Time Warner Cable 2009 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2009 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

were issued and outstanding, and no shares of preferred stock had been issued. As discussed more fully in Note 4, in connection with the

Recapitalization, on March 12, 2009, each share of the Company’s Class A and Class B common stock was automatically converted into

a single share of TWC Common Stock.

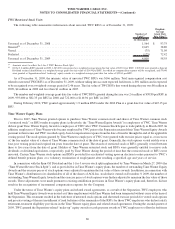

Common Stock Dividend

On January 27, 2010, the Company’s Board of Directors declared a quarterly cash dividend on TWC Common Stock. The quarterly

dividend of $0.40 per share of TWC Common Stock, representing the first payment of a planned annual dividend of $1.60 per share, will

be payable in cash on March 15, 2010 to stockholders of record at the close of business on February 26, 2010.

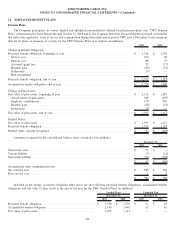

17. COMMITMENTS AND CONTINGENCIES

Prior to the restructuring of TWE, which was completed in March 2003 (the “TWE Restructuring”), TWE had various contingent

commitments, including guarantees, related to the TWE non-cable businesses. In connection with the TWE Restructuring, some of these

commitments were not transferred with their applicable non-cable business and they remain contingent commitments of TWE. Time

Warner and its subsidiary, WCI, have agreed, on a joint and several basis, to indemnify TWE from and against any and all of these

contingent liabilities, but TWE remains a party to these commitments.

TWC has cable franchise agreements containing provisions requiring the construction of cable plant and the provision of services to

customers within the franchise areas. In connection with these obligations under existing franchise agreements, TWC obtains surety

bonds or letters of credit guaranteeing performance to municipalities and public utilities and payment of insurance premiums. Such

surety bonds and letters of credit as of December 31, 2009 and 2008 totaled $313 million and $288 million, respectively. Payments under

these arrangements are required only in the event of nonperformance. TWC does not expect that these contingent commitments will

result in any amounts being paid in the foreseeable future.

Contractual Obligations

The Company has obligations under certain contractual arrangements to make future payments for goods and services. These

contractual obligations secure the future rights to various assets and services to be used in the normal course of operations. For example,

the Company is contractually committed to make certain minimum lease payments for the use of property under operating lease

agreements. In accordance with applicable accounting rules, the future rights and obligations pertaining to firm commitments, such as

operating lease obligations and certain purchase obligations under contracts, are not reflected as assets or liabilities in the consolidated

balance sheet.

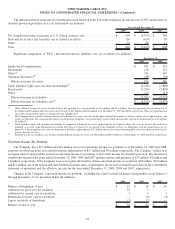

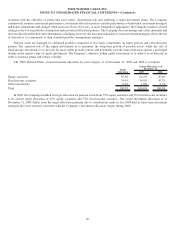

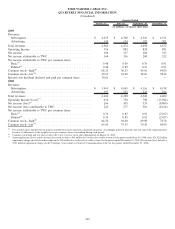

The following table summarizes the Company’s aggregate contractual obligations as of December 31, 2009, excluding obligations

related to long-term debt and preferred equity that are discussed in Note 7, and the estimated timing and effect that such obligations are

expected to have on the Company’s liquidity and cash flows in future periods (in millions):

2010

2011-

2012

2013-

2014

2015 and

thereafter Total

Year Ended December 31,

Programming purchases

(a)

............................. $ 3,339 $ 5,697 $ 4,235 $ 2,538 $ 15,809

Digital Phone connectivity

(b)

........................... 536 631 151 — 1,318

Facility leases

(c)

.................................... 115 208 166 389 878

Data processing services .............................. 50 88 7 — 145

High-speed data connectivity

(d)

......................... 39 14 4 20 77

Other ............................................ 46 34 11 71 162

Total ............................................ $ 4,125 $ 6,672 $ 4,574 $ 3,018 $ 18,389

(a)

Programming purchases represent contracts that the Company has with cable television networks and broadcast stations to provide programming services to its

subscribers. There is generally no obligation to purchase these services if the Company is not providing video services. Programming fees represent a significant

portion of its costs of revenues. Future fees under such contracts are based on numerous variables, including number and type of customers. The amounts included

above represent estimates of future programming costs based on subscriber numbers as of December 31, 2009 applied to the per-subscriber contractual rates

contained in contracts for which the Company does not have the right to cancel the contract or for contracts with a guaranteed minimum commitment.

(b)

Digital Phone connectivity obligations relate to transport, switching and interconnection services that allow for the origination and termination of local and

long-distance telephony traffic. These expenses also include related technical support services. There is generally no obligation to purchase these services if the

Company is not providing Digital Phone service. The amounts included above are generally based on the number of Digital Phone subscribers as of December 31,

2009 and the per-subscriber contractual rates contained in the contracts that were in effect as of December 31, 2009.

(c)

The Company has facility lease obligations under various operating leases including minimum lease obligations for real estate and operating equipment.

(d)

High-speed data connectivity obligations are based on the contractual terms for bandwidth circuits that were in use as of December 31, 2009.

93

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)