Time Warner Cable 2009 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2009 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Investments

Investments in companies in which TWC has significant influence, but less than a controlling interest, are accounted for using the

equity method. Under the equity method of accounting, only TWC’s investment in and amounts due to and from the equity investee are

included in the consolidated balance sheet; only TWC’s share of the investee’s earnings (losses) is included in the consolidated statement

of operations; and only the dividends, cash distributions, loans or other cash received from the investee, additional cash investments, loan

repayments or other cash paid to the investee are included in the consolidated statement of cash flows. Additionally, the carrying value of

investments accounted for using the equity method of accounting is adjusted downward to reflect any other-than-temporary declines in

value. Refer to “Asset Impairments” below for further details.

Property, Plant and Equipment

Property, plant and equipment are stated at cost. TWC incurs expenditures associated with the construction of its cable systems.

Costs associated with the construction of transmission and distribution facilities are capitalized. With respect to customer premise

equipment, which includes set-top boxes and high-speed data and telephone modems, TWC capitalizes installation costs only upon the

initial deployment of these assets. All costs incurred in subsequent disconnects and reconnects of previously installed customer premise

equipment are expensed as incurred. TWC uses standard capitalization rates to capitalize installation activities. Significant judgment is

involved in the development of these capitalization standards, including the average time required to perform an installation and the

determination of the nature and amount of indirect costs to be capitalized. The capitalization standards are reviewed at least annually and

adjusted, if necessary, based on comparisons to actual costs incurred. TWC generally capitalizes expenditures for tangible fixed assets

having a useful life of greater than one year. Depreciation on these assets is provided generally using the straight-line method over their

estimated useful lives.

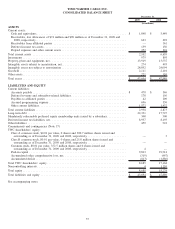

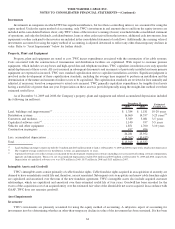

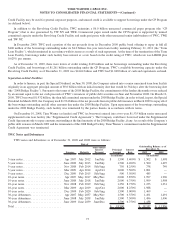

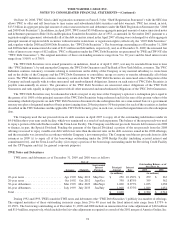

As of December 31, 2009 and 2008, the Company’s property, plant and equipment and related accumulated depreciation included

the following (in millions):

2009 2008

Estimated

Useful Lives

December 31,

Land, buildings and improvements

(a)

......................................... $ 1,384 $ 1,181 10-20 years

Distribution systems ..................................................... 16,060 14,557 3-25 years

(b)

Converters and modems................................................... 5,389 5,081 3-5 years

Capitalized software costs

(c)

................................................ 1,140 937 3-5 years

Vehicles and other equipment . ............................................. 1,851 1,700 3-10 years

Construction in progress .................................................. 457 496

26,281 23,952

Less: accumulated depreciation ............................................. (12,362) (10,415)

Total ................................................................. $13,919 $ 13,537

(a)

Land, buildings and improvements includes $151 million and $147 million related to land as of December 31, 2009 and 2008, respectively, which is not depreciated.

(b)

The weighted-average useful lives for distribution systems are approximately 12 years.

(c)

Capitalized software costs reflect certain costs incurred for the development of internal use software, including costs associated with coding, software configuration,

upgrades and enhancements. These costs, net of accumulated depreciation, totaled $514 million and $505 million as of December 31, 2009 and 2008, respectively.

Depreciation of capitalized software costs was $174 million in 2009, $157 million in 2008 and $115 million in 2007.

Intangible Assets and Goodwill

TWC’s intangible assets consist primarily of cable franchise rights. Cable franchise rights acquired in an acquisition of an entity are

deemed to have an indefinite useful life and, therefore, are not amortized. Subsequent costs to negotiate and renew cable franchise rights

are capitalized and amortized over the term of the new franchise agreement. TWC’s intangible assets also include acquired customer

relationships, which are capitalized and amortized over their estimated useful life of four years. Goodwill has been recorded for the

excess of the acquisition cost of an acquired entity over the estimated fair value of the identifiable net assets acquired. In accordance with

GAAP, TWC does not amortize goodwill.

Asset Impairments

Investments

TWC’s investments are primarily accounted for using the equity method of accounting. A subjective aspect of accounting for

investments involves determining whether an other-than-temporary decline in value of the investment has been sustained. If it has been

64

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)