Time Warner Cable 2009 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2009 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• Carefully managed our operating

and capital expenses and generated

free cash flow of over $1.9 billion

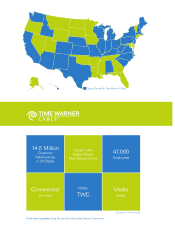

• Grew primary service units (PSUs),

which are total video, high-speed data

and digital phone subscribers, by

nearly 800,000 to 26.4 million

• Added 562,000 high-speed data

customers and introduced our

Wideband DOCSIS 3.0 broad-

band service

• Increased digital phone subscribers

by nearly 12% and continued to take

share away from the traditional

phone companies

• Launched our 4G wireless broadband

service, Road Runner MobileTM

• Significantly increased the number of

high-definition channels available to

our customers (to more than 100 HD

channels in many of our service areas)

• Expanded availability of our popular

network DVR-based Start Over

service to about 80% of our digital

video subscribers

Although our media sales business

suffered from the overall advertising

downturn, we’re confident that adver-

tising revenues will return to growth

in 2010, in part from expected robust

political ad spending in advance of

the mid-term elections.

On the competitive front, we continued

to compete strongly against satellite TV

and the traditional phone companies’

new video services in 2009, even as the

telcos continued expanding availability

of their services in our footprint.

Returning Capital to

Stockholders

In March 2010, we paid our first quarterly

cash dividend of $0.40 per share of com-

mon stock. It makes a strong statement

about our confidence in our company.

The dividend provides a significant

yield to investors while leaving the

company the flexibility to invest in

organic growth and consider new

business opportunities and other ways

of returning capital to stockholders

over time.

Product Enhancements

A big focus for us in 2010, as always,

is to continue enhancing our products

to meet our customers’ needs and

compete effectively. Building on last

year’s accomplishments, our focus on

A big focus for us in 2010, as always,

is to continue enhancing our products

to meet our customers’ needs and

compete effectively.

TIME WARNER CABLE 2009 ANNUAL REPORT 3

Our consistency and focus in the face of unprecedented

challenges in 2009 reinforced our belief that we operate

in a great industry and that Time Warner Cable is a

fundamentally strong company.