Time Warner Cable 2009 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2009 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

securities with the objective of preserving asset values, diversifying risk and achieving a target investment return. The Company

continuously monitors investment performance, investment allocation policies and the performance of individual investment managers

and makes adjustments and changes when necessary. Every five years, or more frequently if appropriate, the Company conducts a broad

strategic review of its portfolio construction and investment allocation policies. The Company does not manage any assets internally and

does not directly utilize derivative instruments or hedging; however, the investment mandate of some investment managers allows the use

of derivatives as components of their standard portfolio management strategies.

Pension assets are managed in a balanced portfolio comprised of two major components: an equity portion and a fixed-income

portion. The expected role of the equity investments is to maximize the long-term growth of pension assets, while the role of

fixed-income investments is to provide for more stable periodic returns and potentially provide some protection against a prolonged

decline in the market value of equity investments. The Company’s objective within equity investments is to achieve asset diversity in

order to increase return and reduce volatility.

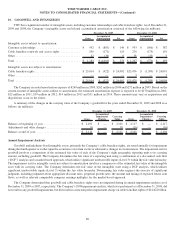

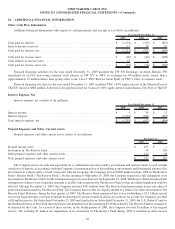

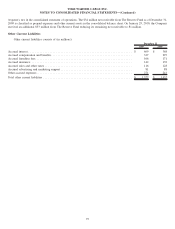

The TWC Pension Plans’ actual investment allocation by asset category as of December 31, 2009 and 2008 is as follows:

Target

Allocation 2009 2008

Actual Allocation as of

December 31,

Equity securities .................................................... 65.0% 64.2% 49.6%

Fixed-income securities ............................................... 35.0% 34.0% 47.7%

Other investments ................................................... 0.0% 1.8% 2.7%

Total ............................................................. 100.0% 100.0% 100.0%

In 2009, the Company modified its target allocation for pension assets from 75% equity securities and 25% fixed-income securities

to its current target allocation of 65% equity securities and 35% fixed-income securities. The actual investment allocation as of

December 31, 2008 differs from the target allocation primarily due to contributions made in late 2008 held in short-term investment

strategies that were invested consistent with the Company’s investment allocation targets during 2009.

90

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)