Time Warner Cable 2009 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2009 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

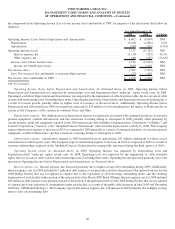

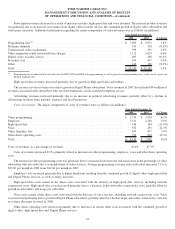

Depreciation expense. The increase in depreciation expense was primarily associated with purchases of customer premise

equipment, scalable infrastructure and line extensions occurring during or subsequent to 2007, partially offset by certain property,

plant and equipment acquired in the Adelphia/Comcast Transactions that was fully depreciated as of July 31, 2008.

Amortization expense. Amortization expense decreased primarily due to the absence of amortization expense associated with

customer relationships recorded in connection with the 2003 restructuring of TWE, which were fully amortized as of the end of the first

quarter of 2007.

Operating Income (Loss). As discussed above, in 2008, Operating Loss was impacted by the impairment of cable franchise rights,

the loss on sale of cable systems and restructuring costs. In 2007, Operating Income was impacted by merger-related and restructuring

costs. Excluding these items, Operating Income increased primarily due to the increase in Operating Income before Depreciation and

Amortization, partially offset by the increase in depreciation expense, as discussed above.

Interest expense, net. Interest expense, net, increased primarily due to an increase in fixed-rate debt with higher average interest

rates as a result of the 2008 Bond Offerings. Additionally, interest expense, net, was impacted by the April 2007 issuance of fixed-rate

debt securities and, for 2008, also included $45 million of debt issuance costs primarily related to the portion of the upfront loan fees for

the 2008 Bridge Facility that was recognized as expense due to the reduction of commitments under such facility as a result of the 2008

Bond Offerings. These items were partially offset by a decrease in interest on the Company’s variable-rate debt, which resulted from both

a decrease in variable-rate debt and lower variable interest rates, and an increase in interest income.

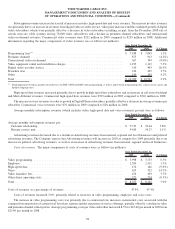

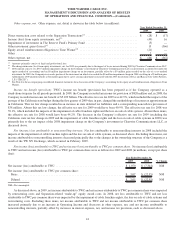

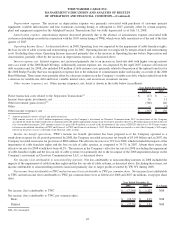

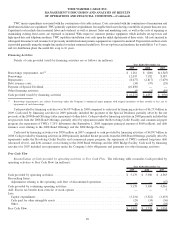

Other income (expense), net. Other income (expense), net, detail is shown in the table below (in millions):

2008 2007

Year Ended December 31,

Direct transaction costs related to the Separation Transactions

(a)

............................... $ (17) $ —

Income from equity investments, net ................................................... 16 11

Other investment gains (losses)

(b)

...................................................... (366) 146

Other .......................................................................... — (1)

Other income (expense), net ......................................................... $ (367) $ 156

(a)

Amount primarily consists of legal and professional fees.

(b)

2008 amount consists of a $367 million impairment charge on the Company’s investment in Clearwire Communications LLC (an investment of the Company

accounted for under the equity method of accounting) and an $8 million impairment charge on an investment, partially offset by a $9 million gain recorded on the sale

of a cost-method investment. 2007 amount consists of a gain of $146 million as a result of the distribution of the assets of TKCCP, which was a 50-50 joint venture

between a consolidated subsidiary of TWC and Comcast, to TWC and Comcast on January 1, 2007. The distribution was treated as a sale of the Company’s 50% equity

interest in the pool of assets consisting of the Houston cable systems.

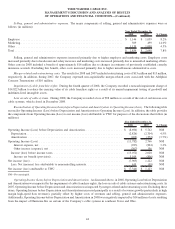

Income tax benefit (provision). TWC’s income tax benefit (provision) has been prepared as if the Company operated as a

stand-alone taxpayer for all periods presented. In 2008, the Company recorded an income tax benefit of $5.109 billion and, in 2007, the

Company recorded an income tax provision of $806 million. The effective tax rate was 39.1% in 2008, which included the impacts of the

impairment of cable franchise rights and the loss on sale of cable systems, as compared to 39.7% in 2007. Absent these items, the

effective tax rate for 2008 would have been 44.2%. The increase in the Company’s effective tax rate for 2008 (excluding the impairment

of cable franchise rights and the loss on sale of cable systems) was primarily due to the tax impact of the 2008 impairment charge on the

Company’s investment in Clearwire Communications LLC, as discussed above.

Net (income) loss attributable to noncontrolling interests. Net loss attributable to noncontrolling interests in 2008 included the

impacts of the impairment of cable franchise rights and the loss on sale of cable systems, as discussed above. Excluding these items, net

income attributable to noncontrolling interests increased primarily due to larger profits recorded by TW NY during 2008.

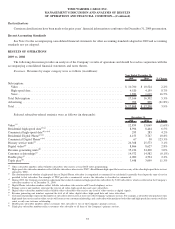

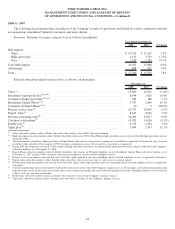

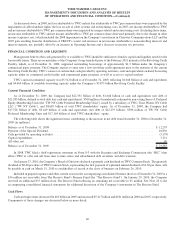

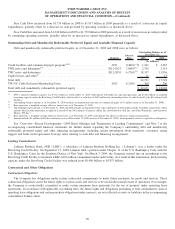

Net income (loss) attributable to TWC and net income (loss) attributable to TWC per common share. Net income (loss) attributable

to TWC and net income (loss) attributable to TWC per common share were as follows for 2008 and 2007 (in millions, except per share

data):

2008 2007 % Change

Year Ended December 31,

Net income (loss) attributable to TWC ....................................... $ (7,344) $ 1,123 NM

Net income (loss) attributable to TWC per common share:

Basic .............................................................. $ (22.55) $ 3.45 NM

Diluted ............................................................. $ (22.55) $ 3.45 NM

NM—Not meaningful.

45

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)