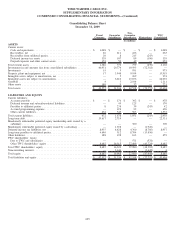

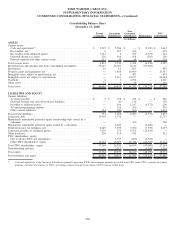

Time Warner Cable 2009 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2009 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

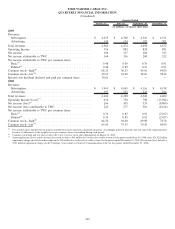

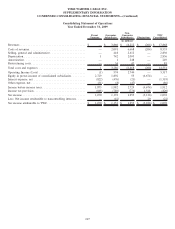

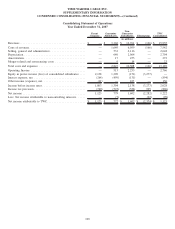

Consolidating Statement of Operations

Year Ended December 31, 2009

Parent

Company

Guarantor

Subsidiaries

Non-

Guarantor

Subsidiaries Eliminations

TWC

Consolidated

(in millions)

Revenues ......................................... $ — $ 3,860 $ 14,212 $ (204) $ 17,868

Costs of revenues................................... — 2,091 6,668 (204) 8,555

Selling, general and administrative ...................... — 418 2,412 — 2,830

Depreciation . . . ................................... 1 742 2,093 — 2,836

Amortization . . . ................................... — 1 248 — 249

Restructuring costs.................................. — 34 47 — 81

Total costs and expenses ............................. 1 3,286 11,468 (204) 14,551

Operating Income (Loss) ............................. (1) 574 2,744 — 3,317

Equity in pretax income of consolidated subsidiaries ......... 2,729 1,892 53 (4,674) —

Interest expense, net ................................ (822) (476) (21) — (1,319)

Other expense, net .................................. (31) (8) (47) — (86)

Income before income taxes ........................... 1,875 1,982 2,729 (4,674) 1,912

Income tax provision ................................ (805) (789) (774) 1,548 (820)

Net income ....................................... 1,070 1,193 1,955 (3,126) 1,092

Less: Net income attributable to noncontrolling interests ...... — (42) — 20 (22)

Net income attributable to TWC........................ $ 1,070 $ 1,151 $ 1,955 $ (3,106) $ 1,070

107

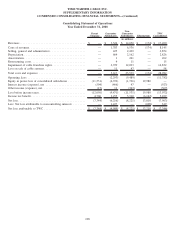

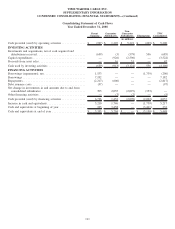

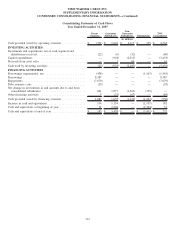

TIME WARNER CABLE INC.

SUPPLEMENTARY INFORMATION

CONDENSED CONSOLIDATING FINANCIAL STATEMENTS—(Continued)