Time Warner Cable 2009 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2009 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

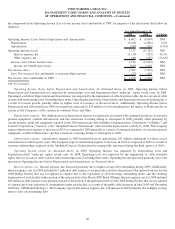

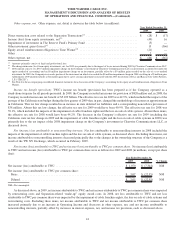

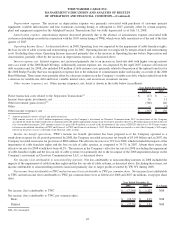

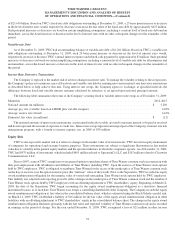

As discussed above, in 2008, net loss attributable to TWC and net loss attributable to TWC per common share were impacted by the

impairment of cable franchise rights, the loss on sale of cable systems and restructuring costs. In 2007, net income attributable to TWC

and net income attributable to TWC per common share were impacted by merger-related and restructuring costs. Excluding these items,

net income attributable to TWC and net income attributable to TWC per common share decreased primarily due to the change in other

income (expense), net, (which included the 2008 impairment on the Company’s investment in Clearwire Communications LLC and the

2007 gain resulting from the distribution of TKCCP’s assets) and increases in net income attributable to noncontrolling interests and

interest expense, net, partially offset by an increase in Operating Income and a decrease in income tax provision.

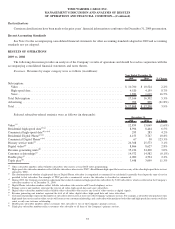

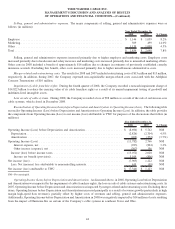

FINANCIAL CONDITION AND LIQUIDITY

Management believes that cash generated by or available to TWC should be sufficient to fund its capital and liquidity needs for the

foreseeable future. There are no maturities of the Company’s long-term debt prior to the February 2011 maturity of the Revolving Credit

Facility, which, as of December 31, 2009, supported outstanding borrowings of approximately $1.3 billion under the Company’s

commercial paper program. The Company expects to enter into a new revolving credit agreement prior to the maturity of the current

Revolving Credit Facility. TWC’s sources of cash include cash provided by operating activities, cash and equivalents on hand, borrowing

capacity under its committed credit facility and commercial paper program, as well as access to capital markets.

TWC’s unused committed capacity was $5.512 billion as of December 31, 2009, reflecting $1.048 billion of cash and equivalents

and $4.464 billion of available borrowing capacity under the Company’s $5.875 billion Revolving Credit Facility.

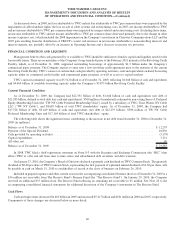

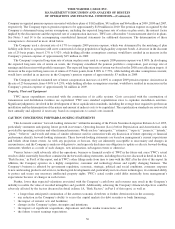

Current Financial Condition

As of December 31, 2009, the Company had $22.331 billion of debt, $1.048 billion of cash and equivalents (net debt of

$21.283 billion, defined as total debt less cash and equivalents), $300 million of mandatorily redeemable non-voting Series A Preferred

Equity Membership Units (the “TW NY Cable Preferred Membership Units”) issued by a subsidiary of TWC, Time Warner NY Cable

LLC (“TW NY Cable”), and $8.685 billion of total TWC shareholders’ equity. As of December 31, 2008, the Company had

$17.728 billion of debt, $5.449 billion of cash and equivalents (net debt of $12.279 billion), $300 million of TW NY Cable

Preferred Membership Units and $17.164 billion of total TWC shareholders’ equity.

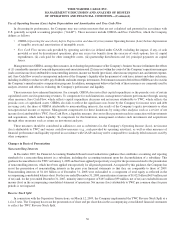

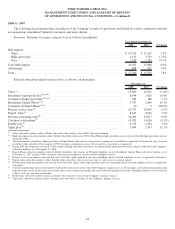

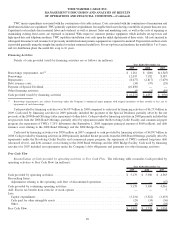

The following table shows the significant items contributing to the increase in net debt from December 31, 2008 to December 31,

2009 (in millions):

Balance as of December 31, 2008 ................................................................ $ 12,279

Payment of the Special Dividend ................................................................. 10,856

Cash provided by operating activities .............................................................. (5,179)

Capital expenditures .......................................................................... 3,231

All other, net ................................................................................ 96

Balance as of December 31, 2009 ................................................................ $ 21,283

In 2008, TWC filed a shelf registration statement on Form S-3 with the Securities and Exchange Commission (the “SEC”) that

allows TWC to offer and sell from time to time senior and subordinated debt securities and debt warrants.

On January 27, 2010, the Company’s Board of Directors declared a quarterly cash dividend on TWC Common Stock. The quarterly

dividend of $0.40 per share of TWC Common Stock, representing the first payment of a planned annual dividend of $1.60 per share, will

be payable in cash on March 15, 2010 to stockholders of record at the close of business on February 26, 2010.

Included in prepaid expenses and other current assets in the accompanying consolidated balance sheet as of December 31, 2009 is a

$34 million net receivable from The Reserve Fund’s Primary Fund (the “The Reserve Fund”). On January 29, 2010, the Company

received an additional $33 million from The Reserve Fund reducing its remaining net receivable to $1 million. See Note 18 to the

accompanying consolidated financial statements for additional discussion of the Company’s investment in The Reserve Fund.

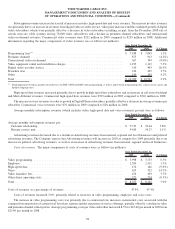

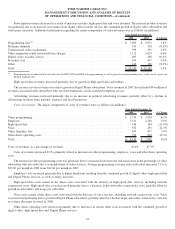

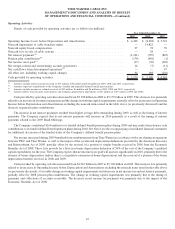

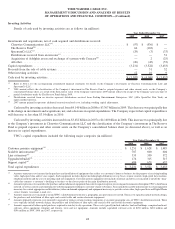

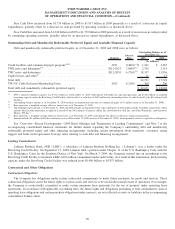

Cash Flows

Cash and equivalents decreased $4.401 billion in 2009 and increased $5.217 billion and $181 million in 2008 and 2007, respectively.

Components of these changes are discussed below in more detail.

46

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)