Time Warner Cable 2009 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2009 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.statements were issued or the date the consolidated financial statements were available to be issued. This guidance became effective for

TWC on April 1, 2009, is being applied prospectively beginning in the second quarter of 2009 and did not have a material impact on the

Company’s consolidated financial statements.

Accounting Standards Not Yet Adopted

Consolidation of Variable Interest Entities

In June 2009, the FASB issued authoritative guidance that requires an enterprise to perform an analysis to determine whether the

enterprise’s variable interest or interests give it a controlling financial interest in a variable interest entity. This analysis identifies the

primary beneficiary of a variable interest entity as the enterprise that has both of the following characteristics, among others: (a) the

power to direct the activities of a variable interest entity that most significantly impact the entity’s economic performance and (b) the

obligation to absorb losses of the entity, or the right to receive benefits from the entity, that could potentially be significant to the variable

interest entity. Under this guidance, ongoing reassessments of whether an enterprise is the primary beneficiary of a variable interest entity

are required. This guidance will be effective for TWC on January 1, 2010 and is not expected to have a material impact on the Company’s

consolidated financial statements.

Accounting for Revenue Arrangements with Multiple Deliverables

In September 2009, the FASB issued authoritative guidance that provides for a new methodology for establishing the fair value for a

deliverable in a multiple-element arrangement. When vendor specific objective or third-party evidence for deliverables in a multiple-

element arrangement cannot be determined, an enterprise is required to develop a best estimate of the selling price of separate

deliverables and to allocate the arrangement consideration using the relative selling price method. This guidance will be effective for

TWC on January 1, 2011 and is not expected to have a material impact on the Company’s consolidated financial statements.

Accounting for Revenue Arrangements with Software Elements

In September 2009, the FASB issued authoritative guidance that provides for a new methodology for recognizing revenue for

tangible products that are bundled with software products. Under the new guidance, tangible products that are bundled with software

components that are essential to the functionality of the tangible product will no longer be accounted for under the software revenue

recognition accounting guidance. Rather, such products will be accounted for under the new authoritative guidance surrounding

multiple-element arrangements described above. This guidance will be effective for TWC on January 1, 2011 and is not expected to have

a material impact on the Company’s consolidated financial statements.

Fair Value Measurements and Disclosures

In January 2010, the FASB issued authoritative guidance that expands the required disclosures about fair value measurements. This

guidance provides for new disclosures requiring the Company to (i) disclose separately the amounts of significant transfers in and out of

Level 1 and Level 2 fair value measurements and describe the reasons for the transfers and (ii) present separately information about

purchases, sales, issuances and settlements in the reconciliation of Level 3 fair value measurements. This guidance also provides

clarification of existing disclosures requiring the Company to (i) determine each class of assets and liabilities based on the nature and

risks of the investments rather than by major security type and (ii) for each class of assets and liabilities, disclose the valuation techniques

and inputs used to measure fair value for both Level 2 and Level 3 fair value measurements. This guidance will be effective for TWC on

January 1, 2010, except for the presentation of purchases, sales, issuances and settlements in the reconciliation of Level 3 fair value

measurements, which is effective for TWC on January 1, 2011. This guidance is not expected to have a material impact on the Company’s

consolidated financial statements.

3. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Cash and Equivalents

Cash and equivalents include money market funds, overnight deposits and other investments that are readily convertible into cash

and have original maturities of three months or less. Cash equivalents are carried at cost, which approximates fair value.

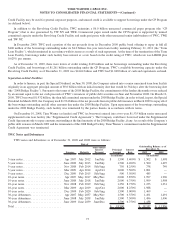

Accounts Receivable

Accounts receivable are recorded at net realizable value. The Company maintains an allowance for doubtful accounts, which is

determined after considering past collection experience, aging of accounts receivable, general economic factors and other considerations.

63

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)