss) before Depreciation and Amortization to Operating Income (Loss). The following table

reconciles Operating Income (Loss) before Depreciation and Amortization to Operating Income (Loss). In addition, the table provides

39

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)