Time Warner Cable 2009 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2009 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

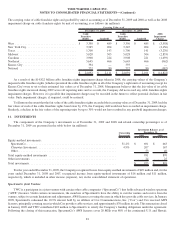

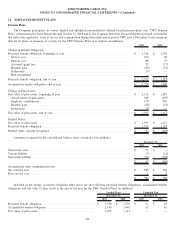

The following table sets forth the TWC Pension Plan investment assets of $1.592 billion, which exclude accrued investment income

of $5 million and accrued liabilities of $2 million, by level within the fair value hierarchy as of December 31, 2009 (in millions):

Fair Value

as of

December 31,

2009

Quoted Prices in

Active Markets

for Identical

Assets

(Level 1)

Significant

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Common stocks

(a)

........................................ $ 921 $ 921 $ — $ —

Commingled equity funds

(b)

................................ 100 — 100 —

Other equity securities

(c)

................................... 2 2 — —

Corporate debt securities

(d)

................................. 158 — 158 —

Collective trust funds

(e)

.................................... 143 — 143 —

Commingled bond funds

(b)

................................. 89 — 89 —

U.S. Treasury debt securities

(a)

.............................. 87 87 — —

Corporate asset-backed debt securities

(f)

....................... 40 — 40 —

U.S. government asset-backed debt securities

(g)

.................. 19 — 19 —

Other fixed-income securities

(h)

.............................. 4 — 4 —

Other investments

(i)

...................................... 29 — — 29

Total investment assets .................................... $ 1,592 $ 1,010 $ 553 $ 29

(a)

Common stocks and U.S. Treasury debt securities are valued at the closing price reported on the active market on which the individual securities are traded.

(b)

Commingled equity funds and commingled bond funds are valued using the net asset value provided by the administrator of the fund. The net asset value is based on

the value of the underlying assets owned by the fund, less liabilities, and then divided by the number of units outstanding.

(c)

Other equity securities consist of real estate investment trusts and preferred stocks, which are valued at the closing price reported on the active market on which the

individual securities are traded.

(d)

Corporate debt securities are valued based on observable prices from the new issue market, benchmark quotes, secondary trading and dealer quotes. An option adjusted

spread model is incorporated to adjust spreads of issues that have early redemption features and final spreads are added to the U.S. Treasury curve.

(e)

Collective trust funds primarily consist of short-term investment strategies comprised of instruments issued or fully guaranteed by the U.S. government and/or its

agencies and are valued using the net asset value provided by the administrator of the fund. The net asset value is based on the value of the underlying assets owned by

the fund, less liabilities, and then divided by the number of units outstanding.

(f)

Corporate asset-backed debt securities primarily consist of pass-through mortgage-backed securities issued by U.S. and foreign corporations valued using available

trade information, dealer quotes, market color (including indices and market research reports), spreads, bids and offers.

(g)

U.S. government asset-backed debt securities consist of pass-through mortgage-backed securities issued by the Federal Home Loan Mortgage Corporation and the

Federal National Mortgage Association valued using available trade information, dealer quotes, market color (including indices and market research reports), spreads,

bids and offers.

(h)

Other fixed-income securities consist of foreign government debt securities and U.S. government agency debt securities, which are valued based on observable prices

from the new issue market, benchmark quotes, secondary trading and dealer quotes. An option adjusted spread model is incorporated to adjust spreads of issues that

have early redemption features and final spreads are added to the U.S. Treasury curve.

(i)

Other investments primarily consist of private equity investments, such as those in limited partnerships that invest in operating companies that are not publicly traded

on a stock exchange, and hedge funds. Private equity investments are valued using inputs such as trading multiples of comparable public securities, merger and

acquisition activity and pricing data from the most recent equity financing taking into consideration illiquidity. Hedge funds are valued using the net asset value

provided by the administrator of the fund, which is based on the value of the underlying assets owned by the fund, less liabilities, and then divided by the number of

units outstanding.

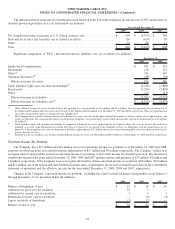

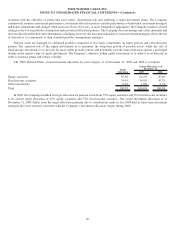

The change in the fair value of investment assets valued using significant unobservable inputs (Level 3) was due to the following (in

millions):

Balance as of December 31, 2008 .............................................................. $ 29

Purchases, issuances and settlements ............................................................ 2

Actual return on plan assets still held at December 31, 2009 . . . ........................................ 2

Transfer out of Level 3 ...................................................................... (4)

Balance as of December 31, 2009 .............................................................. $ 29

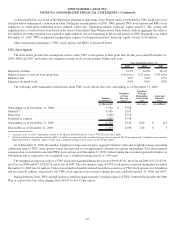

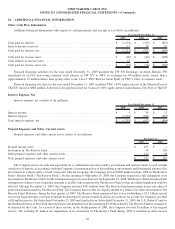

Expected Cash Flows

After considering the funded status of the TWC Pension Plans, movements in the discount rate, investment performance and related

tax consequences, the Company may choose to make contributions to the TWC Pension Plans in any given year. As of December 31,

2009, there were no minimum required contributions for the Company’s funded plans. The Company contributed $160 million to its

funded defined benefit pension plans during 2009 and may make discretionary cash contributions to these plans in 2010. For the

Company’s unfunded plan, contributions will continue to be made to the extent benefits are paid. Benefit payments for the unfunded plan

are expected to be $3 million in 2010.

91

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)