Time Warner Cable 2009 Annual Report Download - page 68

Download and view the complete annual report

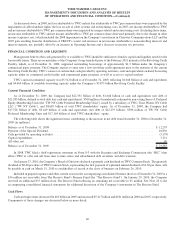

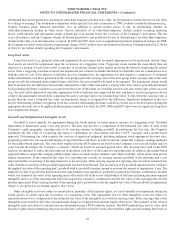

Please find page 68 of the 2009 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Company recognized pension expense associated with these plans of $162 million, $91 million and $64 million in 2009, 2008 and 2007,

respectively. The Company expects pension expense to be approximately $130 million in 2010. The pension expense recognized by the

Company is determined using certain assumptions, including the expected long-term rate of return on plan assets, the interest factor

implied by the discount rate and the expected rate of compensation increases. TWC uses a December 31 measurement date for its plans.

See Notes 3 and 14 to the accompanying consolidated financial statements for additional discussion. The determination of these

assumptions is discussed in more detail below.

The Company used a discount rate of 6.17% to compute 2009 pension expense, which was determined by the matching of plan

liability cash flows to a pension yield curve constructed of a large population of high-quality corporate bonds. A decrease in the discount

rate of 25 basis points, from 6.17% to 5.92%, while holding all other assumptions constant, would have resulted in an increase in the

Company’s pension expense of approximately $15 million in 2009.

The Company’s expected long-term rate of return on plan assets used to compute 2009 pension expense was 8.00%. In developing

the expected long-term rate of return on assets, the Company considered the pension portfolio’s composition, past average rate of

earnings and discussions with portfolio managers. The expected long-term rate of return was based on the 2008 asset allocation targets. A

decrease in the expected long-term rate of return of 25 basis points, from 8.00% to 7.75%, while holding all other assumptions constant,

would have resulted in an increase in the Company’s pension expense of approximately $3 million in 2009.

The Company used an estimated rate of future compensation increases of 4.00% to compute 2009 pension expense. An increase in

the rate of 25 basis points, from 4.00% to 4.25%, while holding all other assumptions constant, would have resulted in an increase in the

Company’s pension expense of approximately $4 million in 2009.

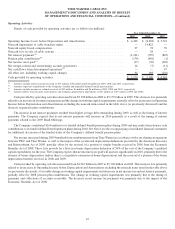

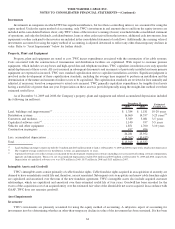

Property, Plant and Equipment

TWC incurs expenditures associated with the construction of its cable systems. Costs associated with the construction of

transmission and distribution facilities are capitalized. TWC uses standard capitalization rates to capitalize installation activities.

Significant judgment is involved in the development of these capitalization standards, including the average time required to perform an

installation and the determination of the nature and amount of indirect costs to be capitalized. The capitalization standards are reviewed at

least annually and adjusted, if necessary, based on comparisons to actual costs incurred.

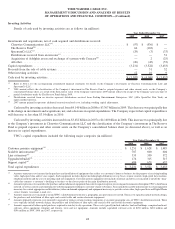

CAUTION CONCERNING FORWARD-LOOKING STATEMENTS

This document contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995,

particularly statements anticipating future growth in revenues, Operating Income (Loss) before Depreciation and Amortization, cash

provided by operating activities and other financial measures. Words such as “anticipates,” “estimates,” “expects,” “projects,” “intends,”

“plans,” “believes” and words and terms of similar substance used in connection with any discussion of future operating or financial

performance identify forward-looking statements. These forward-looking statements are based on management’s current expectations

and beliefs about future events. As with any projection or forecast, they are inherently susceptible to uncertainty and changes in

circumstances, and the Company is under no obligation to, and expressly disclaims any obligation to, update or alter its forward-looking

statements whether as a result of such changes, new information, subsequent events or otherwise.

Various factors could adversely affect the operations, business or financial results of TWC in the future and cause TWC’s actual

results to differ materially from those contained in the forward-looking statements, including those factors discussed in detail in Item 1A,

“Risk Factors,” in Part I of this report, and in TWC’s other filings made from time to time with the SEC after the date of this report. In

addition, the Company operates in a highly competitive, consumer and technology-driven and rapidly changing business. The

Company’s business is affected by government regulation, economic, strategic, political and social conditions, consumer response

to new and existing products and services, technological developments and, particularly in view of new technologies, its continued ability

to protect and secure any necessary intellectual property rights. TWC’s actual results could differ materially from management’s

expectations because of changes in such factors.

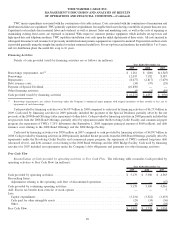

Further, lower than expected valuations associated with the Company’s cash flows and revenues may result in the Company’s

inability to realize the value of recorded intangibles and goodwill. Additionally, achieving the Company’s financial objectives could be

adversely affected by the factors discussed in detail in Item 1A, “Risk Factors,” in Part I of this report, as well as:

• a longer than anticipated continuation of the current economic slowdown or further deterioration in the economy;

• any reduction in the Company’s ability to access the capital markets for debt securities or bank financings;

• the impact of terrorist acts and hostilities;

• changes in the Company’s plans, strategies and intentions;

• the impacts of significant acquisitions, dispositions and other similar transactions; and

• the failure to meet earnings expectations.

56

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)