Time Warner Cable 2009 Annual Report Download - page 96

Download and view the complete annual report

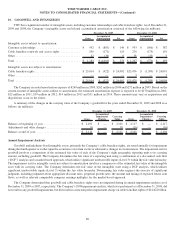

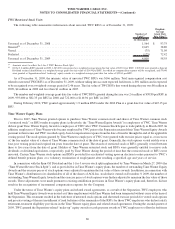

Please find page 96 of the 2009 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Company does not currently anticipate that its existing reserves related to uncertain income tax positions as of December 31,

2009 will significantly increase or decrease during the twelve-month period ending December 31, 2010; however, various events could

cause the Company’s current expectations to change in the future.

In August 2009, the Internal Revenue Service (“IRS”) examination of the Company’s income tax returns for the period 2002 to 2004

was settled, with the exception of an immaterial item subject to an ongoing examination. The resolution of these items did not have a

material impact on the Company’s consolidated financial position or results of operations. In December 2009, the IRS examination for

the period 2005 to 2007 began. The Company does not anticipate that this examination will have a material impact on the Company’s

consolidated financial position or results of operations. In addition, the Company is also subject to ongoing examinations of the

Company’s tax returns by state and local tax authorities for various periods. Activity related to these state and local examinations did not

have a material impact on the Company’s consolidated financial position or results of operations in 2009, nor does the Company

anticipate a material impact in the future.

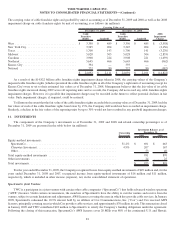

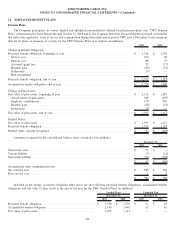

13. EQUITY-BASED COMPENSATION

TWC Equity Plan

The Company has granted options to purchase TWC Common Stock and restricted stock units (“RSUs”) to its employees and

non-employee directors under the Time Warner Cable Inc. 2006 Stock Incentive Plan (the “2006 Plan”).

In connection with the Separation, the 2006 Plan was amended, among other things, to increase the number of shares of TWC

Common Stock authorized for issuance thereunder by 18.0 million shares. As a result, the Company is authorized to issue up to

51.3 million shares of TWC Common Stock under the 2006 Plan (which also reflects certain Separation-related adjustments effected

pursuant to the 2006 Plan and the 1-for-3 TWC Reverse Stock Split).

Stock options granted under the 2006 Plan have exercise prices equal to the fair market value of TWC Common Stock at the date of

grant. Generally, the stock options vest ratably over a four-year vesting period and expire ten years from the date of grant. Certain stock

option awards provide for accelerated vesting upon the grantee’s termination of employment after reaching a specified age and years of

service. In connection with the payment of the Special Dividend and the TWC Reverse Stock Split, adjustments were made to the number

of shares covered by and exercise prices of outstanding TWC stock options to maintain the fair value of those awards. These adjustments

were made pursuant to existing antidilution provisions in the 2006 Plan and related award agreements and, therefore, did not result in the

recognition of incremental compensation expense. Refer to “Separation-related Equity Awards” below for further details.

The RSUs granted under the 2006 Plan generally vest 50% on the third anniversary of the grant date and 50% on the fourth

anniversary. RSUs provide for accelerated vesting upon the grantee’s termination of employment after reaching a specified age and years

of service. Shares of TWC Common Stock will generally be issued at the end of the vesting period of an RSU. RSUs awarded to

non-employee directors are not subject to vesting or forfeiture restrictions and the shares underlying the RSUs will generally be issued in

connection with a director’s termination of service as a director. Holders of RSUs are generally entitled to receive dividend equivalents or

retained distributions related to regular dividends or distributions, respectively, paid by TWC. Refer to “Separation-related Equity

Awards” below for further details.

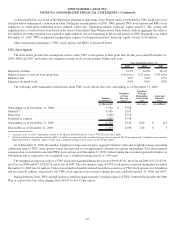

Upon the exercise of a TWC stock option or the vesting of a TWC RSU award, shares of TWC Common Stock may be issued from

authorized but unissued shares or from treasury stock, if any.

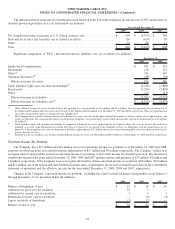

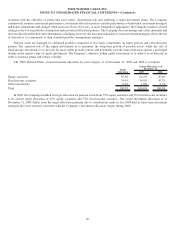

Separation-related Equity Awards

In connection with the Special Dividend, holders of TWC RSUs could elect to receive the retained distribution on their TWC RSUs

related to the Special Dividend (the “Special Dividend retained distribution”) in the form of cash (payable, without interest, upon vesting

of the underlying RSUs) or in the form of additional RSUs (with the same vesting dates as the underlying RSUs). In connection with these

elections and in conjunction with the payment of the Special Dividend, during the first quarter of 2009, the Company (a) granted

1.3 million RSUs and (b) established a liability of $46 million in other liabilities and TWC shareholders’ equity in the consolidated

balance sheet for the Special Dividend retained distribution to be paid in cash, taking into account estimated forfeitures. In addition, in

connection with the 1-for-3 TWC Reverse Stock Split, pursuant to the 2006 Plan and related award agreements, adjustments were made

to reduce the number of outstanding RSUs. Neither the payment of the Special Dividend retained distribution (in cash or additional

RSUs) nor the adjustment to reflect the 1-for-3 TWC Reverse Stock Split results in the recognition of incremental compensation expense.

During the year ended December 31, 2009, the Company made cash payments of $1 million against the Special Dividend retained

distribution liability, which is included in other financing activities in the consolidated statement of cash flows. Of the remaining

$45 million liability, $5 million is classified as a current liability in other current liabilities, with the remaining $40 million classified as a

noncurrent liability in other liabilities in the consolidated balance sheet as of December 31, 2009.

84

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)