Time Warner Cable 2009 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2009 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Credit Facility may be used for general corporate purposes, and unused credit is available to support borrowings under the CP Program

(as defined below).

In addition to the Revolving Credit Facility, TWC maintains a $6.0 billion unsecured commercial paper program (the “CP

Program”) that is also guaranteed by TW NY and TWE. Commercial paper issued under the CP Program is supported by unused

committed capacity under the Revolving Credit Facility and ranks pari passu with other unsecured senior indebtedness of TWC, TWE

and TW NY.

In December 2009, TWC used a portion of the net proceeds from its December 2009 public bond offering to repay in full all

$400 million of the borrowings outstanding under its $4.0 billion five-year term loan facility maturing February 21, 2011 (the “Term

Loan Facility”), which terminated in accordance with its terms as a result of such repayment. At the time of the termination of the Term

Loan Facility, borrowings under such facility bore interest at a rate based on the credit rating of TWC, which rate was LIBOR plus

0.625% per annum.

As of December 31, 2009, there were letters of credit totaling $149 million and no borrowings outstanding under the Revolving

Credit Facility, and borrowings of $1.261 billion outstanding under the CP Program. TWC’s available borrowing capacity under the

Revolving Credit Facility as of December 31, 2009 was $4.464 billion and TWC had $1.048 billion of cash and equivalents on hand.

Separation-related Facilities

In order to finance, in part, the Special Dividend, on June 30, 2008, the Company entered into a senior unsecured term loan facility

originally in an aggregate principal amount of $9.0 billion with an initial maturity date that would be 364 days after the borrowing date

(the “2008 Bridge Facility”). Pursuant to the terms of the 2008 Bridge Facility, the commitments of the lenders thereunder were reduced

by an amount equal to the net cash proceeds of TWC’s issuances of public debt securities in June and November 2008. On March 12,

2009, TWC borrowed $1.932 billion, the then full committed amount under the 2008 Bridge Facility, in order to fund, in part, the Special

Dividend. In March 2009, the Company used $1.934 billion of the net proceeds from its public debt issuance in March 2009 to repay all of

the borrowings outstanding and all other amounts due under the 2008 Bridge Facility. Upon repayment of the borrowings outstanding

under the 2008 Bridge Facility, such facility was terminated by the parties thereto in accordance with its terms.

On December 10, 2008, Time Warner (as lender) and TWC (as borrower) entered into a two-year $1.535 billion senior unsecured

supplemental term loan facility (the “Supplemental Credit Agreement”). The Company could have borrowed under the Supplemental

Credit Agreement only to repay amounts outstanding at the final maturity of the 2008 Bridge Facility, if any. As a result of the Company’s

public debt issuance in March 2009 and the termination of the 2008 Bridge Facility, Time Warner’s commitment under the Supplemental

Credit Agreement was terminated.

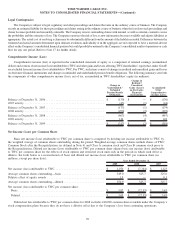

TWC Notes and Debentures

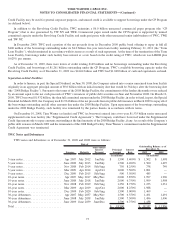

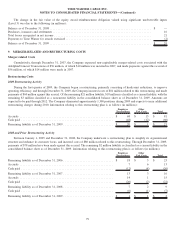

TWC notes and debentures as of December 31, 2009 and 2008 were as follows:

Issuance Maturity

Semi-annual

Interest

Payment

Principal

Amount

Interest

Rate 2009 2008

Outstanding Balance as of

December 31,

Date of

(in millions) (in millions)

5-year notes........................ Apr2007 July 2012 Jan/July $ 1,500 5.400% $ 1,502 $ 1,498

5-year notes........................ June 2008 July 2013 Jan/July 1,500 6.200% 1,500 1,497

5-year notes........................ Nov2008 Feb 2014 Feb/Aug 750 8.250% 738 749

5-year notes........................ Mar2009 Apr 2014 Apr/Oct 1,000 7.500% 1,001 —

5-year notes........................ Dec2009 Feb 2015 Feb/Aug 500 3.500% 485 —

10-year notes ....................... Apr2007 May 2017 May/Nov 2,000 5.850% 1,997 1,996

10-year notes ....................... June 2008 July 2018 Jan/July 2,000 6.750% 1,999 1,998

10-year notes ....................... Nov2008 Feb 2019 Feb/Aug 1,250 8.750% 1,233 1,231

10-year notes ....................... Mar2009 Apr 2019 Apr/Oct 2,000 8.250% 1,988 —

10-year notes ....................... Dec2009 Feb 2020 Feb/Aug 1,500 5.000% 1,469 —

30-year debentures. . . ................ Apr2007 May 2037 May/Nov 1,500 6.550% 1,491 1,491

30-year debentures. . . ................ June 2008 July 2038 Jan/July 1,500 7.300% 1,496 1,496

30-year debentures. . . ................ June 2009 June 2039 June/Dec 1,500 6.750% 1,458 —

Total ............................. $ 18,500 $ 18,357 $ 11,956

73

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)