Time Warner Cable 2009 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2009 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

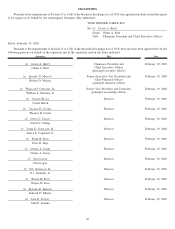

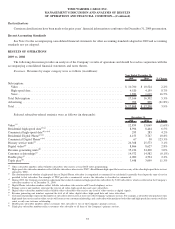

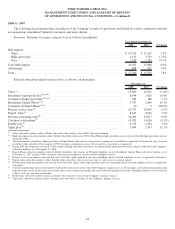

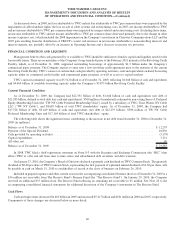

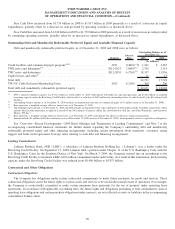

the components from Operating Income (Loss) to net income (loss) attributable to TWC for purposes of the discussions that follow (in

millions):

2009 2008 % Change

Year Ended December 31,

Operating Income (Loss) before Depreciation and Amortization ....................... $ 6,402 $ (8,694) NM

Depreciation ........................................................... (2,836) (2,826) 0.4%

Amortization .......................................................... (249) (262) (5.0%)

Operating Income (Loss) ................................................... 3,317 (11,782) NM

Interest expense, net ................................................... (1,319) (923) 42.9%

Other expense, net .................................................... (86) (367) (76.6%)

Income (loss) before income taxes........................................... 1,912 (13,072) NM

Income tax benefit (provision) ............................................ (820) 5,109 NM

Net income (loss) ......................................................... 1,092 (7,963) NM

Less: Net (income) loss attributable to noncontrolling interests ...................... (22) 619 NM

Net income (loss) attributable to TWC ......................................... $ 1,070 $ (7,344) NM

NM—Not meaningful.

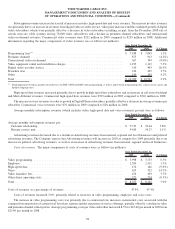

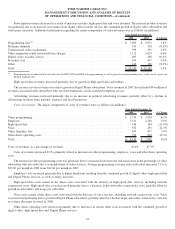

Operating Income (Loss) before Depreciation and Amortization. As discussed above, in 2009, Operating Income before

Depreciation and Amortization was impacted by restructuring costs and Separation-related “make-up” equity award costs. In 2008,

Operating Loss before Depreciation and Amortization was impacted by the impairment of cable franchise rights, the loss on sale of cable

systems and restructuring costs. Excluding these items, Operating Income before Depreciation and Amortization increased principally as

a result of revenue growth, partially offset by higher costs of revenues, as discussed above. Additionally, Operating Income before

Depreciation and Amortization in 2008 was negatively impacted by $14 million of costs resulting from the impact of Hurricane Ike on

certain of the Company’s cable systems in southeast Texas and Ohio.

Depreciation expense. The slight increase in depreciation expense was primarily associated with continued purchases of customer

premise equipment, scalable infrastructure and line extensions occurring during or subsequent to 2008, partially offset primarily by

certain property, plant and equipment acquired in the 2006 transactions with Adelphia Communications Corporation (“Adelphia”) and

Comcast Corporation (“Comcast”) (the “Adelphia/Comcast Transactions”) that was fully depreciated as of July 31, 2008. The Company

expects depreciation expense to increase in 2010 as compared to 2009 primarily as a result of continued purchases of customer premise

equipment, scalable infrastructure and line extensions occurring during or subsequent to 2009.

Amortization expense. Amortization expense in 2009 benefited from an approximate $13 million adjustment to reduce excess

amortization recorded in prior years. The Company expects amortization expense to decrease in 2010 as compared to 2009 as a result of

customer relationships acquired in the Adelphia/Comcast Transactions becoming fully amortized during the third quarter of 2010.

Operating Income (Loss). As discussed above, in 2009, Operating Income was impacted by restructuring costs and

Separation-related “make-up” equity award costs. In 2008, Operating Loss was impacted by the impairment of cable franchise

rights, the loss on sale of cable systems and restructuring costs. Excluding these items, Operating Income increased primarily due to the

increase in Operating Income before Depreciation and Amortization, as discussed above.

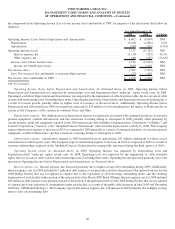

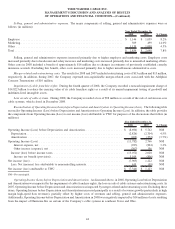

Interest expense, net. Interest expense, net, increased primarily due to higher average debt outstanding during 2009. Additionally,

interest expense, net, for 2009 included $13 million of debt issuance costs primarily related to the portion of the upfront loan fees for the

2008 Bridge Facility that was recognized as expense due to the repayment of all borrowings outstanding under, and the resulting

termination of, such facility with a portion of the net proceeds of the March 2009 Bond Offering. Interest expense, net, for 2008 included

$45 million of debt issuance costs primarily related to the portion of the upfront loan fees for the 2008 Bridge Facility that was recognized

as expense due to the reduction of commitments under such facility as a result of the public debt issuances in June 2008 and November

2008 (the “2008 Bond Offerings”). The Company expects that interest expense, net, will increase in 2010 primarily due to higher average

interest rates on outstanding debt.

40

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)