Time Warner Cable 2009 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2009 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

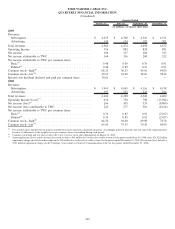

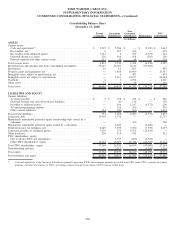

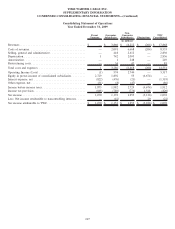

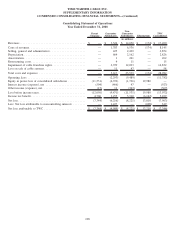

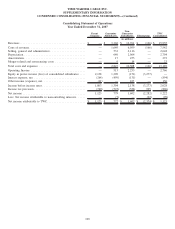

Consolidating Statement of Operations

Year Ended December 31, 2008

Parent

Company

Guarantor

Subsidiaries

Non-

Guarantor

Subsidiaries Eliminations

TWC

Consolidated

(in millions)

Revenues ......................................... $ — $ 3,324 $ 14,050 $ (174) $ 17,200

Costs of revenues................................... — 1,783 6,536 (174) 8,145

Selling, general and administrative ...................... — 425 2,429 — 2,854

Depreciation . . . ................................... — 664 2,162 — 2,826

Amortization . . . ................................... — 1 261 — 262

Restructuring costs.................................. — 4 11 — 15

Impairment of cable franchise rights ..................... — 2,729 12,093 — 14,822

Loss on sale of cable systems.......................... — 11 47 — 58

Total costs and expenses ............................. — 5,617 23,539 (174) 28,982

Operating Loss . ................................... — (2,293) (9,489) — (11,782)

Equity in pretax loss of consolidated subsidiaries ........... (11,531) (6,723) (1,726) 19,980 —

Interest income (expense), net ......................... (504) (466) 47 — (923)

Other income (expense), net ........................... (15) 11 (363) — (367)

Loss before income taxes ............................. (12,050) (9,471) (11,531) 19,980 (13,072)

Income tax benefit .................................. 4,706 3,255 3,310 (6,162) 5,109

Net loss .......................................... (7,344) (6,216) (8,221) 13,818 (7,963)

Less: Net loss attributable to noncontrolling interests ........ — 1,227 — (608) 619

Net loss attributable to TWC .......................... $ (7,344) $ (4,989) $ (8,221) $ 13,210 $ (7,344)

108

TIME WARNER CABLE INC.

SUPPLEMENTARY INFORMATION

CONDENSED CONSOLIDATING FINANCIAL STATEMENTS—(Continued)